Dealer

Whether trading stocks, options, futures or forex, I’ve never heard a kind word from retail traders about dealers. They cheat, they steal, and they make markets wide enough to drive a Mack truck through. They back away from their quotes when markets get wild. And on and on and on. All true, but immaterial.

In recent years, two factors have made markets fairer and more efficient for retail traders – competition and computerization. Presently, all major financial markets are fully electronic with strict price and time-stamp rules that provide traders with auditable results and lightning-fast execution. Often traders have the opportunity to join the dealers in buying on the bid and selling on the ask, thus completely leveling the playing field. In short, why be mad at the dealers for your own bad decisions? Dealers, after all, offer a necessary market service – liquidity. Don’t think so? Just try to get rid of a 100,000-share position after market hours if some adverse news hits the stock. Volatility takes on a whole new meaning when 33 percent of your position value disappears in less than a minute on what often is only a mildly bad piece of news.

Instead of hating dealers, traders should learn to trade like them. Unlike regular retail traders, dealers usually follow two maxims: Always be fading, and never trust the first price. The fact that dealers usually are on the opposite side of price action really should come as no surprise when one realizes that 80 percent of the time markets are range-bound – and, therefore, retrace the original move. During the 20 percent of the time when markets do trend, dealers often sustain losses. Tom Baldwin was a former meatpacker who started with a $25,000 grubstake and became one of the largest market makers in the Chicago Board of Trade’s Treasury bond pit, often turning over $1 billion of inventory per day. In an interview with Jack Schwager he said the following, “Because I’m a market maker, I take the other side of the trend. So if the market goes one way for 50 ticks, I can guarantee you I’m going the wrong way, and at some point it is going to be a loss.”

Typically when dealers incur trend risk, they chalk it up to cost of doing business. However, on some occasions the one-way moves are so severe and so relentless that dealers can go bankrupt. Witness the example of several NYSE specialist firms that continued to make markets during the 1987 stock market crash and sustained unrecoverable losses.

Scaling in – Not Averaging Down

Although fading the trend may not be the rule most retail traders wish to follow, it is the dealers’ second trick that can be of tremendous help to retail speculators. In his very informative book, The Market Makers Edge, Josh Lukeman writes, “Successful market makers have controlled the ego-based need to be absolutely correct. Because markets are constantly in motion, it is almost impossible to be exactly right on (in your entries).” Such a probative approach to the markets is at the heart of most successful professional trading. Dealers know full well that their first foray into the trade is often wrong. They rarely commit the full position amount on the first try.

One of the key differences between professionals and amateurs is that professionals scale into trades... |

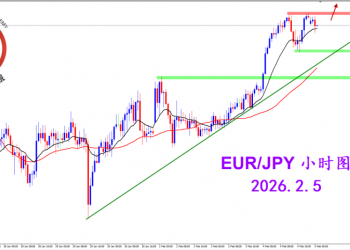

2026.2.5 图文交易计划:欧日短线强势 谨慎251 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎251 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指317 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指317 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头462 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头462 人气#黄金外汇论坛 2026.2.2 图文交易计划:美指快速拉升 理性568 人气#黄金外汇论坛

2026.2.2 图文交易计划:美指快速拉升 理性568 人气#黄金外汇论坛