GFT 原版汇评(中英文对照) - 卢卡 (4月21日)

美元在周四下滑并越过边线,但随后相对于除了欧元之外的所有货币反弹。被超卖的美元看上去似乎形成了一个短期的走势,所以这组将试图在今天上扬。但这除非是在走势明朗之后。

欧元/美元

欧元/美元在周四达到了一个新的高点,因此这组整体的预期是积极的。虽然这组被超买了,但只有当下跌被肯定之后才有可能改变。

如果这组打破并收于1.3575之下,那这种肯定将加剧。强大的支撑随后在1.3525。在1。3470以下,在1.3440有支撑。远处的支撑在1.3390。

在1.3818以上,这组在1.3645承受阻力。在1.3705,远处的阻力在1.3805。

震荡分析:上扬

近期:混合

中期:上扬

长期:上扬

美元/日元

美元/日元周四早盘触摸到了这组上升轨道的地步,但随后很快地积极挽回了大部分的损失。

首要的支撑仍然在118.25通过一个50分的支点,瞄准117.75和118.75。在117.60,支撑在116.85,通过一个50分的支点,瞄准116.35和117.35。

在118.85以上,强大的阻力仍然在119.65,通过一个50分的支点,瞄准119.15和120.15。在120.15以上,阻力在120.75。

震荡分析:走低

近期:混合

中期:微弱上扬

长期:上扬

英镑/美元

英镑/美元在周二上扬并达到了一个26年来的高点2.0133之后,这明显的被严重超买的英镑/美元走低。这个走势在图表上形成一个可能的下滑。这种下滑不可能很厉害,因此这组将在今天试图反弹。这个积极的中期的预期仍然有效,但是这离转向只有一步之遥。

首先的阻力仍然在1.2080。新的层面2.0140和2.0155之间。假如这个区域被突破,英镑可能冲击一个Gann层面2.0200。

首先的支撑仍然在1.9980。在1.9955以下,强大的支撑在1.9925跟上。

震荡分析:上扬

近期:混合

中期:上扬

长期:上扬

美元/瑞士法朗

美元/瑞士法郎在周四从一个四月以来的低点反弹,而超卖的这组将形成一个上扬的逆转态势。只有当一个紧缩的停板之后,才能买进。

如果这组打破位于1.2100的层面的阻力,就可以确认这种走势。进一步的阻力在1.2050。新的层面在1.2095。在1.2145以上,新的层面是1.2200。远处的阻力在1.2255。

首要的支撑在1.2000。在这之下,在1.1945是一个关键层面。美元/瑞士法郎然后在1.1885获得强大支撑。

震荡分析:下滑

近期:混合

中期:微弱下滑

长期:微弱下滑

(英文版如下)

Forex Market Commentary for April 20, 2007 by Cornelius Luca

GFT Daily Forex Market Commentary

The dollar fell across the board on Thursday but managed to recover its losses against all the majors but the euro. The oversold US currency looks like it formed a short-term bottom, so it should attempt to climb up today. Buy it only if the move is confirmed.

Euro/dollar

Euro/dollar made a marginally new high on Thursday, so its overall positive outlook remains intact. It’s overbought but dump it only on confirmation.

This confirmation would arise from a break below 1.3575. Good support follows at 1.3525. Below 1.3470 there is support at 1.3440. Distant support is at 1.3390.

Above 1.3818, the pair retains resistance at 1.3645. Above 1.3705, distant resistance is at 1.3805.

Oscillators are rising.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Dollar/yen

Dollar/yen touched the bottom of its rising channel in early trading on Thursday and then quickly and aggressively recovered most of its losses.

Initial support remains at 118.25 from a 50-point pivot that targets 117.75 and 118.75.

Below 117.60, support is seen at 116.85, from a 50-point pivot, which targets 116.35 and 117.35.

Above 118.75 strong resistance is still seen at 119.65 from a 50-point pivot that targets 119.15 and 120.15.

Oscillators are edging lower.

NEAR-TERM: Mixed

MEDIUM-TERM: Slightly bullish

LONG-TERM: Bullish

Sterling/dollar

One day after surging to a 26-year high of 2.0133 on Wednesday the obviously heavily overbought sterling/dollar headed lower. The move had been telegraphed by a probable doji. The decline was not impressive, so the pair should attempt to recover its strength today. The positive medium-term outlook remains in place, but it’s a hair away from turning south.

Initial resistance is at 1.2080. Next cap is seen between 2.0140 and 2.0155. If this area breaks, the pound would likely take attack a Gann level at 2.0200.

Immediate support is at 1.9980. Below 1.9955, strong support follows at 1.9925.

Oscillators are rising.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Dollar/Swiss franc

Dollar/Swiss franc recovered from a new four-month low of 1.2000 on Thursday and the oversold pair formed a bullish reversal pattern. Buy only on a confirmation or with a tight stop.

The confirmation should come from a break above the resistance at 1.2100. Further resistance comes at 1.2050. Next level is at 1.2095. Above 1.2145, the next level is 1.2200. Distant resistance is at 1.2255.

Immediate support is at 1.2000. Below it there is a key level at 1.1945. Dollar/Swiss franc then has strong support at 1.1885.

Oscillators are declining.

NEAR-TERM: Mixed

MEDIUM-TERM: Slightly bearish

LONG-TERM: Slightly bearish |

2025.12.16 图文交易计划:布油开放下行 关1572 人气#黄金外汇论坛

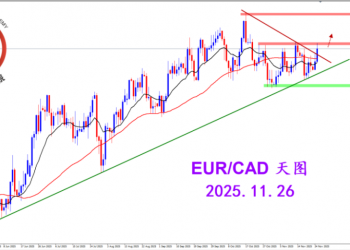

2025.12.16 图文交易计划:布油开放下行 关1572 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2944 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2944 人气#黄金外汇论坛 MQL5全球十大量化排行榜3018 人气#黄金外汇论坛

MQL5全球十大量化排行榜3018 人气#黄金外汇论坛 【认知】5807 人气#黄金外汇论坛

【认知】5807 人气#黄金外汇论坛