最近我又读了一遍《走进我的交易室》一书,认为其中关于交易纪律和心态的篇章描述的不错,想和大家一起分享,因为此书无电子版本,我只能按照书中内容打字,会比较的慢。 ...

michael022 发表于 2009-6-21 14:13

LZ辛苦辛苦,我帮你贴出来把!

第04章 思想——有纪律的交易者

Traders come to the markets with great expectations, but few make profits and most wash out. The industry hides good statistics from the public, while promoting its Big Lie that money lost by losers goes to winners. In fact, winners collect only a fraction of the money lost by losers. The bulk of losses goes to the trading industry as the cost of doing business - commissions, slippage, and expenses - by both winners and losers. A successful trader must hop over several high hurdles - and keep hopping. Being better than average is not good enough - you have to be head and shoulders above the crowd. You can win only if you have both knowledge and discipline.

交易者进入市场,都有很大的期望,但只有很少的人赚钱了,大部分人都被洗出局了。上市公司向公众隐瞒真实的数据,却不断撒谎,造成输家的钱流入赢家的口袋。事实上,赢家只是拿了输家的一部分钱。很多人亏损的钱被这个行业的公司赚去了——佣金,滑点亏损和其它费用——赢家和输家都要付钱。成功的交易者要跳越过这些障碍——不停地跳。比平均水平高不算很好——你要站在大众的头上。如果你有知识,还有纪律,你才会赢。

Most amateurs come to the markets with half-baked trading plans, clueless about psychology or money management. Most get hurt and quit after a few painful hits. Others find more cash and return to trading. We do not have to call people who keep dropping money in the markets losers because they do get something in return. What they get is fantastic entertainment value.

大部分业余选手的交易计划根本不完善,根本没有心理和资金管理方面的计划,他们就进入了市场。大部人都会受伤,痛苦几次之后就会退出。其他人又找了一些钱再次进入市场。我们不必呼吁他们不要在市场亏钱,因为他们也有收获。他们的收获就是奇妙的娱乐价值。

Markets are the most entertaining places on the face of the Earth. They are like a card game, a chess game, and a horse race all rolled into one. The game goes on at all hours - you can always find action.

市场是这个地球上最能娱乐人的地方。就像打扑克,下棋,赛马一样。这些游戏随时都有——你永远有动手的机会。

An acquaintance of mine had a terrible home life. He avoided his wife by staying late in the office, but the building closed on weekends, pushing him into the bosom of his family. By Sunday mornings he could take no more “family togetherness” and escaped to the basement of his house. There he had set up a trading apparatus, using the equipment loaned to him by another loser in exchange for a share of future profits. What can you trade on a Sunday morning in suburban Boston? It turned out that the gold markets were open in the Middle East. My acquaintance used to turn on his quote screen, get on the phone (this was in the pre-Internet days), and trade gold in Abu Dhabi!

我的一个熟人,他的家庭生活很糟糕。他在办公室待到很晚,以回避他的妻子,但是周末大楼不开放,没办法只好回家。在周日的早上,他不想和老婆见面,就躲到地下室。他有交易设备,是另一个输家赔给他的。他准备做期货赚钱。在波士顿郊区的周日早上,你能交易什么?原来中东的黄金市场是开放的。我的这个熟人就打开波动报价器,拿起电话(这还是互联网以前的事),开始交易阿布扎比的黄金!

He never asked himself what his edge was over local traders. What has he got, sitting in a bucolic suburb of Boston, that they haven’t got in Abu Dhabi? Why should locals send him money? Every professional knows his edge, but ask an amateur and he’ll draw a blank. A person who doesn’t know his edge does not have it and will lose money. Warren Buffett, one of the richest investors on Earth, says that when you sit down to a game of poker, you must know within 15 minutes who is going to supply the winnings, and if you don’t know the answer, that person is you. My Boston buddy wound up losing his house in a bankruptcy, which put a whole new spin on his marital problems, even though he no longer traded gold in Abu Dhabi.

