USD/CAD: Loonie Likes FOMC Comments, Pops To New Session High

New York, June 28.

It is always difficult to comprehend what was going through the "group collective" mind ahead of the FOMC meeting, as each of us has their own view, and imbues the ensuing comments with our own expectations. Spot USD/CAD probed below 1.0600 for the first time in two weeks, hitting 1.0598 at the low. The Fed comments focused on inflationary risks, and resource utilization pressures as future inflation risks; hawkish enough, however the collective mind felt otherwise, or maybe just one trader felt otherwise and decided to back ideas up with action. On the day USD/CAD has traded heavy under the influence of the Norilsk/Lionore M&A flow, and the heavy buying of July 17 1.0500 CAD calls, presumed to be the same French bank that was aggressive in the spot markets. When spot slides, and strikes are close to market, options traders have to buy more spot CAD to hedge delta, which puts more pressure on spot.

Tech traders are looking at this 1.0595/05 level as potentially a good support area which is one of the reasons why price action down here is "sticky", RSI is also stretched on the hourly at 22.0, so spot is trading very apprehensively in the 1.0600-10 range. There is a definite risk that the techies get long, and the M&A boys don't care about oversold levels, the key to the downside remains the June 4 1.0550 low, and if spot closes below 1.0610-15, at least one tech trader is recommending a sale as they say the channel bottom has been violated.

I hate M&A, but in a certain way I'm kind of like them。。。 Just don't play too much of the game, or it'll get hurt. Just don't play too much of the game, or it'll get hurt. |

2025.12.16 图文交易计划:布油开放下行 关1154 人气#黄金外汇论坛

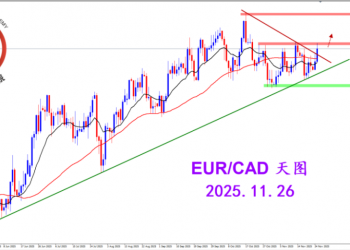

2025.12.16 图文交易计划:布油开放下行 关1154 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2864 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2864 人气#黄金外汇论坛 MQL5全球十大量化排行榜2937 人气#黄金外汇论坛

MQL5全球十大量化排行榜2937 人气#黄金外汇论坛 【认知】5729 人气#黄金外汇论坛

【认知】5729 人气#黄金外汇论坛