EUR/USD

Short-term:

Support/ 1.3389-1.3357 Resistance/ 1.3521-1.3546,

1.3670-1.3683

U.S. May non-farm payroll was better-than-expected with 157,000 gain, also the construction sector signaled stable outlook. In addition, ISM May manufacturing data reached 55.0, which is also higher than market consensus. Although the U.S. data was stronger than expected, USD advance was still limited. EUR/USD was range traded and consolidated at 1.3450.

USD/CHF

Short-term:

Support/ 1.2200/1.2168

Resistance/ 1.2312-1.2354

Due to the better-than-expected U.S. employment and manufacturing data, USD/CHF advanced to 1.2298. Last week, Swiss announced the first quarter GDP increased by 2.4%, which was slightly above consensus.

USD/JPY

Short-term:

Support/ 120.54-120.53/119.50

Resistance/ 121.83-122.42

Due to the better-than-expected U.S. employment and manufacturing data, USD/JPY advanced to 4-month-high 122.14 and retreated to 121.97 on June 4 morning. Unless the global risk appetite shrinks, otherwise JPY weakness is expected to persist.

GBP/USD

Short-term:

Support/ 1.9677-1.9654, 1.9584

Resistance/ 1.9895-1.9900, 2.0025

U.K. May purchasing manager index (PMI) rose to 54.9, that signaled the manufacturing sector remained in expansionary phase, and triggered GBP/USD back to 1.9800 level. On the other hand, recent economic data, such as the U.K. report showed that the number of loan applicants has reduced in April and market speculates the U.K. economy will slowdown, that may lower the BoE rate hike expectation.

AUD/USD

Short-term:

Support/ 0.8163-0.8130

Resistance/ 0.8324/0.8390

AUD/USD climbed above 83 cents and led by the commodity price rebound; LMEX index weekly gained 2.49%. Australia announced the April trade deficit dropped to AUD 962 millions last week, as global economy remained in a good shape, which enhanced the export of Australia. |

2025.12.16 图文交易计划:布油开放下行 关2680 人气#黄金外汇论坛

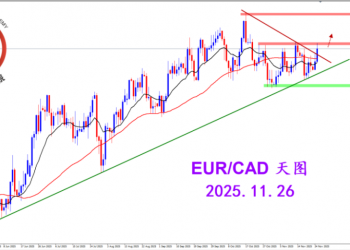

2025.12.16 图文交易计划:布油开放下行 关2680 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3215 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3215 人气#黄金外汇论坛 MQL5全球十大量化排行榜3283 人气#黄金外汇论坛

MQL5全球十大量化排行榜3283 人气#黄金外汇论坛 【认知】6091 人气#黄金外汇论坛

【认知】6091 人气#黄金外汇论坛