他从不问问自己,他比当地人的优势是什么。他坐在波士顿的郊区,有什么东西是阿布扎比的人所没有的?当地人为什么要给他钱?每个专业人士都知道自己的优势是什么,但是你问业余选手,他就不知道。一个人如果不知道自己的优势,那么他就没有优势,他就会亏钱。沃伦•巴菲特,是全球最富有的投资者之一,他说当你坐下来打扑克时,你必须在15分钟内搞清楚谁是给赢家送钱的人,如果你不知道答案,你就是那个人。我的波士顿伙计最后亏损破产,输掉了自己的房子,虽然他再也不交易阿布扎比的黄金了,他的婚姻也没有好转。

Many people, whether rich or poor, feel trapped and bored. As Henry David Thoreau wrote almost two centuries ago, “The mass of men lead lives of quiet desperation.”

很多人,不管是富人还是穷人,都觉得自己深陷泥潭,烦躁。就像差不多100年前的亨利•大卫•索罗写的那样:“大部分人都在绝望中生活。”

We wake up in the same bed each morning, eat the same breakfast, and drive to work down the same road. We see the same dull faces in the office and shuffle papers on our old desks. We drive home, watch the same dumb shows on TV, have a beer, and go to sleep in the same bed. We repeat this routine day after day, month after month, year after year. It feels like a life sentence without parole. What is there to look forward to? Perhaps a brief vacation next year? We’ll buy a package deal, fly to Paris, get on a bus with the rest of the group, and spend 15 minutes in front of the Triumphal Arch and half an hour going up the Eiffel Tower. Then back home, back to the old routine.

每天早上我们在同样的床上醒来,吃同样的早餐,在同样的路上开车上班。在办公室看见的是同样的苦脸,在办工作上马马虎虎地翻文件。我们开车回家时,看着同样的愚蠢做秀电视,喝酒,到同样的床上去睡觉。我们日复一日地重复这些例行的事,月复一月,年复一年。感觉就像是没有假释的无期徒刑。有什么好期盼的?也许是明年有个短暂的假期?我们购买了全程服务,飞到巴黎,和组团的其他人一起上车,在凯旋门前面待15分钟,在艾菲尔铁塔上面待30分钟。然后回家,过以前的例行生活。

Most people live in a deep invisible groove - no need to think, make decisions, feel the raw edge of life. The routine does feel comfortable - but deathly boring.

大部分过着隐性的理想生活——不用思考,不用做决定,感觉生活的无聊。例行工作确实舒服——但无聊死了。

Even amusements stop being fun. How many Hollywood movies can you watch on a weekend until they all become a blur? How many trips to Disneyland can you take before all the rides in plastic soap dishes feel like one endless ride to nowhere? To quote Thoreau again, “A stereotyped but unconscious despair is concealed even under what are called games and amusements of mankind. There is no play in them.”

即使是现在的娱乐项目也不搞笑了。有多少部好莱坞的电影能让你在周末坚持看下去?迪斯尼乐园的那些气垫船,感觉总是不知去哪里,你会去玩几次?再次引用索罗的话:“所谓的游戏和人类的娱乐下面隐瞒了刻板和了无生趣的绝望,根本没有乐趣。”

And then you open a trading account and punch in an order to buy 500 shares of Intel. Anyone with a few thousand dollars can escape the routine and find excitement in the markets.

然后你开了一个账户,立刻买了500股英特尔的股票。任何人,只要有几千元,都可以逃离例行工作并在市场中找到刺激。

Suddenly, the world is in living color! Intel ticks up half a point - you check quotes, run out for a newspaper, and tune in for the latest updates. If you have a computer at work, you set up a little quote window to keep an eye on your stock. Before the Internet, people used to buy pocket FM receivers for market quotes and hide them in half-open desk drawers. Their antennae, sticking out of desks of middle-aged men, looked like beams of light shining into prison cells.

突然,这个世界变的色彩斑斓起来。英特尔涨了0.5个点——你查波动报价,看所有的报纸,寻找最新的消息。如果你上班时有电脑,你会开个小窗口看波动。在互联网之前,人们喜欢买个调频收音机,把它藏在半开的抽屉里面。收音机的天线从桌子里面伸出来,桌上的中年男人,就像坐牢的人,看着那几线阳光。

Intel is up a point! Should you sell and take profits? Buy more and double up? Your heart is pounding - you feel alive! Now it’s up three points. You multiply that by the number of shares you have and realize that your profits after just a few hours are close to your weekly salary. You start calculating percentage returns - if you continue trading like that for the rest of the year, what a fortune you’ll have by Christmas!

英特尔涨了1个点!你要不要卖掉兑现利润?还是多买点等翻番?你的心怦怦地跳——你感觉活了!现在涨了3个点。你计算了一下,发现才几个小时,你赚的钱比周薪还多。你开始计算利润百分比——如果这样坚持到年底,到圣诞节时,你已经赚了很多钱了!

