原帖由 cashmere 于 2006-7-31 22:51 发表

娃哈哈啊,娃哈哈啊,我们脸上都笑开颜.......   . .

ZT

EURUSD:

June closed with the “pincers” and candlestick alike “doji”. On the weekly chart the pair formed the “Hammer” once it failed to fix below 2470. After correction to 2550/60 the euro resumed uptrend, it is still below 2800. Triangle is forming on the daily chart, rise and fixing above 2800 will signal in favor of further mid-term uptrend. Last week the euro was between 2550-2800, it failed to break the lower edge. Divergences may form on the H4 chart that may trigger the pair decline, return below 2550 will signal in favor of downtrend forming.

Strategy:

1. Aggressive traders may try to sell around 2790/2800 with stops above 2850. Buying may be done around 2640/50 with stops below 2600.

2. Less risky selling may be done once the pair returns and fixes below 2550. Buying may be done after fixing above 2800. |

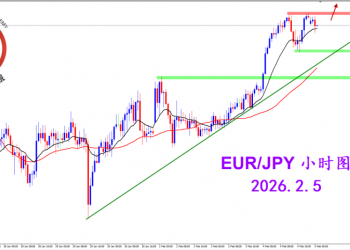

2026.2.5 图文交易计划:欧日短线强势 谨慎401 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎401 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指399 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指399 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头533 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头533 人气#黄金外汇论坛 2026.2.2 图文交易计划:美指快速拉升 理性633 人气#黄金外汇论坛

2026.2.2 图文交易计划:美指快速拉升 理性633 人气#黄金外汇论坛