GFT每日原版汇评(中英文对照) - 卢卡 (2月3日)

GFT 2月3日每日汇评

最重要的经济报告——美国非农就业数据报告将于周五出炉,而在此前的一天的汇市起起伏伏,并受到了一定的阻力,但并未触底。除了兑英镑之外,美元几乎挽回了兑其它主要币种的损失。交投承载了一定的压力,但新的走向将取决于几小时后出炉的失业报告,而这是不能被预测的。

欧元/美元

欧元/美元在周四达到了四周以来的最高位,挽回了之前的损失,并收于此高位下的稍低点。技术分析显示这组正面临超买,但还是要关注失业报告所透露的线索来作进一步判断。

在1.3030的双斐波纳契层面上,仍然持续着一个强大的阻力。在1.3060的瓶颈位之上,这组将在1.3085受到阻力。新的层面将在1.3135。

首要的支撑点来自1.2995。新的层面则位于1.2960和1.2925。在1.2868以下,欧元/美元在1.2820获得有力的支撑。

震荡分析:混合

近期:混合

中期:混合

长期:上扬

美元/日元

美元/日元在周四继续下跌,就像我们所预期的,但报收点其实和周三持平。现在这组趋向于上升,但仍然需要更多的信息。

在120.55之下,关键的支撑面在120.15。美元/日元在119.65得到有力支撑,通过一个50分的支点,瞄准120.15和119.15。

最近的阻力来自121.05,通过一个50分的支点瞄准120.55和121.55。在121.90以上,强大的阻力将持续在122.50,以一个50分的支点,瞄准122.00和123.00。

震荡分析:下滑

近期:混合并微弱下滑

中期:上扬

长期:上扬

英镑/美元

在周四,英镑/美元维持了两天以来的并不疲软的走势,剧烈整合,但只报收于稍高点。又一次,这组将有待更多的资料来判断新的走向。

首要的阻力维持在1.9694。在周四持稳的1.9736以上,阻力将来自1.9775,然后是1.9810。

首要的支撑仍然来自1.9586。跟着是1.9547。在此之下,在1.9510到1.9500的区域中,强有力的支撑将随着一个上升趋势线在1.9460出现。进一步的支撑位于1.9400。

震荡分析:混合

近期:混合

中期:上扬

长期:混合

美元/瑞士法朗

美元/瑞士法郎在周四继续走低,然后暂时打破了一个长期的斐波纳契回旋层面1.2425。然后报收于几乎于前一天相同的位置,意味着今天将收获更多。但失业报告的数据将在今天赋予其新的方向。

巨大的支撑维持在1.2410通过一个上升曲线获得。在1.2375以下,这组将在1.2325获得支撑。

在1.2465以上,美元/瑞士法郎在1.2495受到阻力。新的层面在1.2520和1.2570。

震荡分析:混合

近期:混合

中期:混合

长期:上扬

英文版如下:

Forex Market Commentary for February 2, 2007 by Cornelius Luca

GFT Daily Forex Market Commentary

The most important economic report - the US non-farm` payrolls report – is due on Friday, and the day before was choppy, frustrating but bottom-line irrelevant. The US currency recovered early losses against all of the majors, except for the pound. The carry trades remain under relative pressure, but the next direction for a few hours will come from the jobless data, which can nor really be forecast.

Euro/dollar Euro/dollar reversed early gains that took it to a four-week high to close with minor losses on Thursday. The technicals say the pair is overbought here, but take your cues from the jobless report.

There is still strong resistance from a double Fibonacci level at 1.3030. Above the neckline at 1.3060, the pair has resistance at 1.3085, which held on Thursday. The next level is 1.3135.

Initial support is at 1.2995. The next levels are at 1.2960 and 1.2925. Below 1.2868, euro/dollar has strong support at 1.2820.

Oscillators are mixed.

NEAR-TERM: Mixed

MEDIUM-TERM: Mixed

LONG-TERM: Bullish

Dollar/yen

Dollar/yen spiked down on Thursday, as expected, but closed virtually unchanged. The upside is now favored, but more information is needed here.

Below 120.55, the key support level remains at 120.15. Dollar/yen retains good support at 119.65 from a 50-pip pivot, which targets 120.15 and 119.15.

Immediate resistance is still seen at 121.05 from a 50-pip pivot that targets 120.55 and 121.55. Above 121.90, strong resistance remains at 122.50 from a 50-point pivot, which targets 122.00 and 123.00.

Oscillators are falling.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Sterling/dollar

For the second day, sterling/dollar was not for faint-hearted on Thursday, when it rallied sharply, only to close marginally higher. Again, the pair needs more information before a new direction ensues.

Initial resistance remains at 1.9694. Above 1.9736, which held on Thursday, resistance comes at 1.9775 and then at 1.9810.

Immediate support is still seen at 1.9585 and 1.9547 follows that. Below the area between 1.9510 and 1.9500, strong support follows from a rising trendline at 1.9460. Further support lies at 1.9400.

Oscillators are mixed.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Mixed

Dollar/Swiss franc

Dollar/Swiss franc spiked lower on Thursday and briefly broke below a long-term the Fibonacci retracement level at 1.2425. It then closed virtually unchanged, suggesting more gains today, but the jobless data will give direction on the day.

Significant support remains at 1.2410 from a rising trendline. Below 1.2375 there is support at 1.2325.

Above 1.2465, dollar/Swiss franc still has resistance at 1.2495. Next levels are 1.2520 and 1.2570.

Oscillators are mixed.

NEAR-TERM: Mixed

MEDIUM-TERM: Mixed

LONG-TERM: Bullish |

2026.2.13 图文交易计划:美指持续震荡 等1394 人气#黄金外汇论坛

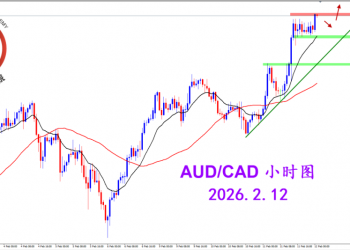

2026.2.13 图文交易计划:美指持续震荡 等1394 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1369 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1369 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1554 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1554 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1475 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1475 人气#黄金外汇论坛