Remarks by Chairman Ben S. Bernanke

At the Federal Reserve Bank of Kansas City's Thirtieth Annual Economic Symposium, Jackson Hole, Wyoming

August 25, 2006

Global Economic Integration: What's New and What's Not?

When geographers study the earth and its features, distance is one of the basic measures they use to describe the patterns they observe. Distance is an elastic concept, however. The physical distance along a great circle from Wausau, Wisconsin to Wuhan, China is fixed at 7,020 miles. But to an economist, the distance from Wausau to Wuhan can also be expressed in other metrics, such as the cost of shipping goods between the two cities, the time it takes for a message to travel those 7,020 miles, and the cost of sending and receiving the message. Economically relevant distances between Wausau and Wuhan may also depend on what trade economists refer to as the "width of the border," which reflects the extra costs of economic exchange imposed by factors such as tariff and nontariff barriers, as well as costs arising from differences in language, culture, legal traditions, and political systems.

One of the defining characteristics of the world in which we now live is that, by most economically relevant measures, distances are shrinking rapidly. The shrinking globe has been a major source of the powerful wave of worldwide economic integration and increased economic interdependence that we are currently experiencing. The causes and implications of declining economic distances and increased economic integration are, of course, the subject of this conference.

The pace of global economic change in recent decades has been breathtaking indeed, and the full implications of these developments for all aspects of our lives will not be known for many years. History may provide some guidance, however. The process of global economic integration has been going on for thousands of years, and the sources and consequences of this integration have often borne at least a qualitative resemblance to those associated with the current episode. In my remarks today I will briefly review some past episodes of global economic integration, identify some common themes, and then put forward some ways in which I see the current episode as similar to and different from the past. In doing so, I hope to provide some background and context for the important discussions that we will be having over the next few days.

A Short History of Global Economic Integration

As I just noted, the economic integration of widely separated regions is hardly a new phenomenon. Two thousand years ago, the Romans unified their far-flung empire through an extensive transportation network and a common language, legal system, and currency. One historian recently observed that "a citizen of the empire traveling from Britain to the Euphrates in the mid-second century CE would have found in virtually every town along the journey foods, goods, landscapes, buildings, institutions, laws, entertainment, and sacred elements not dissimilar to those in his own community." (Hitchner, 2003, p. 398). This unification promoted trade and economic development.

A millennium and a half later, at the end of the fifteenth century, the voyages of Columbus, Vasco da Gama, and other explorers initiated a period of trade over even vaster distances. These voyages of discovery were made possible by advances in European ship technology and navigation, including improvements in the compass, in the rudder, and in sail design. The sea lanes opened by these voyages facilitated a thriving intercontinental trade--although the high costs of and the risks associated with long voyages tended to limit trade to a relatively small set of commodities of high value relative to their weight and bulk, such as sugar, tobacco, spices, tea, silk, and precious metals. Much of this trade ultimately came under the control of the trading companies created by the English and the Dutch. These state-sanctioned monopolies enjoyed--and aggressively protected--high markups and profits. Influenced by the prevailing mercantilist view of trade as a zero-sum game, European nation-states competed to dominate lucrative markets, a competition that sometimes spilled over into military conflict.

The expansion of international trade in the sixteenth century faced some domestic opposition. For example, in an interesting combination of mercantilist thought and social commentary, the reformer Martin Luther wrote in 1524:

"But foreign trade, which brings from Calcutta and India and such places wares like costly silks, articles of gold, and spices--which minister only to ostentation but serve no useful purpose, and which drain away the money of the land and people--would not be permitted if we had proper government and princes... God has cast us Germans off to such an extent that we have to fling our gold and silver into foreign lands and make the whole world rich, while we ourselves remain beggars." (James, 2001, p. 8)

