For those who are speculating the bottom. I feel it's probably better to

know that there is an eager waiting on the time bomb - CDS now. No one

knows what the scale of the crisis. It's as big as 64 trillion USD. This

is a totally unregulated market with a sheer size that can cause a chain

reaction.

This Thursday, there will be an auction on Lehman's loads, with a notional

value of 400 billion, valued some thing around 10 cents on the dollar. The

size of CDS contract on Lehman is not know. If it is as big as the loan,

then the sellers will have to find 360 billion to settle. In September,

there are quite some naked CDS bought against Lehman speculating its default

.

Fed is trying to set up a CDS clearing house with the help from the big

banks. You can find this in News. If Lehman's auction goes well, then there

will be a relief on the market especially money market.

2F 's auction was done on Monday, with a recovering rate of 91-99.5 cents on

the dollar, the outstanding CDS settlement was aorund 20 billions. That was

not a catastrophic figure. But there is a lots of uncertainty about Lehman'

s CDS settlements now.

Another auction on WaMu's loan is on 22 Oct. It is the next window to gain

some insight about the potential danger of CDS.

FYI:

The largest sellers of CDS are MS, Deutsche, GS, JPM, UBS, LEH,

Barclays, Cit, CSFB (2005).

The largest hour reference bodies are GM, Ford, Brazil and Chrysler (as end

of 2005 I dont have newer data).

Be careful when you predicting the bottom -- unless you have taken what I

said into account. |

2025.12.16 图文交易计划:布油开放下行 关1464 人气#黄金外汇论坛

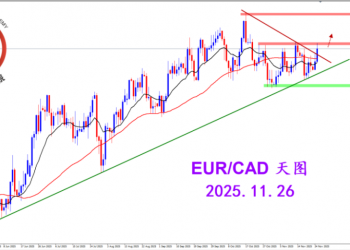

2025.12.16 图文交易计划:布油开放下行 关1464 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2921 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2921 人气#黄金外汇论坛 MQL5全球十大量化排行榜3010 人气#黄金外汇论坛

MQL5全球十大量化排行榜3010 人气#黄金外汇论坛 【认知】5798 人气#黄金外汇论坛

【认知】5798 人气#黄金外汇论坛