每日原版汇评(中英文对照) - 卢卡 (2月17日)

GFT 每日汇评

美元兑日元和美元兑瑞士法郎在复杂的数据影响下急剧下滑。纽约州的指数虽然很强劲,但却不包括它的工业产值。费城联邦以及美国技术情报中心的数据都很弱。另一边方面,欧元下挫,英镑也下滑,都是因为疲软的经济报告的原因。这意味着市场将期待上扬。在今天也将如此,由于所有的注意力都集中在美国的PPI数据上以及房产指数和Mich的报告。欧元兑日元交易将继续承受压力,而美元将试图反弹。

欧元/美元

欧元/美元如我们预料中地在周四进一步上扬达到近一个半月来的最高点1.3171。这组挑战并承受着巨大的阻力,所以现在下滑趋势被看好。

首要的支撑位在1.3115。新的层面在1.3080。在1.3030以下,将有两个支点分别是1.2985和1.2940。在远处有两个关键的支点在1.2882和1.2868。首先的阻力继续来自1.3170。在1.3200以上,这组将挑战关键的1.3296区域。

震荡分析:上扬

近期:混合并呈下滑趋势

中期:混合

长期:上扬

美元/日元

美元/日元在周四进一步下滑,就像我们预期的一样。这组证实了一个双高点的趋势的形成,瞄准117.80,因此在一个微弱反弹之后,将继续下滑。

最近的阻力在119.65,通过一个50分的支点,瞄准120.15和119.15。在120.55以上,阻力出现在121.05,通过一个50分的支点,瞄准121.55和120.55。

最近的支撑在118.85。美元兑日元在118.25通过另一个50分的支点得到支撑,瞄准117.75和118.75。

震荡分析:下滑

近期:混合并微弱上扬

中期:上扬

长期:上扬

英镑/美元

英镑/美元在周四一早调整,但就像我们所预期的,上涨空间有限,而疲软的零售报告更限制了上涨

一个在1.9500之下的闭合将标志着对关键层面1.9445的考验。

首要的阻力来自1.9550。如果要有进一步上涨的动力,则必须打破1.9585这个层面。新的层面则在1.9745。新的层面在1.9635。进一步的阻力来自于1.9676这个关键的高点。

震荡分析:混合

近期:混合并微弱下滑

中期:下滑

长期:混合

美元/瑞士法朗

美元/瑞士法郎在周四进一步下滑到一个近一个半月来的地点。在短期内下滑的幅度不会很大,但可能会有一些预先的调整。不管怎样,这组形成了一个下滑的趋势,瞄准1.2190,所以中期的走向仍然是下滑的。

首要阻力来自1.2370。在1.2425之上,阻力将在1.2510到来。在1.2570将是一个关键的层面。

首要支撑在1.2330被看到。在1.2290以下,支撑来自1.2220,但这层面不可能达到。

震荡分析:下滑

近期:混合并微弱上扬

中期:下滑

长期:上扬

(英文版如下)

Forex Market Commentary for February 16, 2007 by Cornelius Luca

GFT Daily Forex Market Commentary

The dollar fell sharply versus the yen and Swiss franc on Thursday amid mixed data. The Empire State index was strong, but the Industrial production. Philly Fed and the TIC data were very soft. The euro gave up its early gains and the pound was clobbered again because of weak economic reports. This means the crosses are holding the upper hand. They should remain in favor today as well, with all eyes on the US PPI, housing starts and U of Mich reports. The Europe/yen crosses should remain under pressure and the dollar should attempt to recover.

Euro/dollar

Euro/dollar surged further on Thursday, as expected, and nailed a 1 ½-month high at 1.3171. It challenged and held significant resistance, so now the downside is favored.

Immediate support is at 1.3115. Next level is 1.3080. Below 1.3030 there is support at 1.2985 and 1.2940. There are two distant pivotal lows at 1.2882 and 1.2868.

Initial resistance remains at 1.3170. Above 1.3200, the euro/dollar should challenge the pivotal 1.3296 area.

Oscillators are rising.

NEAR-TERM: Mixed with downside bias

MEDIUM-TERM: Mixed

LONG-TERM: Bullish

Dollar/yen

Dollar/yen declined further on Thursday, as expected. It has confirmed the formation of a double top, which targets 117.80, so following some mild recovery, the weakness should continue.

Immediate resistance is at 119.65 from a 50-pip pivot, which targets 120.15 and 119.15. Above 120.55 there is resistance at 121.05 from a 50-pip pivot, which targets 121.55 and 120.55.

Initial support is at 118.85. Dollar/yen then has support at 118.25 from another 50-point pivot that targets 117.75 and 118.75.

Oscillators are falling.

NEAR-TERM: Mixed to slightly bullish

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Sterling/dollar

Sterling/dollar made rallied early on Thursday, but the upside was limited, as expected, and the weak retail sales report tripped it.

A break below 1.9500 would signal a test of the key 1.9445 level.

Initial resistance is at 1.9550. The 1.9585 level must break if a further correction may ensue. Next level is 1.9635. Further resistance looms at 1.9676 from a pivot high.

Oscillators are mixed.

NEAR-TERM: Mixed to slightly bearish

MEDIUM-TERM: Bearish

LONG-TERM: Mixed

Dollar/Swiss franc

Dollar/Swiss franc fell further on Thursday to a near 1 ½-month low. The downside seems limited in the short term, so some initial correction is likely. However, the pair formed a head-and-shoulder pattern, which targets 1.2190, so the medium-term outlook is negative.

Initial resistance is at 1.2370. Above 1.2425, resistance remains at 1.2510. There is a pivotal high level is 1.2570.

Immediate support is now seen at 1.2330. Below 1.2290 there is support at 1.2220, but this level should not be seen.

Oscillators are edging lower.

NEAR-TERM: Mixed to slightly bullish

MEDIUM-TERM: Bearish

LONG-TERM: Bullish |

2026.2.13 图文交易计划:美指持续震荡 等1280 人气#黄金外汇论坛

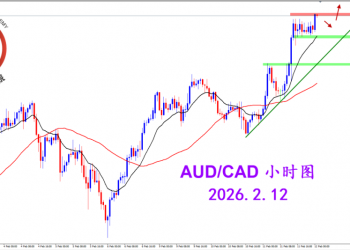

2026.2.13 图文交易计划:美指持续震荡 等1280 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1289 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1289 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1395 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1395 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1302 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1302 人气#黄金外汇论坛