Global economic integration took another major leap forward during the period between the end of the Napoleonic Wars in 1815 and the beginning of World War I. International trade again expanded significantly as did cross-border flows of financial capital and labor. Once again, new technologies played an important role in facilitating integration: Transport costs plunged as steam power replaced the sail and railroads replaced the wagon or the barge, and an ambitious public works project, the opening of the Suez Canal, significantly reduced travel times between Europe and Asia. Communication costs likewise fell as the telegraph came into common use. One observer in the late 1860s described the just completed trans-Atlantic telegraph cable as having "annihilated both space and time in the transmission of intelligence" (Standage, 1998, p. 90). Trade expanded the variety of available goods, both in Europe and elsewhere, and as the trade monopolies of earlier times were replaced by intense competition, prices converged globally for a wide range of commodities, including spices, wheat, cotton, pig iron, and jute (Findlay and O'Rourke, 2002).

The structure of trade during the post-Napoleonic period followed a "core-periphery" pattern. Capital-rich Western European countries, particularly Britain, were the center, or core, of the trading system and the international monetary system. Countries in which natural resources and land were relatively abundant formed the periphery. Manufactured goods, financial capital, and labor tended to flow from the core to the periphery, with natural resources and agricultural products flowing from the periphery to the core. The composition of the core and the periphery remained fairly stable, with one important exception being the United States, which, over the course of the nineteenth century, made the transition from the periphery to the core. The share of manufactured goods in U.S. exports rose from less than 30 percent in 1840 to 60 percent in 1913, and the United States became a net exporter of financial capital beginning in the late 1890s.1

For the most part, government policies during this era fostered openness to trade, capital mobility, and migration. Britain unilaterally repealed its tariffs on grains (the so-called corn laws) in 1846, and a series of bilateral treaties subsequently dismantled many barriers to trade in Europe. A growing appreciation for the principle of comparative advantage, as forcefully articulated by Adam Smith and David Ricardo, may have made governments more receptive to the view that international trade is not a zero-sum game but can be beneficial to all participants.

That said, domestic opposition to free trade eventually intensified, as cheap grain from the periphery put downward pressure on the incomes of landowners in the core. Beginning in the late 1870s, many European countries raised tariffs, with Britain being a prominent exception. Britain did respond to protectionist pressures by passing legislation that required that goods be stamped with their country of origin. This step provided additional grist for trade protesters, however, as the author of one British anti-free-trade pamphlet in the 1890s lamented that even the pencil he used to write his protest was marked "made in Germany" (James, 2001, p. 15). In the United States, tariffs on manufactures were raised in the 1860s to relatively high levels, where they remained until well into the twentieth century. Despite these increased barriers to the importation of goods, the United States was remarkably open to immigration throughout this period.

Unfortunately, the international economic integration achieved during the nineteenth century was largely unraveled in the twentieth by two world wars and the Great Depression. After World War II, the major powers undertook the difficult tasks of rebuilding both the physical infrastructure and the international trade and monetary systems. The industrial core--now including an emergent Japan as well as the United States and Western Europe--ultimately succeeded in restoring a substantial degree of economic integration, though decades passed before trade as a share of global output reached pre-World War I levels.

One manifestation of this re-integration was the rise of so-called intra-industry trade. Researchers in the late-1960s and the 1970s noted that an increasing share of global trade was taking place between countries with similar resource endowments, trading similar types of goods--mainly manufactured products traded among industrial countries.2 Unlike international trade in the nineteenth century, these flows could not be readily explained by the perspectives of Ricardo or of the Swedish economists Eli Heckscher and Bertil Ohlin that emphasized national differences in endowments of natural resources or factors of production. In influential work, Paul Krugman and others have since argued that intra-industry trade can be attributed to firms' efforts to exploit economies of scale, coupled with a taste for variety by purchasers.

Postwar economic re-integration was supported by several factors, both technological and political. Technological advances further reduced the costs of transportation and communication, as the air freight fleet was converted from propeller to jet and intermodal shipping techniques (including containerization) became common. Telephone communication expanded, and digital electronic computing came into use. Taken together, these advances allowed an ever-broadening set of products to be traded internationally. In the policy sphere, tariff barriers--which had been dramatically increased during the Great Depression--were lowered, with many of these reductions negotiated within the multilateral framework provided by the General Agreement on Tariffs and Trade. Globalization was, to some extent, also supported by geopolitical considerations, as economic integration among the Western market economies became viewed as part of the strategy for waging the Cold War. However, although trade expanded significantly in the early post-World War II period, many countries--recalling the exchange-rate and financial crises of the 1930s--adopted regulations aimed at limiting the mobility of financial capital across national borders.