Suddenly you raise your eyes from the calculator to see that Intel has dropped two points. Your stomach is tied in a knot, your face pushes into the screen, you hunch over, compressing your lungs, reducing the flow of blood to the brain, which is a terrible position for making decisions. You are flooded with anxiety, like a trapped animal. You are hurting - but you are alive!

突然,当你的眼睛从计算器抬起时,你发现英特尔跌了2个点。你开始揪心,你的脸变绿了,你弓着背,压着肺,减少流向大脑的血液,这种可怕的姿势不适合做决定。你充满了焦急,就像受困的野兽。你受伤了——但是你还活着!

Trading is the most exciting activity that a person can do with their clothes on. Trouble is, you cannot feel excited and make money at the same time. Think of a casino, where amateurs celebrate over free drinks, while professional card-counters coldly play game after game, folding most of the time, and pressing their advantage when the card count gives them a slight edge over the house. To be a successful trader, you have to develop iron discipline (Mind), acquire an edge over the markets (Method), and control risks in your trading account (Money).

一个人,只要还有衣服穿,交易就是最刺激的事。问题是,你无法既感到刺激,又同时赚钱。想想赌场,业余选手在那里为免费的饮料而高兴,然而专业人士坐在牌桌上冷静地思考,每局都是这样,大多数情况下,他们都不跟牌,如果他们的牌确实占优势,他们就会行动了。要想成为成功的交易者,你必须建立铁一样的纪律(思想),拥有优势(方法),控制账户的风险(资金管理)。

SLEEPWALKING THROUGH THE MARKETS

在市场中一相情愿

There is only one rational reason to trade - to make money. Money attracts us to the markets, but in the excitement of the new game we often lose sight of that goal. We start trading for entertainment, as an escape, to show off in front of our family and friends, and so on. Once a trader loses his focus on money, his goose is cooked.

交易的唯一理性的原因是——赚钱。金钱把我们吸引到市场,但是在游戏的刺激中,我们失去了金钱的目标。我们开始为了娱乐而交易,就像是为了逃避家人和朋友。一旦一个交易者不再关注金钱,他就自己害了自己。

It is easy to feel cool, calm, and collected reading a book or looking at your charts on a weekend. It’s easy to be rational when the markets are closed - but what happens after 30 minutes in front of a live screen? Does your pulse begin to race? Do upticks and downticks hypnotize you? Traders get an adrenaline rush from the market, and the excitement clouds their judgment. Calm resolutions made on a weekend fly out the window during rallies or declines. “This time is different . . . It’s an exception . . . I won’t put in a stop now, the market is too volatile” are the giveaway phrases of emotional traders.

在周末,轻松下来,酷一下,看看书,看看波动,都是很容易做到的。收盘的时候是很容易做到理性——但是如果盯着即时波动30分钟以后会如何?你的脉搏会不会加快?上涨和下跌会不会让你着迷?市场让交易者疯狂,但是这种激动影响判断力。在周末做的冷静决定,遇到市场反弹和下跌时还是前功尽弃。“这次不同……这是特殊情况……这次我不设止损,市场波动太大了”这些都是情绪交易者的想法。

Many intelligent people sleepwalk through the markets. Their eyes are open, but their minds are shut. They are driven by emotions and keep repeating their mistakes. It is OK to make mistakes but not OK to repeat them. When you make a mistake for the first time, it shows that you are alive, searching, experimenting. Repeating a mistake is a neurotic symptom.

很多聪明人在市场做梦。他们的眼睛是睁开的,但是他们的思想却关闭了。他们被情绪控制,还重复犯错。犯错可以,但不可以重复犯错。当你第一次犯错时,这说明你还活着,你还在研究,做测试。重复犯同样的错就是神经质。

Losers come in all genders, ages, and colors, but several stock phrases give them away. Let us review some of the common excuses. If you recognize yourself, use that as a sign to start learning a new approach to the markets.

输家不同性别,年龄,肤色的都有,几次波动还不能赶走他们。让我们复习一下常见的借口。如果你发现了你自己也用类似的借口开始学习市场的话,请小心。

Blame the Broker

责怪经纪人

A trader hears his broker’s voice at the most important and tense moments - when placing buy or sell orders or requesting information that may lead to an order. The broker is close to the market, and many of us assume that he knows more than we do. We try to read our broker’s voice and figure out whether he approves or disapproves of our actions.

