|

Japanese GDP printed at a woeful –1.2% for Q2 as opposed to projections of –0.7% decline as private consumption collapsed to –0.3% from 0.1% initially forecast. The news erased any chance of a rate hike from the BOJ at the upcoming monetary policy meeting on September 18th and in fact put into doubt the possibility of further rate hikes for the rest of the year. The interest rates on the yen therefore will likely remain extremely low at 0.5%, making the writing obituaries for the carry trade such as the one that was done by UK Times over the week-end, a bit premature. Nevertheless, should US equities slide further today testing the 13,000 handle on the Dow USDJPY will most assuredly decline once again. Presently, yen appreciation only comes as a result of carry trade liquidation while the fundamental picture in Japans provides absolutely no support to yen bulls. |

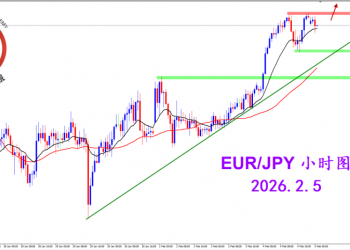

2026.2.5 图文交易计划:欧日短线强势 谨慎401 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎401 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指399 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指399 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头533 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头533 人气#黄金外汇论坛 2026.2.2 图文交易计划:美指快速拉升 理性633 人气#黄金外汇论坛

2026.2.2 图文交易计划:美指快速拉升 理性633 人气#黄金外汇论坛