Several conclusions emerge from this brief historical review. Perhaps the clearest conclusion is that new technologies that reduce the costs of transportation and communication have been a major factor supporting global economic integration. Of course, technological advance is itself affected by the economic incentives for inventive activity; these incentives increase with the size of the market, creating something of a virtuous circle. For example, in the nineteenth century, the high potential return to improving communications between Europe and the United States prompted intensive work to better understand electricity and to improve telegraph technology--efforts that together helped make the trans-Atlantic cable possible.

A second conclusion from history is that national policy choices may be critical determinants of the extent of international economic integration. Britain's embrace of free trade and free capital flows helped to catalyze international integration in the nineteenth century. Fifteenth-century China provides an opposing example. In the early decades of that century, the Chinese sailed great fleets to the ports of Asia and East Africa, including ships much larger than those that the Europeans were to use later in the voyages of discovery. These expeditions apparently had only limited economic impact, however. Ultimately, internal political struggles led to a curtailment of further Chinese exploration (Findlay, 1992). Evidently, in this case, different choices by political leaders might have led to very different historical outcomes.

A third observation is that social dislocation, and consequently often social resistance, may result when economies become more open. An important source of dislocation is that--as the principle of comparative advantage suggests--the expansion of trade opportunities tends to change the mix of goods that each country produces and the relative returns to capital and labor. The resulting shifts in the structure of production impose costs on workers and business owners in some industries and thus create a constituency that opposes the process of economic integration. More broadly, increased economic interdependence may also engender opposition by stimulating social or cultural change, or by being perceived as benefiting some groups much more than others.

The Current Episode of Global Economic Integration

How does the current wave of global economic integration compare with previous episodes? In a number of ways, the remarkable economic changes that we observe today are being driven by the same basic forces and are having similar effects as in the past. Perhaps most important, technological advances continue to play an important role in facilitating global integration. For example, dramatic improvements in supply-chain management, made possible by advances in communication and computer technologies, have significantly reduced the costs of coordinating production among globally distributed suppliers.

Another common feature of the contemporary economic landscape and the experience of the past is the continued broadening of the range of products that are viewed as tradable. In part, this broadening simply reflects the wider range of goods available today--high-tech consumer goods, for example--as well as ongoing declines in transportation costs. Particularly striking, however, is the extent to which information and communication technologies now facilitate active international trade in a wide range of services, from call center operations to sophisticated financial, legal, medical, and engineering services.

The critical role of government policy in supporting, or at least permitting, global economic integration, is a third similarity between the past and the present. Progress in trade liberalization has continued in recent decades--though not always at a steady pace, as the recent Doha Round negotiations demonstrate. Moreover, the institutional framework supporting global trade, most importantly the World Trade Organization, has expanded and strengthened over time. Regional frameworks and agreements, such as the North American Free Trade Agreement and the European Union's "single market," have also promoted trade. Government restrictions on international capital flows have generally declined, and the "soft infrastructure" supporting those flows--for example, legal frameworks and accounting rules--have improved, in part through international cooperation.

In yet another parallel with the past, however, social and political opposition to rapid economic integration has also emerged. As in the past, much of this opposition is driven by the distributional impact of changes in the pattern of production, but other concerns have been expressed as well--for example, about the effects of global economic integration on the environment or on the poorest countries.