交易者在下单的时候,或者是下单前询问信息时,在这些关键的时候都会听到经纪人的观点。经纪人和市场很近,我们中间的很多人就以为他比我们懂的多。我们尽力听经纪人的话中之话,想搞清楚他是不是支持我们的操盘行动。

Is listening to your broker’s voice a part of your trading system? Does it say to buy when the weekly moving average is up, daily Force Index is down, and the broker sounds enthused? Or does it simply say to buy when such and such indicators reach such and such parameters?

是不是听经纪人的话算你交易系统的一部分?是不是他说买,均线就上很脏,力量指数就下跌,经纪人也很激动?又或者是他说因为某某指标达到了某某参数,所以要买?

Trying to read your broker’s voice is a sign of insecurity, a common state for beginners. Markets are huge and volatile, and their rallies and declines can feel overpowering. Frightened people look for someone strong and wise to lead them out of the wilderness. Can your broker lead you? Probably not, but if you lose money, you’ll have a great excuse - it was your broker who put you into that stupid trade.

听经纪人的话说明你感觉不安全,这是新手的普遍特征。市场很大,市场在波动,他们的上涨和下跌确实让人觉的它的强大。担惊受怕的人需要一个强大和聪明的人带他走出迷茫。你的经纪人会带你吗?也许不会,但是如果你亏钱了,能找到好借口——就是你的经纪人让你进行那个糟糕的交易的。

A lawyer who was shopping for an expert witness recently called me. His client, a university professor, had shorted Dell at 20 several years ago, before the splits, after his broker told him it “could not go any higher.” That stock became the darling of the bull market, went through the roof, and a year later the professor covered at 80, wiping out his million-dollar account, which represented his life savings. That man was smart enough to earn a Ph.D. and save a million dollars but emotional enough to follow his broker while his life savings were doing a slow burn. Few people sue their brokers, but almost all beginners blame them.

最近有个律师,他要找鉴定证人,他给我打了电话。他的客户是一个大学教授,教授几年前在20元做空戴尔电脑股票,后来戴尔电脑股票除权了,做空的原因是他的经纪人告诉他“戴尔再也不会涨了。”后来,这只股票成为牛市的明星股,冲破了天花板,1年后,教授只好在80元回补平仓,账户的100万亏光了,这100万是他一辈子的储蓄。这个教授很聪明,有博士学历,存了100万,但是却情绪化地听取经纪人的意见而毁了100万。很少有人控告经纪人,但大部分新手都喜欢骂经纪人。

Traders’ feelings towards brokers are similar to patients’ feelings towards psychoanalysts. A patient lies on the couch, and the analyst’s voice, emerging at important moments, seems to carry deeper psychological truths than the patient could have possibly discovered himself. In reality, a good broker is a craftsman who can sometimes help you get better fills and dig up information you requested. He is your helper - not your advisor. Looking to a broker for guidance is a sign of insecurity, which is not conducive to trading success.

交易者对经纪人的感觉和病人对心理医生的感觉类似。病人躺在沙发上,医生的话,在关键时刻会出现,似乎可以比病人更能挖掘病人的内心深处。事实上,好的经纪人是一个艺术师,他帮你过滤信息,挖掘信息。他会帮助你——但不是你的顾问。找经纪人是因为自己觉的不放心,这种心态无助于成功的交易。

Most people start trading more actively after switching to electronic brokers. Low commissions are a factor, but the psychological change is more important. People are less self-conscious when they don’t have to deal with a live person. All of us occasionally make stupid trades, and electronic brokers allow us to make them in private. We are less ashamed hitting a key than calling a broker.

大部分人开始交易时很活跃,然后转向电子经纪人。佣金低是主要的原因,但是心理的变化更重要。如果不和真人打交道,人们就会变的没有自知。我们偶尔都会进行愚蠢的交易,电子经纪人让我们可以私下犯错。敲键盘肯定比打电话给经纪人要不怕丑。

Some traders manage to transfer their anxieties and fears onto electronic brokers. They complain that electronic brokers do not do what they want, such as accept certain types of orders. Why don’t you transfer your account, I ask - and see fear in their faces. It is the fear of change, of upsetting the cart.

