Boston, May 10.

In a unanimous decision, the Fed has lifted the funds rate by another 25 bps to

5.00% but left in its intent to address inflation risks as appropriate. The

size and timing of additional moves, if any, would depend on data. The

statement is fairly balanced but definitely leaves the door open to another hike

at the June 29-30 meeting.

The statement introduced the lag effect in policy, echoing comments from Fed

officials over recent weeks. Deceleration in house prices was also mentioned as

a restraining factor on economic growth. The Committee already accepts the

economy is likely to slow to a more sustainable pace.

While oil prices were said to be having "only modest" impacts on inflation,

voters said energy prices have the potential to induce inflation. Similarly,

higher rates of resource utilization pose a risk to price stability.

The market seemed to be holding its breath for a more dovish statement.

Odds of a 25 bps hike at the end of the June meeting rose from 32% before the

statement to 42% after. Retail sales (Thursday at 12:30) are the next economic

event to warrant close inspection, while any piece of the inflation puzzle

(e.g., PCE deflator, capacity use, the unemployment rate) will be used to deduce

the Fed's next move. |

2026.2.13 图文交易计划:美指持续震荡 等1523 人气#黄金外汇论坛

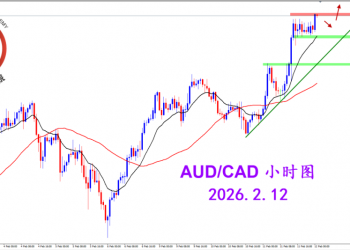

2026.2.13 图文交易计划:美指持续震荡 等1523 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1451 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1451 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1715 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1715 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1589 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1589 人气#黄金外汇论坛