What, then, is new about the current episode? Each observer will have his or her own perspective, but, to me, four differences between the current wave of global economic integration and past episodes seem most important. First, the scale and pace of the current episode is unprecedented. For example, in recent years, global merchandise exports have been above 20 percent of world gross domestic product, compared with about 8 percent in 1913 and less than 15 percent as recently as 1990; and international financial flows have expanded even more quickly.3 But these data understate the magnitude of the change that we are now experiencing. The emergence of China, India, and the former communist-bloc countries implies that the greater part of the earth's population is now engaged, at least potentially, in the global economy. There are no historical antecedents for this development. Columbus's voyage to the New World ultimately led to enormous economic change, of course, but the full integration of the New and the Old Worlds took centuries. In contrast, the economic opening of China, which began in earnest less than three decades ago, is proceeding rapidly and, if anything, seems to be accelerating.

Second, the traditional distinction between the core and the periphery is becoming increasingly less relevant, as the mature industrial economies and the emerging-market economies become more integrated and interdependent. Notably, the nineteenth-century pattern, in which the core exported manufactures to the periphery in exchange for commodities, no longer holds, as an increasing share of world manufacturing capacity is now found in emerging markets. An even more striking aspect of the breakdown of the core-periphery paradigm is the direction of capital flows: In the nineteenth century, the country at the center of the world's economy, Great Britain, ran current account surpluses and exported financial capital to the periphery. Today, the world's largest economy, that of the United States, runs a current-account deficit, financed to a substantial extent by capital exports from emerging-market nations.

Third, production processes are becoming geographically fragmented to an unprecedented degree.4 Rather than producing goods in a single process in a single location, firms are increasingly breaking the production process into discrete steps and performing each step in whatever location allows them to minimize costs. For example, the U.S. chip producer AMD locates most of its research and development in California; produces in Texas, Germany, and Japan; does final processing and testing in Thailand, Singapore, Malaysia, and China; and then sells to markets around the globe. To be sure, international production chains are not entirely new: In 1911, Henry Ford opened his company's first overseas factory in Manchester, England, to be closer to a growing source of demand. The factory produced bodies for the Model A automobile, but imported the chassis and mechanical parts from the United States for assembly in Manchester. Although examples like this one illustrate the historical continuity of the process of economic integration, today the geographical extension of production processes is far more advanced and pervasive than ever before. As an aside, some interesting economic questions are raised by the fact that in some cases international production chains are managed almost entirely within a single multinational corporation (roughly 40 percent of U.S. merchandise trade is classified as intra-firm) and in others they are built through arm's-length transactions among unrelated firms. But the empirical evidence in both cases suggests that substantial productivity gains can often be achieved through the development of global supply chains.5

The final item on my list of what is new about the current episode is that international capital markets have become substantially more mature. Although the net capital flows of a century ago, measured relative to global output, are comparable to those of the present, gross flows today are much larger. Moreover, capital flows now take many more forms than in the past: In the nineteenth century, international portfolio investments were concentrated in the finance of infrastructure projects (such as the American railroads) and in the purchase of government debt. Today, international investors hold an array of debt instruments, equities, and derivatives, including claims on a broad range of sectors. Flows of foreign direct investment are also much larger relative to output than they were fifty or a hundred years ago.6 As I noted earlier, the increase in capital flows owes much to capital-market liberalization and factors such as the greater standardization of accounting practices as well as to technological advances.

Conclusion

By almost any economically relevant metric, distances have shrunk considerably in recent decades. As a consequence, economically speaking, Wausau and Wuhan are today closer and more interdependent than ever before. Economic and technological changes are likely to shrink effective distances still further in coming years, creating the potential for continued improvements in productivity and living standards and for a reduction in global poverty.

Further progress in global economic integration should not be taken for granted, however. Geopolitical concerns, including international tensions and the risks of terrorism, already constrain the pace of worldwide economic integration and may do so even more in the future. And, as in the past, the social and political opposition to openness can be strong. Although this opposition has many sources, I have suggested that much of it arises because changes in the patterns of production are likely to threaten the livelihoods of some workers and the profits of some firms, even when these changes lead to greater productivity and output overall. The natural reaction of those so affected is to resist change, for example, by seeking the passage of protectionist measures. The challenge for policymakers is to ensure that the benefits of global economic integration are sufficiently widely shared--for example, by helping displaced workers get the necessary training to take advantage of new opportunities--that a consensus for welfare-enhancing change can be obtained. Building such a consensus may be far from easy, at both the national and the global levels. However, the effort is well worth making, as the potential benefits of increased global economic integration are large indeed.

