GFT原版汇评(中英文对照) - 卢卡 (4月28日)

美元在周四相对于欧元重整,就像我们预期的一样。而意外来自于美元/日元,这组在停滞了一个星期后也再次走高。假如美国GDP不象传言中的那么低的话,美元将继续试图走高。

欧元/美元

被超买的欧元/美元在周四走低,并冲击了在1.3590的强大支撑点。这组仍然在上升轨道的上半区域,因此只有一个打破1.3590的下滑才能引发进一步的下跌。

假如这个层面失守,欧元/美元将挑战在1.3550的支点。假如这个层面也被打破,才标志着上扬的结束。强大的支撑在1.3470。远处的支撑在1.3390。

首先的阻力在1.3655。在1.3718以上,这组在1.3805获得远处的阻力。

震荡分析:走低

近期:混合

中期:上扬

长期:上扬

美元/日元

美元/日元在周四通过交替交易而走高,并打破了上升轨道的中点。这组正在挑战新层面中的强大阻力位,并且这组在这一层面的动作将预示着新的走向。今天将有积极的交易,但下一步的方向仍不明朗。

首先的阻力在119.65,通过一个50分的支点,瞄准119.15和120.15。远处的阻力在120.55。

首先的支撑在119.15和119.00之间。 强大的支撑然后在118.25跟上,通过一个50分的支点,瞄准117.75和118.75。

震荡分析:混合

近期:混合

中期:上扬

长期:上扬

英镑/美元

英镑/美元在周四暴跌且达到2英镑以下区域,形成了一个九天来的最低点。这组必须冲破强大的1.9860支点,才能使下滑态势继续。

假如1.9860被打破,这组将挑战1.9800的支点。远处的支撑在1.9705。

首先的阻力在1.9980。在2.0050以上,新的层面在2.0100。然后在2.0140和2.0155之间。

震荡分析:下滑

近期:混合并呈下滑趋势

中期:上扬

长期:上扬

美元/瑞士法朗

在下滑并达到稍低于四月以来的低点的第二天,美元/瑞士法郎有力反弹暂。这组看上去像形成了一个双底部,但现在还不肯定。首先的预期是上扬,但中期的走势仍持续微弱下滑。

首先的阻力在1.2130。 如果今天这组打破这个层面,就可以确认下滑走势的结束。进一步的阻力在1.2200。远处的阻力在1.2255。

首先的支撑在1.2065。然后在1.1990获得强大的支撑,接着1.1980通过一个字2005年1月以来形成的上升趋势线,而只有冲破它才标志一个下滑。在1.1945是一个关键层面。美元/瑞士法郎然后在1.1885获得强大支撑。

震荡分析:上扬

近期:混合并呈上扬趋势

中期:微弱下滑

长期:微弱下滑

(英文版如下)

Forex Market Commentary for April 27, 2007 by Cornelius Luca

GFT Daily Forex Market Commentary

The dollar rallied versus the European currencies on Thursday, as expected. The surprise came from dollar/yen, which exploded higher as well, after marking time for a week. The dollar should attempt to march higher – provided that the US GDP is not as weak as it is rumored.

Euro/dollar

The overbought euro/dollar headed down on Thursday and hit strong support at 1.3590. It is swerving in the upper half of its rising channel, so only an aggressive break below 1.3590 would invite a further downmove.

If this level gives way, euro/dollar should test the support at 1.3550. If this level breaks as well, this would signal the end of the upmove. Good support follows at 1.3470. Distant support remains at 1.3390.

Initial resistance is at 1.3655. Above 1.3718, the pair has distant resistance is at 1.3805.

Oscillators are edging down.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Dollar/yen

Dollar/yen exploded higher on Thursday on cross trading and managed to break above the middle of its rising channel. It’s probing significant resistance at the opening levels, and the pair’s behavior at this level would dictate the next direction. Expect aggressive trading today, but the next direction is unclear.

Initial resistance is at 119.65 from a 50-point pivot that targets 119.15 and 120.15. Distant resistance is at 120.55.

Immediate support is between 119,15 and 119.00. Strong support is still seen at 118.25 by a 50-point pivot that targets 117.75 and 118.75.

Oscillators are mixed.

NEAR-TERM: Mixed

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Sterling/dollar

Sterling/dollar made an aggressive decline below the $2 area and hit a nine-day low on Thursday. It must pierce significant support at 1.9860 if the slide may continue unabated.

If 1.9860 gives way, the pair would challenge the support at 1.9800. Distant support follows at 1.9705.

Initial resistance is at 1.9980. Above 2.0050, the next level is 2.0100. Next cap is seen between 2.0140 and 2.0155.

Oscillators are declining.

NEAR-TERM: Mixed with bearish bias

MEDIUM-TERM: Bullish

LONG-TERM: Bullish

Dollar/Swiss franc

One day after hitting a four-month low dollar/Swiss franc made a nice recovery that was fueled by short covering. It looks like a double bottom is forming, but there is no confirmation yet. The immediate outlook is positive, but the medium-term view remains slightly bearish.

Initial resistance is at 1.2130. A confirmation that the slide is over would come only from a break above this level. Further resistance comes at 1.2200. Distant resistance is still seen at 1.2255.

Immediate support is at 1.2065. Very significant support is at 1.1990 and then nearby at 1.1980 from a trendline rising since January 2005. Only an aggressive move beneath this line would signal a sustained decline. There is a key level at 1.1945. Dollar/Swiss franc then has strong support at 1.1885.

Oscillators are rising.

NEAR-TERM: Mixed with bullish bias

MEDIUM-TERM: Slightly bearish

LONG-TERM: Slightly bearish |

2026.2.13 图文交易计划:美指持续震荡 等1416 人气#黄金外汇论坛

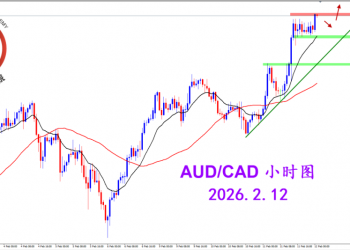

2026.2.13 图文交易计划:美指持续震荡 等1416 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1371 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1371 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1573 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1573 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1495 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1495 人气#黄金外汇论坛