一些交易者喜欢把焦急和恐惧转给电子经纪人。他们抱怨说电子经纪人不会按他们的意思做,比如不接受某些类型的订单。为什么你不转户,我问他们——我看见他们满脸恐惧。他们害怕变化,害怕计划被扰乱。

To be a successful trader, you must accept total responsibility for your decisions and actions.

要想成为成功的交易者,你必须为自己的决定和行为全部负责。

Blame the Guru

谴责老师

A beginner entering the markets soon finds himself surrounded by a colorful crowd of gurus - experts who sell trading advice. Most charge fees, but some give advice for free to drum up business for their brokerage firms. Gurus publish newsletters, are quoted in the media, and many would kill to get on TV. Masses are hungry for clarity, and gurus are there to feed that hunger. Most are failed traders, but being a guru is not that easy. Their mortality rate is high, and few stay around for more than two years. The novelty wears off, customers do not renew subscriptions, and a guru finds it easier to earn a living selling aluminum siding than drawing trendlines. My chapter on the guru business in Trading for a Living drew more howls and threats than any other in that book.

刚进入市场的新手会发现自己被各种各样的老师包围了——他们是销售投资建议的专业人士。大部分人都收费,但是一些人不收费,因为要为他的经纪公司做宣传。老师们会发行投资报告,媒体也会引用,很多老师想尽一且办法上电视。大众渴望真知,而老师们正好是来满足这些渴望的。老师的死亡率很高的,很少人能熬过2年。当事物失去了新鲜劲之后,客户就不会再看投资报告了,此时老师会发现卖铝线都比画趋势线要容易谋生。我在《以交易为生》里面有一章说了老师是如何做生意的,引起了很多人的怒火和威胁,他们对这一部分的火气是最大的。

Traders go through three stages in their attitudes towards gurus. In the beginning, they drink in their advice, expecting to make money from it. At the second stage, traders start avoiding gurus like the plague, viewing them as distractions from their own decision-making process. Finally, some successful traders start paying attention to a few gurus who alert them to new opportunities.

交易者对老师的态度会经历3个阶段。一开始,他们信老师的建议,期待建议能赚钱。第2阶段,交易者觉的老师像瘟疫,避免见到老师,觉的见到老师就会影响自己的决策过程。最后,一些成功的交易者开始关注少数老师,这些老师会提示新的机会。

Some losing traders go looking for a trainer, a teacher, or a therapist. Very few people are experts in both psychology and trading. I’ve met several gurus who couldn’t trade their way out of a paper bag but claimed that their alleged expertise in psychology qualified them to train traders. Stop for a moment and compare this to sex therapy. If I had a sexual problem, I might see a psychiatrist, a psychologist, a sex therapist, or even a pastoral counselor, but I would never go to a Catholic priest, even if I were Catholic. That priest has no practical knowledge of the problem - and if he does, you want to run, not walk away. A teacher who does not trade is highly suspect.

一些失败的交易者会去找训练师,教师或医生。很少的人既懂心理学,又懂交易。我遇到了一些老师,他们自己不会赚钱,却说他们的心理学经验适合培训交易者。先停下来谈谈性方面的治疗吧。如果我在性方面有问题,我应该去看心理医生,精神病专家,性学医生,或者是牧师,但是,即使我是天主教徒,也不能去找天主教的牧师。天主教的牧师没有这方面的知识——如果他有,你要赶快跑开。一个没有交易经验的老师很值得怀疑。

Traders go through several stages in their attitudes towards tips. Beginners love them, those who are more serious insist on doing their own homework, while advanced traders may listen to tips but always drop them into their own trading systems to see whether that advice will hold up. Whenever I hear a trading tip, I run it through my own computerized screens. The decision to buy, go short, or stand aside is mine alone, with an average yield of one tip accepted out of every 20 heard. Tips draw my attention to opportunities I might have overlooked, but there are no shortcuts to sweating your own trades.

交易者对待消息的态度要经历3个阶段。新手爱消息,那些喜欢自己做功课的人,是比较优秀的交易者,他们也许会听消息,但总会把消息放进他们自己的交易系统验证消息是否有用。不管什么时候,只要听到消息,我会用电脑去验证。是买,是做空,或者是观望,这些决定我来做。平均来说,20个消息里面有1个是有用的。消息会引起我关注过去忽略的东西,但是你自己的交易并没有捷径可走。

A greenhorn who has gotten burned may ask for a guru’s track record. Years ago I used to publish a newsletter and noticed how frighteningly easy it was for gurus to massage and slant their records, even if they were tracked by independent rating services.

