GFT10日原版汇评(中英文对照) - 卢卡 (2月10日)

美元相对于其他主要货币都重新调整,除了欧元。欧元受到央行行长暗示将进一步缩紧借款成本的影响,重组并跨过边线。美元将在周

五显示出一定的疲软性,之后将有力上扬。

欧元/美元

欧元/美元挽回了之前的损失,并短暂突破了从38.2%到61.8%的巩固区间(1.2825到1.3030)。最近的趋势仍然是上扬。

首要的阻力持续在1.3064。在强有力的阻力位1.3080以上,这组将在1.3140和更高点1.3210受到阻力。

首要的支撑位在1.3005。在1.2970以下,将在1.2945和1.2913受到支撑。之后,将有两个关键的支点分别是1.2882和1.2868。

震荡分析:上扬

近期:混合并微弱上扬

中期:混合

长期:上扬

美元/日元

美元/日元重整并达到了一周以来的最高点121.42,之后下滑。这种重整趋势将僵持在这里,而近期趋势维持在下跌层面。

最近的支撑在121.05,通过一个50分的支点,瞄准121.55和120.55。在120.55以下,这对将在119.65得到有力支撑,通过一个50分的支

点,瞄准120.15和119.15。

最近的阻力位出现在121.05。在121.87以上,也就是在2003年3月达到的最高点,阻力将持续在122.50,通过一个50分的支点,瞄准

122.00和123.00。

震荡分析:混合

近期:混合

中期:上扬

长期:上扬

英镑/美元

英镑/美元在周四急剧下跌,但我们仍需更多信息。趋势是,英镑将首先试图反弹。

首要的支撑来自1.9534。对1.9480层面以下的突破将标志着一个进一步的下跌直到1.9330。

首要的阻力来自1.9630。新的层面在1.9695。假如位于1.9750的斐波纳契回旋层面被突破,则英镑将挑战于1.9822的新层面,但这不太

可能。

震荡分析:混合

近期:混合

中期:上扬

长期:混合

美元/瑞士法朗

美元/瑞士法郎在周四强力反弹,但之后僵持。这对将首先下滑,之后才有可能再次上扬。

首要的阻力来自1.25150。在1.2475之上,将在1.2575有一个关键的阻力位。远处的关键阻力位在1.2620。

首要支撑在1.2440。在1.2379以下,支撑维持在1.2330。之后,强有力的支撑将在1.2285跟上。

震荡分析:混合

近期:混合

中期:混合

长期:上扬

(英文版如下)

Forex Market Commentary for February 9, 2007 by Cornelius Luca

GFT Daily Forex Market Commentary

The dollar rallieFd versus all of the majors, except the euro. The euro rallied across the board because the ECB head Trichet signaled

further tightening of the borrowing costs. The dollar should encounter some weakness on Friday before any further strength can resume.

Euro/dollar

Euro/dollar reversed early losses and briefly broke above the 38.2% to 61.8% consolidation area (1.2825 to 1.3030). The initial bias is still

bullish for Friday.

Initial resistance remains at 1.3064. Above the strong resistance at 1.3080, the pair has resistance at 1.3140 and further up at 1.3210.

Immediate support is at 1.3005. Below 1.2970 there is support a t1.2945 and 1.2913. Then, there are two pivotal lows at 1.2882 and

1.2868.

Oscillators are rising.

NEAR-TERM: Mixed with upside bias

MEDIUM-TERM: Mixed

LONG-TERM: Bullish

Dollar/yen

Dollar/yen rallied to a one-week high of 121.42 before trimming gains on Thursday. The rally should stall here and the bias is on the

downside.

Initial support is at 121.05 by a 50-pip pivot, which targets 121.55 and 120.55. Below 120.55, the pair then has good support at 119.65

from a 50-pip pivot, which targets 120.15 and 119.15.

Immediate resistance comes at 121.55. Above 121.87, the peak of March 2003, resistance remains at 122.50 from a 50-point pivot, which

targets 122.00 and 123.00.

Oscillators are mixed.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Sterling/dollar

Sterling/dollar fell sharply on Thursday, but we still need more information. Odds are, the pound should attempt to recover first.

There is immediate support at 1.9534. A break below the 1.9480 level would signal a further decline toward 1.9330.

Initial resistance is at 1.9630. The next level is 1.9695. If the Fibonacci retracement level at 1.9750 breaks, then the pound would challenge

the next level 1.9822 – but this is very unlikely.

Oscillators are mixed.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Mixed

Dollar/Swiss franc

Dollar/Swiss franc made a stronger recovery on Thursday but then stalled. It should attempt to decline first, before any further advance can

be possible.

Initial resistance is at 1.25150. Above 1.2475, there is the pivotal resistance is at 1.2575. Distant resistance comes at 1.2620.

Immediate support now comes at 1.2440. Below 1.2379, support remains at 1.2330. Strong support follows at 1.2285.

Oscillators are mixed.

NEAR-TERM: Mixed

MEDIUM-TERM: Mixed

LONG-TERM: Bullish |

2026.2.13 图文交易计划:美指持续震荡 等1417 人气#黄金外汇论坛

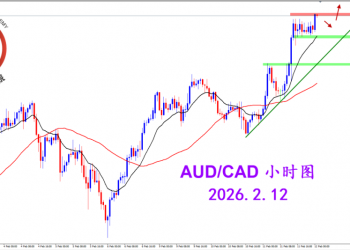

2026.2.13 图文交易计划:美指持续震荡 等1417 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1372 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1372 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1576 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1576 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1495 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1495 人气#黄金外汇论坛