快速翻译稿(很粗)

贝南克

在堪萨斯市的30年度经济研讨会上讲话

2006年8月25日

全球经济一体化:什么是新的什么不是

地理学家在研究地球及其特点,距离他们使用的一项基本措施来形容他们遵循的模式. 距离是一个弹性的概念,但始终未能得逞. 沿着大圆的距离从沃索、威斯康星到武汉,中国固定在7020英里. 但经济学家,距离沃索,武汉也可以表达其他米,如发运货物这两个城市之间,需要时间进行信息的旅行7020英里,费用发送和接收信息. 经济相关距离沃索和武汉5月还取决于贸易经济学家称之为"宽的边界",它反映了额外费用经济交流实施等因素的关税和非关税障碍,以及成本产生差异的语言、文化、法律传统、政治制度.

特点之一,我们现在生活在世界上是最经济的相关措施,距离正在迅速萎缩. 全球已萎缩的主要来源,在全球经济一体化浪潮的强大和经济相互依存增加,我们正在经历. 下降的原因和影响经济增长和经济一体化的距离,当然,这次会议的主题.

全球经济变化的速度在近几十年的确已经解体,这些发展的全面影响我们生活的各个方面不会知道,是多年来没有过的. 历史可以提供一些指导,但始终未能得逞. 全球经济一体化的进程已持续了几千年,原因和后果承担这一融合常常质相似,至少与现行的插曲. 在今天我将简要地回顾过去的一些事件,全球经济一体化的趋势,找出一些共同的主题,然后再提出一些方法,我觉得目前的类似事件和以往不同. 在这样做的时候,我希望能提供一些背景和环境的重要论述,我们将在未来数天.

全球经济一体化的历史很短

正如我刚才指出,区域经济一体化的分隔不是一个新现象. 两千多年前,罗马统一了遥远的帝国通过广泛的交通网和共同的语言、法律制度、货币. 一名学者最近指出,"一个公民的帝国地从英国幼发拉底河中期二世纪就已经发现,几乎每一个镇沿程食品、商品、景观、建筑、机构、法律、娱乐、成份相象的人自己的社区" (Hitchner,2003年,398页). 这个统一促进贸易和经济发展.

一个半世纪后,在15世纪结束前,哥伦布的航行,VascoDaGama、探险等行业开展了一段距离更深远. 这些发现都可以航行的船舶技术进步和航运欧洲,包括改进的罗盘,在舵,船设计. <海道打开这些航行提供了发展洲际贸易--虽然成本高、风险漫长航程会限制行业较小的商品价值高,相对于其重量和体积,如糖、烟草、香料、茶叶、丝绸、贵金属. 这是许多行业的控制之下,最终贸易公司和荷兰创造的英文. 这些国有垄断得到认可--保护和积极--markups和高利润. 受到普遍赢利为目的的贸易是零和游戏,欧洲国家对美国独霸丰厚的市场竞争,有竞争,有时波及到军事冲突.

扩大国际贸易,16世纪面临的一些内部的反对. 举例来说,一个有趣的组合主义思想和社会的批判,在1524年的改革者马丁路德写道:

"但外贸,使从印度加尔各答等地,并与昂贵丝绸制品、黄金条、香料--这只是做表面文章,但部长是没有用的, 而疏导货币的土地和人民--不容许有正当政府和王公上帝投下美德国产的幅度,要我们抛金银到海外,使整个世界的丰富,而我们自己仍然是乞丐. " (James,2001年8P)

在全球经济一体化的又一重大飞跃这段期间结束的1815年,拿破伦战争开始时,世界一战再扩大国际贸易也大幅跨境资金流动和劳动力. 再次,新技术发挥了重要作用,促进融合:运输成本为使电力蒸汽取代,驶向铁路取代马车或驳船,一个庞大的公共工程、开放苏伊士运河,大大降低旅行时欧洲和亚洲之间. 电报通信费用也开始下降为共同使用. 一名观察员在描述代后期刚完成跨大西洋电报电缆视为"消灭在时间和空间上传递情报"(Standage,1998年,90页). 扩大贸易的各种现有产品,无论在欧洲和其他地方,因为行业垄断,稍早改为竞争激烈,价格趋于全球的各种商品,包括香料、小麦、棉花、生铁、黄麻(芬尼利和英语,2002年).

