Dollar: Watch Non-Manufacturing ISM and ADP for Clues on Non-Farm Payrolls

Unsurprisingly, the markets have been extremely quiet with US traders off celebrating Independence Day. There has been little action in the foreign exchange market with the dollar strengthening only slightly against the British Pound and Japanese Yen, and weakening slightly against the Euro and commodity currencies. Although the interest rate decisions by the European Central Bank and Bank of England should be the most market moving events tomorrow, traders will also be looking closely at the Service Sector ISM and Challenger layoff reports as well as the ADP Employment survey. With many US traders taking the remainder of the week off, we could see more than usual volatility from this Friday’s non-farm payrolls report. Unlike the manufacturing sector, the expansion in the service sector is expected to slow but having reached the highest level in more than a year last month, even a small dip leaves service sector activity at a lofty level. Unless we get a very hawkish outcome from the ECB and BoE meetings, further dollar weakness should be limited because the inflationary pressures are far more pressing at the moment than growth concerns. Oil prices continue to remain above $70 a barrel while stock prices refuse to fall. Since the beginning of the year, crude prices have increased over 40 percent and if it continues to rise, we could see a sharp jump in both headline and core prices. For more on the ramification of $70 oil for the currency market, see our Special Report. The Federal Reserve will only shift away from their hawkish monetary policy bias by seriously considering lowering interest rates when job growth falls below 100k. If companies stop hiring, then the US economy is in serious trouble. That is why payrolls going forward will be extremely important because the stability of the housing market is hanging by a thread.

Strong Euro Will Play a Role in ECB Policy

Having just raised interest rates last month, the European Central Bank is expected to make no alterations to monetary policy tomorrow. Although this means that the 7:45am EST announcement will be a non-event, the 8:30am EST press conference could be very market moving. As usual, central bank President Trichet will be shedding more light on what they plan to do with interest rates in the months ahead. Like the UK, the Eurozone faces inflationary pressures that warrant higher interest rates, but the strong level of the Euro may give the central bank the flexibility to wait until after the summer to raise rates. They may not want to risk sending the EUR/USD to 1.40 by raising rates prematurely when the strong currency will automatically help to reduce inflationary pressure. This morning’s Eurozone data was mixed. Eurozone service sector PMI was stronger than expected in the month of June which combined with the strong manufacturing data, is very encouraging. Retail sales however fell short of expectations, but that was expected given weakness in German consumption.

[ 本帖最后由 ForexGG 于 2007-7-4 16:26 编辑 ] |

2025.12.16 图文交易计划:布油开放下行 关1156 人气#黄金外汇论坛

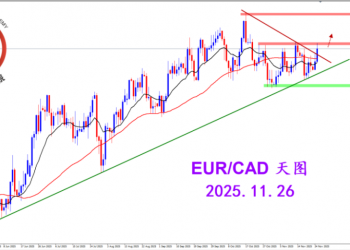

2025.12.16 图文交易计划:布油开放下行 关1156 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2867 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2867 人气#黄金外汇论坛 MQL5全球十大量化排行榜2939 人气#黄金外汇论坛

MQL5全球十大量化排行榜2939 人气#黄金外汇论坛 【认知】5731 人气#黄金外汇论坛

【认知】5731 人气#黄金外汇论坛