原帖由 花木兰1 于 2007-6-8 10:34 发表

如果损后真升去120了,心理好过些,损了却又去了121.80,不气才怪.

市场往往这样。。。墨菲法则

看来日元得了”精神分裂症了“

USD/JPY: Schizophrenic Yen In Two Minds

New York, June 8.

Just when the market had established that this is it, the big carry trade liquidation that was going to be the "mother of all liquidations" the market stops and reverses as if to say "not so fast there Abernathy". Comments from the MoF"s Watanabe who down- played recent exchange rate moves, stating that there was no "immediate risk of carry trade unwinding" upset that nascent trend, and threw the market into reverse.

This morning in New York the range has been 121.53/83, and some traders are wishing wistfully back to yesterday"s clearly directional market that would have afforded ample profits for everybody. Option vols overnight reflected the heightened volatility, with 1-mth vol shooting up from to 6.4/6.65 from 6.15/6.3, but the offers are creeping in again as spot slumps into a sullen sideways chop. There were 121.50 expiries this morning, and large 121.00 expiries are coming off Monday, with a slew of strikes expiring across the 120.50/122.50 landscape, and the likelihood is that the usual expiry congestion is going to constrict spot trading.

Watanabe"s comments were taken as a "green light" that the carry trade is back on, and AUD/JPY and NZD/JPY traded back up on the strength of that. AUD/JPY is up a big fig since last night"s lows around 102.35 and NZD/JPY is also up a big fig at 91.85. EUR/JPY has faired less well, up 50pts to 162.30, reflecting downward pressure on EUR/USD. CAD/JPY is also up almost a big fig at 114.40, and GBP/JPY also at 238.95. CHF/JPY is unchanged around 98.45

[ 本帖最后由 ForexGG 于 2007-6-8 10:46 编辑 ] |

2026.2. 6 图文交易计划:纽美快速回落 短296 人气#黄金外汇论坛

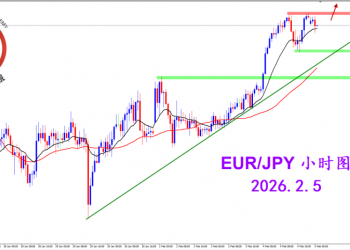

2026.2. 6 图文交易计划:纽美快速回落 短296 人气#黄金外汇论坛 2026.2.5 图文交易计划:欧日短线强势 谨慎505 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎505 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指506 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指506 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头707 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头707 人气#黄金外汇论坛