一个新手,如果受了伤害,他会找老师要交易记录。几年前,我也发行投资报告,我发现对于老师来说,即使有评级机构的监管,他们还是能令人吃惊地轻松修改他们记录。

I’ve never met a trader who took all the recommendations of his guru, even if he paid him a lot of money. If a guru has 200 subscribers, they’ll choose different recommendations, trade them differently, and most will lose money, each in his own way. There is a rule in the advisory business: “If you make forecasts for a living, make a lot of them.” Gurus offer convenient excuses to sleepwalking traders who need a scapegoat for their losses.

我从没见过哪个交易者完全听老师的,即使他付了很多钱。如果一个老师有200个学生,他们会选择不同的推荐,用不同的方式交易,而且大多数人会亏钱,每个人亏的方式都不一样。在顾问行业有个原则:“如果你以顾问为生,那么你可以很多种顾问。”对于一相情愿的交易者,如果他们要求赔偿亏损,老师们可以找到很轻松的借口。

Whether or not you listen to a guru, you’re 100% responsible for the outcome of your trades. The next time you get a hot tip, drop it into your trading system to see whether it gives you a buy or sell signal. You are responsible for the consequences of taking or rejecting advice.

不管你听不听老师的,你是100%对你的交易结果负责的。当你下次得到一个好消息,用你的交易系统去测试,看看是不是会出现买卖信号。你接受建议也好,拒绝建议也好,你都要对自己负责。

Blame the Unexpected News

怪罪意外的新闻

It is easy to feel angry and hurt when a sudden piece of bad news blows a hole in your stock. You buy something, it goes up, bad news hits the market, and your stock collapses. The market did it to you, you say? The news may have been sudden, but you are responsible for handling any challenges.

当一个坏消息突然在市场炸开锅时,感到生气,感到受伤是自然的。你买了,价格上涨,突然来了一个坏消息袭击市场,你的股票崩溃了。市场在对付你,你说?也许新闻是突然,但你要为任何挑战负责。

Most company news is released on a regular schedule. If you trade a certain stock, you should know well in advance when that company releases its earnings and be prepared for any market reaction to the news. Lighten up on your position if unsure about the impact of a coming announcement. If you trade bonds, currencies, or stock index futures, you must know when the key economic statistics are released and how the leading indicators or the unemployment rate can impact your market. It may be wise to tighten your stops or reduce the size of your trade in advance of an important news release.

大部分公司的新闻是定期发布的。如果你买了股票,你应该提前知道这个公司何时发布赢利消息,并要做好准备,看市场如何反应。如果你不知道消息对市场的影响,那就要特别关注自己的仓位。如果你交易债券,外汇,或股指期货,你必须知道何时公布关键的经济统计数据,重要指标,或者是失业率对市场的冲击。在重要新闻发布前下好止损单或减少仓位是明智的。

What about a truly unexpected piece of news - a president gets shot, a noted analyst comes out with a bearish earnings forecast, and so on? You must research your market and know what happened after similar events in the past; you have to do your homework before the event hits you. Having this knowledge allows you to act without delay. For example, the stock market’s reaction to an assault on a president has always been a sharp hiccup to the downside, followed by a complete retracement, so a sensible thing to do is buy the break.

如果确实是真正的意外,怎么办——总统被枪击,一个著名的分析师说市场会下跌,等等?你必须自己做市场研究,以了解过去类似的事情是如何发展的。你必须提前做功课,以防止危险袭击你。有了这方面的知识,你就会反应迅速。比如,总统被袭击后,市场的反应总是下跌,然后又完全返回,所以最好的做法就是在缺口处买入。

Your trading plan must include the possibility of a sharp adverse move caused by sudden events. You must have your stop in place, and the size of your trade must be such that you cannot get financially hurt in the case of a reversal. There are many risks waiting to spring on a trader - you alone are responsible for damage control.

你的交易计划还要考虑到突发事件造成的突然反转。你必须提前下好止损单,而且你的仓位大小要合适,不能因为反转而受伤。有很多风险会随时发生在交易者身上——你要自己负责控制。

Wishful Thinking

一厢情愿

When the pain grows bit by bit, the natural tendency is to do nothing and wait for an improvement. A sleepwalking trader gives his losing trades “more time to work out,” while they slowly destroy his account.