在贸易结构后拿破伦时期奉行的"核心-边缘"模式. 资本雄厚西欧国家,特别是英国的中心,或者核心的贸易体系和国际金融体系. 这些国家的土地和自然资源比较丰富的周边形成. 制造业、金融资本、劳动往往源于核心的边缘,自然资源和农产品带来的核心边缘. 组成的核心和周边仍然相当稳定,一个重要的例外是美国,在过去的19世纪,实现了从边缘到核心. 制成品的比重从不到美国的出口上升30%至60%,18401913,美国成为资本净输出国,自1890年代后期. 1

在大多数情况下,政府的政策在这个时期促进开放贸易、资本流动、迁移. 英国单方面废除谷物关税(所谓的粟米法),1846年,一系列的双边条约,随后拆除贸易壁垒许多欧洲. 越来越赞赏相对优势的原则,有力地阐明了亚当斯密和大卫Ricardo,可能使政府更容易接受新的观点,即国际贸易不是一场零和游戏,而且有利于所有参与者.

虽然如此,国内反对自由贸易的最终加剧,使廉价粮食压力来自周边的土地收入的核心. 自70年代后期,许多欧洲国家提出的关税,而英国著名的例外. 英国曾经通过立法的保护主义压力作出反应,要求将货物盖上自己的国家. 这一步提供了更多的加工贸易的抗议者,在作者之一的英国反自由贸易的小册子在1890年代表示,即使他铅笔写他的抗议标志"在德国制造"(James,2001年,15页). 在美国,人们对制造业的关税水平较高的联想到,如果再有到20世纪. 尽管有这些障碍,提高进口商品,美国非常愿意在此期间出入境.

不幸的是,在国际经济一体化的实现,主要是揭露十九世纪的两次世界大战和20大萧条. 第二世界大战后,大国进行重建工作的实际困难和基础设施的国际金融和贸易系统. 核心产业--包括现在出现了日本以及美国和西欧--最终成功地恢复了相当程度的经济一体化,但几十年前通过的贸易占全球产量达到前一层次的世界大战.

这表明一个重新崛起的所谓行业内部贸易. 研究人员在最近的60年代和70年代指出,越来越多的全球贸易是国与国之间进行的类似资源禀赋类似的交易品--主要是制成品贸易在工业化国家. 2 与国际贸易在19世纪,这些资金不能轻易解释的角度还是里卡多瑞典经济学家Heckscher,Eli伯蒂尔罗思赫林强调不同国家自然资源的天赋和生产要素. 有影响的工作,有的因为PaulKrugman认为行业内部的贸易可以归因于公司的努力利用规模经济,加上口味的品种进行购买.

战后的经济重整得到几个因素,包括政治和技术. 技术进步进一步降低交通和通讯费用,如空运队,把喷射推进技术和联运运输(包括集装箱)很常见. 电话扩充、数字电子计算机和投入使用. 加在一起,这些预付款的更广阔的产品要进入国际贸易. 在政策方面,关税壁垒--这大大增加了在大萧条--降低,减少许多多边谈判的框架内提供的关税总协定与贸易. 全球化在一定程度上也支持了地缘政治的考虑,因为在经济一体化成为西方市场经济看作是战略进行了冷战. 不过,虽然大大扩展贸易初后第二世界大战期间,许多国家--回顾汇率和金融危机的1930年代--通过规章限制金融资本流动跨越国境.

