well, is there anything significant over the past few days that trigger this

current mild correctiion ?

Turkey moving into Iraq ? just a regional conflict

Oil moving onto 85 ? well, part of the Turkey story

BoA, Citi pool monies to buy subprime ? no big deal. everybody know banks are in deep ----.

However, the Equities are still in a Bull Trend. B'cos Uncle Ben is around when needed.

Nothing that monies cannot help would deter this current Bull market.

Another rate cut is confirmed, after Ben speech yesterday. The question is whether if Ben would SHOCK AND AWE with a 50 bp cut.

My bet is a 50 bp cut, bring rate to 4.25. (if you read Ben's dessertation)

Hence, Euro would go higher alongside SPX, NDX, INDU after this mild pullback. The Euro probably would consolidate in the next couple of days, and rise again mid next week for monthend FOMC. 1.45 is a likely target.

Well, Gold is dancing its own tune. Do you know that in China, banks put up banners in faraway small towns encouraging people to buy paper gold ?

Chinese are very aware of their inflation. (unlike US which is masked by flawed statistics). Hence the rush to Gold is inevitable. Current Gold level provides good buying opportunities.

In coming years, China would soon catch up with US/ECB on their Gold deposits.

The market is very predictable nowadays, making monies isn't that difficult as we ride on the BIG FISH.

In case, market crash, we would definitely see a couple of DEAD BIG FISH lying on the beaches. However highly unlikely, unless we discover a Near Earth Object reaching Earth in yr 2050, or an invasion by aliens.

Hence, just wait for the bottom to form, and load up on Euro, Gold, and Equities.

Too much monies around, no where to go. just hangon around in Equities。 |

2026.2. 6 图文交易计划:纽美快速回落 短177 人气#黄金外汇论坛

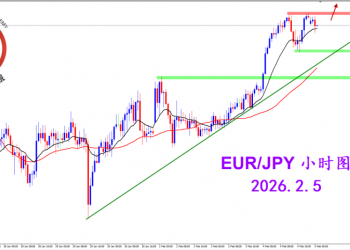

2026.2. 6 图文交易计划:纽美快速回落 短177 人气#黄金外汇论坛 2026.2.5 图文交易计划:欧日短线强势 谨慎434 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎434 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指451 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指451 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头667 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头667 人气#黄金外汇论坛