当痛苦一点一点的增加,自然的反应就是什么都不做,等事情好转。一个一相情愿的交易者给他亏损的账户“更多的时间以恢复”,然而却慢慢的摧毁了他的账户。

A sleepwalker hopes and dreams. He sits on a loss and says, “This stock is coming back; it always did.” Winners accept occasional losses, take them, and move on. Losers postpone taking losses. An amateur puts on a trade the way a kid buys a lottery ticket. He waits for the wheel of fortune to decide whether he wins or loses. Professionals, to the contrary, have ironclad plans for getting out, either with a profit or a small loss. One of the key differences between professionals and amateurs is their planning for exits.

一相情愿就是梦想。他坐在亏损上面说:“这只股票会回来的,过去总是这样。”赢家接受偶尔的亏损,认亏,然后继续努力。输家推迟认亏的时间。业余选手交易和小孩买彩票一样。他等待命运决定他是赢还是输。专业人士,相反,有钢铁般的出场计划,不管是赚钱的,还是亏钱的。专业人士和业余选手的关键区别就是他们的出场计划。

A sleepwalking trader buys at 35 and puts in a stop at 32. The stock sinks to 33, and he says, “I’ll give it a little more room.” He moves his stop down to 30. That is a fatal mistake - he has breached his discipline and violated his own plan.

一相情愿的交易者在35买入,止损设在32。股票跌到33,他说:“我再给它一点空间。”他把止损改到30。这是致命的错误——他已经违反了自己的纪律和计划。

You may move stops only one way - in the direction of your trade. Stops are like a ratchet on a sailboat, designed to take the slack out of your sails. If you start giving your trade “more room to breathe,” that extra slack will swing around and hurt you. When the market rewards traders for breaking their rules, it sets up an even deeper trap in their next trade.

也许你只会把止损点移到一个方向——你的方向。止损就像船上的棘爪,能帮助你找到疏忽的地方。如果你开始给你的交易“更多的呼吸空间” 更多的疏忽会伤害你。如果市场奖赏了一个违背原则的交易者,那么下次就会有更大的陷阱等着他。

The best time to make decisions is before you enter a trade. Your money is not at risk, and you can weigh profit targets and loss parameters. Once you’re in a trade, you begin to form an attachment to it. The market hypnotizes you and lures you into emotional decisions. This is why you must write down your exit plan and follow it.

最好的做决定的时间是进行交易之前。你的资金没有风险,你可以计算利润或亏损的状况。一旦你进行了交易,你要管住它。市场会刺激你,诱惑你,让你情绪激动。这就是让你把出场计划提前写好的原因,这样才能执行计划。

Turning a losing trade into an “investment” is a common disease among small private traders, but some institutional traders also suffer from it. Disasters at banks and major financial firms occur when poorly supervised traders lose money in short-term trades and stick them into long-term accounts, hoping that time will bail them out. If you are losing in the beginning, you’ll lose in the end. Do not put off the hour of reckoning. The first loss is the best loss - this is the rule of those of us who trade with our eyes open.

交易者的通病就是想把亏损的交易变成赚钱的,机构交易者也会这样。很多大银行和大金融机构发生灾难的原因就是他们的交易者没有受到严格监管,亏了钱就想做长线,期望时间会拯救他们。如果你一开始就亏钱,你最终还是要亏钱。不要把时间往后推。最初的亏损是最便宜的亏损——我们睁大双眼交易的人都要遵守这个原则。

A REMEDY FOR SELF-DESTRUCTIVENESS

治疗自毁的方法

People who like to complain about their bad luck are often experts in looking for trouble and snatching defeat from the jaws of victory. A friend in the construction business used to have a driver who dreamed of buying his own truck and working for himself. He saved money for years and finally paid cash for a huge brand-new truck. He quit his job, got gloriously drunk, and at the end of the day rolled his uninsured truck down an embankment - it was totaled, and the driver came back asking for his old job. Tragedy? Drama? Or fear of freedom and an unconscious wish for a safe job with a steady paycheck?

喜欢抱怨自己运气不好的人,喜欢找麻烦,喜欢从胜利中找失败,他们就是这样的专家。我有个建筑行业的朋友,他的司机总是梦想买自己的车,为自己工作。他存了很多年的钱,然后用现金买了一辆新车。他辞职了,拿到了漂亮的车,最后一天,他把还没有保险的车开到坝下面去了——车是他的所有,这个司机又回来要求得到以前的工作。这是灾难?戏剧?还是他害怕自由,潜意识喜欢安全的,稳定的收入?

