6 - 11 - 08 Sharkeater 上证指数图 |

| |

| |

回复 217楼 cci 的帖子

| |

|

make money and make fun

|

|

回复 218楼 cci 的帖子

| |

|

make money and make fun

|

|

| |

回复 224楼 rabe 的帖子

| |

|

make money and make fun

|

|

2026.2.13 图文交易计划:美指持续震荡 等1281 人气#黄金外汇论坛

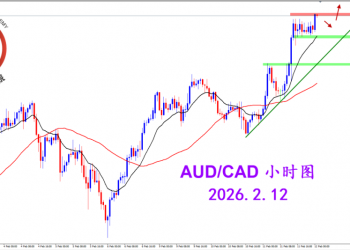

2026.2.13 图文交易计划:美指持续震荡 等1281 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1291 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1291 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1396 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1396 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1303 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1303 人气#黄金外汇论坛