1。NEW YORK -- Hedge funds have been selling billions of dollars worth of stocks and other securities to meet demands from investors who want to pull money out.

The big unknown is whether they've sold enough.

At many hedge funds, Saturday is so-called Redemption Day, the last day of a window when investors can ask for their money back.

Market observers and hedge-fund insiders themselves say it is impossible to estimate to what extent investors, including high net-worth individuals, pension funds and university endowments, will seek to pull out of the secretive US$2-trillion global industry.

Morgan Stanley is estimating redemption requests around the globe could hit 25% for the year.

Some market observers believe that hedge funds have sold enough over the past several weeks to meet the demands of their investors. But worries they haven't have kept stock markets here and abroad under pressure.

"Hedge-fund managers have been anticipating capital outflows over the past couple of months," said Ken Heinz, president of Chicago-based Hedge Fund Research Inc. "But there's no way to quantify it. The magnitude of it depends on what happens in the next six weeks. People who submit redemption requests may not want to go through with them."

In the third quarter, investors pulled out a record US$31-billion.

The wave of redemptions come as the loosely regulated pools of private money are having their worst year since 1998 when the U.S. government had to arrange a multi-billion-dollar rescue of Connecticut hedge fund Long-Term Capital Management.

Hedge fund returns are down an average of about 20% for the year.

To cope, hedge funds have been laying off employees, cutting the hefty fees they charge investors, shutting down certain funds and setting up emergency gates to put a clamp on withdrawals.

Platinum Grove Asset Management, a hedge fund co-founded by Nobel prize winner and math whiz Myron Scholes, halted investor redemptions from its biggest fund after it dropped nearly 30% in the first half of last month.

Carl Icahn, meanwhile, ended up injecting US$250-million of his own money into one of his hedge funds to avoid having to dump assets at bargain-basement prices amid a surge in redemption requests.

Barton Biggs, a New York-based hedge fund manager, doesn't expect, as some fear, "a tsunami of redemptions from disillusioned investors."

His view is in part because "the panic has abated," he wrote in an article in the latest issue of Fortune magazine.

Still, Mr. Biggs, former chief global strategist for Morgan Stanley, conceded, "Nobody, and I mean nobody, really knows what hedge-fund liquidity is or what redemptions are or will be."

The secrecy and lack of transparency in the hedge-fund world has led to renewed calls from U.S. politicians to impose regulations.

Five of the world's richest hedge fund managers, including George Soros, appeared at a heated hearing this week on Capital Hill to answer questions about the huge, undisclosed risks they take in stock and bond markets and the danger they might pose to the broader market.

2。

Get Over The Hedge

Steve Schaefer, 11.16.08, 09:00 AM EST

Wall Street is braced for a wave of fund redemptions that is unlikely to be as as large as feared.

Hedge funds are to the modern stock market as sun spots were to electronics in the 1960s: a convenient scapegoat when things go wrong without an evident cause. But they probably aren't to blame for last week's poor showing on Wall Street, and rumors of the industry's demise are likely premature.

There has been speculation that funds are currently under pressure to sell stocks because Saturday was 45 days from the end of the year. Traditionally, some hedge funds have given their shareholders a month and a half to make their intentions of annual sales known.

BuzzBut Ken Heinz, president of industry-tracking Hedge Fund Research, downplayed the likelihood of market-rattling redemptions this weekend, noting that most funds have shorter advance-notice requirements than 45 days.

Ron Geffner, a lawyer at Sadis & Goldberg who works with hedge fund managers and investors, said the fear of redemptions is more of a self-fulfilling prophecy than a calendar-based inevitability. "I wouldn't hold my breath for a doomsday event," Geffner said.

During the upheaval on Wall Street in recent weeks, trading has been marked by extreme volatility. The so-called "fear index," the Chicago Board Options Exchange's VIX market volatility gauge jumped to an all-time high of 96.40 Oct. 23. To put the figure in perspective, prior to the market dislocations of the past few months a reading over 30.00 was considered an indication of high volatility and investor uncertainty.

Observers have attributed at least some of the unrest to forced selling by hedge fund managers being forced to meet current and upcoming redemption requests from their investors. Geffner said he expects many funds will need to liquidate positions over the next 12 months, based on requests for guidance his firm has received, but added that he does not expect forced liquidations that will take place over a day or week.

Richard Heller, a partner at law firm Thompson Hine, said other factors have been more responsible for the wild swings on Wall Street. Heller said trigger selling brought on by unanticipated events -- like Treasury Secretary Henry Paulson's recent alterations to the Troubled Asset Relief Program (See "TARP Changes Colors" )-- is creating more panic than hedge fund redemptions, which have already been anticipated by sophisticated market watchers.

Comment On This Story

Jack McDonald, chief executive of Conifer Securities, a prime brokerage that clears trades for hedge funds, said many funds have been hoarding cash to meet redemptions. Those managers are likely champing at the bit to redeploy the capital at the current depressed market prices -- the Standard & Poor's 500-stock index hit a new 2008 low at 818 during intraday trading on Thursday. What isn't used to meet redemptions could quickly find its way back into the stock market.

