EUR/USD: Weighed Down By US Payroll Expectations

Sydney, July 6:

Exactly one year ago on July 5 2006, the market was quite excited by the prospects for US non-farm payroll data after the ADP report showed a gain of 368K. US Treasury prices slid lower (yields higher) and the EUR/USD slid from 1.2840 to 1.2705 after the ADP report as expectation rose that the US non-farm payroll data to be released on Friday, July 7, 2006 would come in much stronger than the 180K expected by economists surveyed before the ADP release. Analysts scrambled to change their forecasts after the ADP release and the market whispers were for a number in excess of 200K.

The market was extremely disappointed on the release of the US non-farm payroll data on Friday, July 7, 2006, as the number came in well below forecasts at 121 K leading to headlines the next day that the US might be heading into stagflation. Yesterday in the US, Treasury prices sold off and the EUR/USD eased after the ADP job report showed a rise of 150 K leading to the market looking for a much stronger that the 130 K US job number to be released later today. If you were wondering why the overnight reports had a familiar ring to them, now you know why.

[ 本帖最后由 ForexGG 于 2007-7-5 22:13 编辑 ] |

2025.12.16 图文交易计划:布油开放下行 关1155 人气#黄金外汇论坛

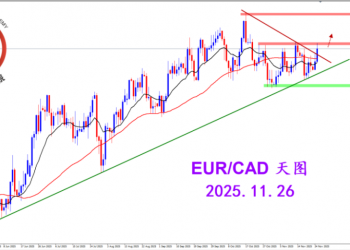

2025.12.16 图文交易计划:布油开放下行 关1155 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2864 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2864 人气#黄金外汇论坛 MQL5全球十大量化排行榜2937 人气#黄金外汇论坛

MQL5全球十大量化排行榜2937 人气#黄金外汇论坛 【认知】5729 人气#黄金外汇论坛

【认知】5729 人气#黄金外汇论坛