[FED CHAIR BERNANKE] is telling his audience |

| |

The [USD] is modestly firmer in the wake of Fed Chairman Bernanke's comments

| |

2026.3.4 图文交易计划:黄金大幅下行 短期172 人气#黄金外汇论坛

2026.3.4 图文交易计划:黄金大幅下行 短期172 人气#黄金外汇论坛 2026.2.13 图文交易计划:美指持续震荡 等1578 人气#黄金外汇论坛

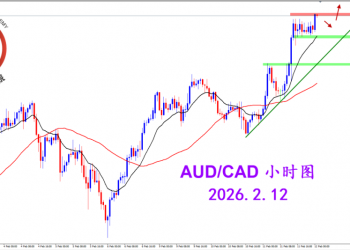

2026.2.13 图文交易计划:美指持续震荡 等1578 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1539 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1539 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1740 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1740 人气#黄金外汇论坛