USD/JPY opened in NY at 119.21/24 today, already under

pressure from carry trade unwinding as risk aversion soared on the back of the

8.8% fall in China stocks. Emerging market currencies along with global stocks

were similarly targeted with the DJIA falling 359 pts by the afternoon and US

ten-year bond yields plummeting from 4.62% to 4.46% on risk aversion. This

weighed on the dollar but so did carry trade unwinding which ultimately took

USD/JPY to 117.50 into the afternoon as stops at 118.35-45 were triggered. Risk

for further losses is strong, targeting 115 in coming sessions.

EUR/JPY opened at 157.67 and triggered stops under 157.00 to trade to 155.73.

AUD/JPY opened at 94.44 and triggered stops under 94.00 to trade to 92.55. Gold

is seen under further heavy selling in Tokyo on unwinding of Tocom positions

tonight. GBP/JPY fell from 234.08 at the NY open to under 231.00 into the NY

close. EUR/JPY, AUD/JPY, USD/JPY, GBP/JPY and CAD/JPY are all closing under the

Ichimoku clouds, a bearish signal for trading in the Tokyo markets. The Nikkei

is seen suffering from a strong JPY and the US stock losses. |

2025.12.16 图文交易计划:布油开放下行 关2382 人气#黄金外汇论坛

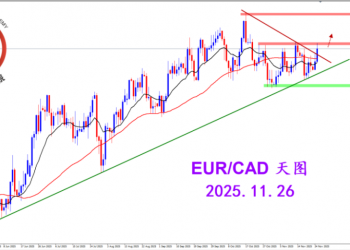

2025.12.16 图文交易计划:布油开放下行 关2382 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3114 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3114 人气#黄金外汇论坛 MQL5全球十大量化排行榜3160 人气#黄金外汇论坛

MQL5全球十大量化排行榜3160 人气#黄金外汇论坛 【认知】5968 人气#黄金外汇论坛

【认知】5968 人气#黄金外汇论坛