这个简单的历史结论,摆脱了审查. 或许最明显的结论是,新技术,降低成本,交通、通讯已支持全球经济一体化的一个重要因素. 当然,科技进步是经济本身受奖励发明活动; 这些措施增加市场的规模,营造了一个良性循环. 例如,在19世纪,极有可能回到欧洲沟通改善与美国的紧张工作,促使更好地理解和改善电力电讯技术--努力,共同推动了跨大西洋电报.

第二,从历史的结论是,各国的政策选择的最重要决定因素可能是国际经济一体化的程度. 英国拥抱自由贸易和资本自由流动的国际一体化有助于促成十九世纪. 15世纪中国提供了一个反例子. 早在几十年到世纪中,中国队以大航港亚洲和东非,包括船舶远大于那些欧洲人使用后发现的航行. 这显然是考察经济影响有限,不过. 最终导致了国内政治斗争中进一步探索减少(芬尼利,1992年). 显然,在这种情况下,选择不同的政治领袖可能导致不同结果的历史.

第三点是社会混乱,因此常常反抗社会、经济更加开放,可能会造成. 重要的是混乱的根源--由于比较利益原则建议--扩大贸易机会往往改变产品结构,每个国家的生产和效益相对资本和劳动. 由此改变生产结构的付出代价,有些工人和企业主业,从而建立一个选区,反对经济一体化的进程. 更广泛地说,也可能带来更多的经济相互依存的激励反对社会或文化的改变,有的被视为较其他一些群体受益.

当前全球经济一体化的插曲

请问目前全球经济一体化浪潮与前集? 以多种方式,在经济上的变化,我们今天正遵循同样的基本力量驱使有同样的效果,因为过去. 或许最重要的是,技术进步继续发挥重要作用,促进全球一体化. 例如,显着改善供应链管理,取得了通信和计算机技术的进步,大大降低了生产成本之间协调分布在全球的供应商.

另一共同特征的现代经济形势与经验是过去的产品范围不断扩大,被视为交易. 在某种程度上,这只是扩大了范围广泛的货物可今天--高科技消费品,例如--以及运输成本不断下降. 特别引人注目的是,在何种程度上的信息和通讯技术目前积极推动国际贸易的一系列服务,请在作业中心先进的金融、法律、医学、工程、服务.

关键作用,支持政府的政策,或至少允许,全球经济一体化,第三是在历史与现实之间的相似性. 在贸易自由化的进展一直近几十年--虽然不一定以稳定的步伐,近期表现多哈回合谈判. 此外,全球贸易体制支持,最重要的世界贸易组织,随着时间的推移不断扩大和加强. 区域框架和协议,如北美自由贸易协定和欧盟的"单一市场",也促进了贸易. 国际资本流动的限制,政府也普遍下降,"软件"支持这些资金--例如,法律框架和会计准则--也得到了改善,部分是通过国际合作.

同时又在过去,由于社会和政治反对派也出现了快速的经济一体化. 同以往一样,许多反对此驱动的分配影响改变生产格局,但其他有人担心好--例如,对影响全球经济一体化的环境中,或在最穷的国家.

什么是对当前新插曲. 每次观察将自己的观点,但对我来说,四个不同波全球经济一体化最重要的是,以往发生. 首先,这次事件的规模和速度是前所未有的. 例如,近年来,全球商品出口的20%以上是世界国内生产总值比1913年的8%左右,低于1990年的近15%. 不断扩大与国际资金流动更为迅速. 3 但这些数据的变动幅度少,我们正在经历. 出现了中国、印度和前共产集团国家,意味着更大的地球人口目前正在至少可能在全球经济. 没有这个历史发展的背景. 哥伦布的航行,最终导致新的世界经济的巨大变化,当然,在充分融合了世界新旧世纪. 与此相反,中国经济开放,开始认真不到3年前,正在迅速,如果什么都似乎加快.

