一周赔50亿美元,对冲基金Amaranth Advisors交易员 Brian Hunter 成为最新华尔街最大的赔家。他赔在炒做天然气上。去年他还因为交易成绩卓著赢得了7千5百多万奖金。今年4月他还浮赢20亿,5月减到10亿,夏季打平,上周亏50亿。去年12月每英制热量单位天然气15元,现在仅5元。

翻译自:

http://articles.moneycentral.msn ... sBiggestLosers.aspx

Wall Street’s biggest losers

By making $5 billion vanish, hedge-fund trader Brian Hunter has joined an elite group of investors who have made some extraordinarily bad bets.

By MSN Money staff and wire reports

If there were a Bad Trade Hall of Fame, Brian Hunter would have just secured himself a prominent spot.

Losing $5 billion in a week will do that.

Hunter lost that amount earlier this month, according to The Wall Street Journal, making big, risky bets on natural gas prices for coming winters. Amaranth Advisors, a Connecticut hedge fund that employs Hunter, has informed investors that its assets under management fell from $9 billion to $4.5 billion since the start of September, according to the Journal.

It’s hard to feel too sorry for Hunter, who works out of his hometown of Calgary, Alberta. He still has his job with Amaranth, according to reports, and his winning trades last year helped him reap total compensation of more than $75 million.

But Hunter’s name, like Nicholas Leeson’s, will now be mentioned every time another huge bet goes sour in the global financial markets. Here’s a quick look at some of the most infamous losing trades in the financial markets.

Brian Hunter, Amaranth Advisors

To say Hunter, 32, has had an up-and-down year doesn’t quite do justice to his 2006. According to the Journal, his account was up by $2 billion at the end of April. Then he lost $1 billion in May, made that amount back over the summer and finally took his $5 billion bloodbath last week. What’s behind the huge swings? Gyrating prices -- natural gas was above $15 per British thermal unit last December but just at $5 now -- and huge multi-billion-dollar positions, according to the Journal. |

2026.2.13 图文交易计划:美指持续震荡 等1263 人气#黄金外汇论坛

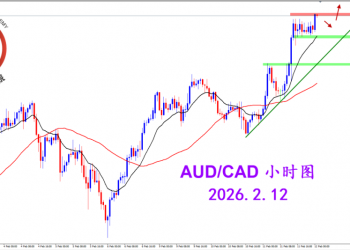

2026.2.13 图文交易计划:美指持续震荡 等1263 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1267 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1267 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1358 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1358 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1280 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1280 人气#黄金外汇论坛