The redemption-forced selling that has plagued some funds, is not indicative of the overall health of the industry, Heinz said. According Hedge Fund Research's data, the top 10.0% of funds by performance are up 34.0% in 2008, offset by the bottom 10.0%, which have declined by 40.0%.

"During storms like this, waters recede from all shores," Geffner said. Since most asset classes, from stocks to bonds to commodities, have suffered, hedging ability has been hampered, and reallocating into better-performing areas has not been an option. As a result, many currently successful investment approaches are in unusual areas with little or no direct correlation to the stock market, Geffner said. He cited budding funds that invest in asset-backed lending, wine and coins as a few examples.

While Nov. 15 redemptions may not spark the selling frenzy some fear, there is no doubt that hedge funds have had a rough go of it during the current financial crisis. The Credit Suisse/Tremont Hedge Fund index, which measures performance across 10 sub-strategies, said funds lost an estimated 5.3% in October. This comes after a third quarter that saw total assets under management decline by $210.0 billion, and investor withdrawals of $31.0 billion, according to data from Hedge Fund Research.

Even if fourth-quarter redemptions are not as severe as some expect, many funds are still caught between a rock and a hard place. While managers can, and some have, put up gates to limit redemptions, they may also be running out of liquid positions to exit even with curbs to keep money from tumbling out of their funds all at once.

Dan Alpert, managing director at boutique investment bank Westwood Capital, said he suspects that the levels of illiquid assets are creeping up at many hedge funds, based on conversations he has had with fund managers. The downturn in financial markets has pushed many investments into the red, but the problem, Alpert said, is that some funds have been forced to sell their most liquid securities, like stocks, to meet redemptions. Problems arise when redemptions keep coming in and the cupboard of easily sold positions runs dry as Alpert said he suspects is happening at some funds.

Investments in private companies that were made with an eye toward public offerings are one example of the illiquid holdings that some funds have been choking on. Due to the frozen credit environment and volatility in equities, the initial public offering market has been at a standstill, leaving no viable exit strategy for investors. A rebound in mergers and acquisitions would likely help break the logjam in this area, but that likely requires lenders to regain their appetite for risk.

Chris Wang, a portfolio manager at hedge fund SYW Capital Management, said investments in private companies and complex debt securities are not the only illiquid investments being held by hedge funds. Thinly traded public securities, worn down by the volatile market to the point where there is no buying interest, are another area of concern. Any disposal of these stocks now sparks selling pressure that drives down the price, tying the hands of funds that hold them.

Some funds have also been hamstrung by what Geffner called "knee-jerk" responses to the financial crisis from federal regulators, like the temporary ban on short-selling imposed by the Securities and Exchange Commission in September. The ban hindered many hedge fund strategies, and a large portion of the money pulled out as a result has remained on the sidelines.

Still, the restrictions on short-selling also opened created a higher barrier of entry on complex trades like shorting index or commodity futures and led to more opportunities for some funds with dedicated short-selling strategies, according to Heinz.

There are other sides to the hedge-fund redemption tale. The funds count many endowments and pension funds among their investors. Many of these investors have cash-flow needs that they meet either from new contributions -- pinched in these tough times -- or by selling investments. Andrew Schneider, founder of hedge fund data tracking firm HedgeCo. Networks, downplayed the impact on these kinds of organizations, noting that most have only a small percentage of their monies tied up in hedge funds, and are able to draw on other investments for liquidity.

While opinions differ over how much the industry will be shrunk by redemptions in 2008, those interviewed were nearly universal in their agreement that there is plenty of cash on the sidelines waiting to find a new home.

Heller said he is not particularly worried about the long haul, though the next few months will be a challenge. "Some hedge funds will go out of business," Heller said, "but when the capital comes back at some point next year the guys who didn't get hurt this time around will get money." Managers he has spoken with have suggested the reformation of capital could begin as soon as April.

Wang, the hedge-fund manager, said his firm's long/short equity fund is in the black for the year, rebounding in October after taking some volatility-related hits in the third quarter when the U.S financial system was on its shakiest footing. He was less ready to predict a broad inflow back into hedge funds though. "Cash presently on the sidelines is likely to stay there for a while," Wang said, until the market hits a bottom "investors are comfortable with." It is more likely that money will ping-pong in and out of markets and hedge funds for some time due to high volatility, Wang added.

When it comes to fourth-quarter redemptions, Wang stressed much can change before Dec. 31. In fact, some of his firm's investors were planning redemptions, but canceled because of its improved October performance.

有没有消息说对冲基金现金够不够赎回,另外共同基金是什么情况,请大家都做点功课,不要等着我来说结果。

[ 本帖最后由 碧咸 于 2008-11-16 23:49 编辑 ] |

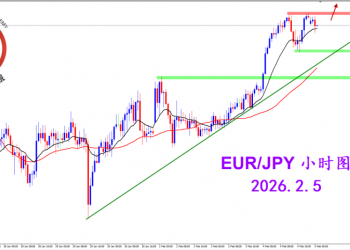

2026.2.5 图文交易计划:欧日短线强势 谨慎199 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎199 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指317 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指317 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头430 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头430 人气#黄金外汇论坛 2026.2.2 图文交易计划:美指快速拉升 理性568 人气#黄金外汇论坛

2026.2.2 图文交易计划:美指快速拉升 理性568 人气#黄金外汇论坛