其次,传统的核心和区分正变得越来越不相关周边作为成熟的工业化经济体和新兴市场经济的日益一体化和相互依存的. 值得注意的是,在19世纪的模式,其中制造业为核心的出口外汇周边商品,不再作为世界上越来越多的制造能力已发现新兴市场. 更引人注意的崩溃核心边缘模式向资本流动:在19世纪,我国为中心的世界经济中,英国04经常帐盈余和出口资金向周边地区. 今天,世界上最大的经济,美国,与经常项目赤字,在相当程度上的资助资金出口新兴市场国家.

第三,生产过程变得支离破碎地达到了前所未有的程度. 4 生产的产品,而不是单一的过程在同一个地点,打破生产厂商越来越成为独立的步骤和程序进行,每一步什么地方去降低成本. 例如,美国芯片生产商大部分位于机场管理研发加州; 制作德州、德国、日本等; 加工、检验并最终在泰国、新加坡、马来西亚、中国; 然后卖给全球各地的市场. 当然,国际新生产线并非全部:在1911年福特亨利开公司的首个海外工厂在曼彻斯特、英格兰、越来越接近需求来源. 该厂生产的汽车模型的机构,但进口的底盘和机械部分由美国曼彻斯特大会. 虽然这样的例子,说明了一个历史的延续性的经济一体化进程,今天的地域扩展更先进的生产工艺,比以往任何时候都多. 作为外,一些有趣的经济问题所提出的事实,在某些情况下,国际生产链管理几乎完全在一个多国公司(大约40%的美国商品贸易属于公司内部),另他们通过建立使得长度之间的交易公司无关. 但实践证明,这两种情况表明,可大幅度提高生产率通常是通过全球供应链的发展. 5

项目最后名单是新约事件目前,国际资本市场也变得更加成熟. 虽然资本净流入百年,相对于全球产量衡量,完全可以与目前流通总今天要大得多. 另外,现在资本流动采取多形式比过去:在19世纪,国际证券投资主要集中在金融基建(如美国铁路)和购买公债. 今天,国际投资者进行了一系列债券、股票和衍生工具,包括要求在广泛领域. 外国直接投资也相对较大,产量比50年前或100. 6 我已经说过,资本流入的增加,主要归因于资本市场的开放等因素,更加规范会计行为,以及技术进步.

结论

几乎所有与经济有关的单位,在最近几十年的距离大大萎缩. 因此,从经济上讲,武汉、沃索今天比以往任何时候都更加密切和相互依存. 经济和技术变化的有效距离可能会进一步萎缩,今后几年内,可能造成生产力不断提高人民生活水平,并为减少全球贫困.

在全球经济一体化的进一步发展不应视为理所当然,实则不然. 地缘政治问题,包括国际恐怖主义的紧张和危险,已经制约世界经济一体化的步伐,更可在未来. 和过去一样,在开放的社会和政治反对派才能稳固. 虽然有不少反对的来源,我认为这是很大的改变,因为在生产模式有可能威胁到部分职工的生活和一些公司的盈利,尽管这些变化带来更大的生产力和整体产出. 受影响的自然反应是抗拒改变,例如,通过寻找保护主义措施. 决策者面临的挑战是要确保全球经济利益结合十分普遍--例如,帮助下岗工人得到必要的培训,抓住新的机遇--共识福利提高可改变. 建立这样一个共识,可远非易事,在国家和全球层面. 不过,值得作的努力,随着全球经济日趋一体化的潜在好处确实是很大.

[ 本帖最后由 onlyou 于 2006-8-25 22:46 编辑 ] |

2026.2. 6 图文交易计划:纽美快速回落 短177 人气#黄金外汇论坛

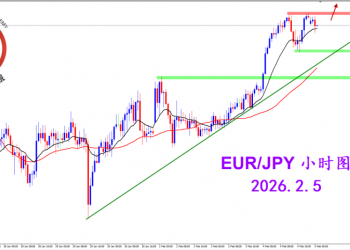

2026.2. 6 图文交易计划:纽美快速回落 短177 人气#黄金外汇论坛 2026.2.5 图文交易计划:欧日短线强势 谨慎434 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎434 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指434 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指434 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头601 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头601 人气#黄金外汇论坛