Why do intelligent people with a track record of success keep losing money on one harebrained trade after another, stumbling from calamity to catastrophe? Ignorance? Bad luck? Or a hidden desire to fail?

过去的成功交易记录显示这个人很聪明,但他为什么会出现一笔又一笔糟糕的交易,从灾难变成大灾难呢?无知?运气差?还是内心就想失败?

Many people have a self-destructive streak. My experience as a psychiatrist has convinced me that most people who complain about severe problems are in fact sabotaging themselves. I cannot change a patient’s external reality, but whenever I cure one of self-sabotage, he quickly resolves his external problems.

很多人都有自毁的倾向。我作为心理医生,我的经验告诉我,大部分抱怨问题的人实际上是在折磨自己。我不能改变病人的外部现实,但只要我治好了一个自我折磨的人,他很快就会解决外部的问题。

Self-destructiveness is such a pervasive human trait because civilization is built on controlling aggression. As we grow up, we are trained to control aggression against others - behave, do not push, be nice. Our aggression has to go somewhere, and many turn it against themselves, the only unprotected target. We turn our anger inward and learn to sabotage ourselves. Little wonder so many of us grow up fearful, inhibited, and shy.

自毁的情绪容易蔓延,因为文明建立在控制攻击性的基础上。我们成长的时候,我们被教育不要攻击别人——要行为规矩,不冲撞,得体。我们的攻击性要有一个宣泄的地方,很多人转为针对自己,唯一不受保护的目标。我们对自己愤怒,并学会了自毁。这就不奇怪为何很多人长大后感到恐惧,没有情感流露,害羞。

Society has several defenses against the extremes of self-sabotage. The police will talk a potential suicide down from the roof, and the medical board will take the scalpel away from an accident-prone surgeon, but no one will stop a self-defeating trader. He can run amok in the financial markets, inflicting wounds on himself, while brokers and other traders gladly take his money. Financial markets lack protective controls against self-sabotage.

对于自毁的极端情况,社会上有几个办法来阻止。警察会居高临下地和有自杀倾向的人谈话,在容易出事故的手术医生手术时,医院的人会把手术刀拿远点,但是没有人来阻止自欺欺人的交易者。他可以杀进金融市场,给自己造成伤害,然而,经纪人和其他交易者则很高兴地笑纳他的钱。金融市场并没有防止自毁的措施。

Are you sabotaging yourself? The only way to find out is to keep good records, especially a Trader’s Journal and an equity curve, shown later in this book. The angle of your equity curve is an objective indicator of your behavior. If it slopes up, with few downticks, you’re doing well. If it points down, it shows you’re not in gear with the markets and possibly in a self-sabotage mode. When you observe that, reduce the size of your trades and spend more time with your Trader’s Journal figuring out what you’re doing.

你自毁吗?最好的方法是做交易记录,尤其是一个交易者的日记和资金曲线,本书后面会谈的。资金曲线的角度是你行为的最客观指标。如果它上涨,中途的下跌很少,你做的不错。如果它下跌,说明你和市场不同步,也许在自毁状态。当你注意到了这些时,减少你的交易,多花时间在交易日记上,搞清楚你在做什么。

You need to become a self-aware trader. Keep good records, learn from past mistakes, and do better in the future. Traders who lose money tend to feel ashamed. A bad loss feels like a nasty comment - most people just want to cover up, walk away, and never be seen again. Hiding doesn’t solve anything. Use the pain of a loss to turn yourself into a disciplined winner.

你必须成为有自知的交易者。做交易记录,从错误中学习,未来做的更好。亏钱的交易者会觉得羞愧。严重的亏损就像恶毒的评价——大部分人想掩饰,走开,永远不想再看见。躲藏不能解决问题。利用亏损的痛苦把你变成一个有纪律的赢家。

Losers Anonymous

匿名输家

Years ago I had an insight that changed my trading life forever. Back in those days my equity used to swing up and down like a yo-yo. I knew enough about markets to profit from many trades but couldn’t hold on to my gains and grow equity. The insight that eventually got me off the roller coaster came from a chance visit to a meeting of Alcoholics Anonymous.

多年前,我对交易的深刻认识改变了我的交易生涯。过去,我的资金总是上上下下,像溜溜球一样。我对市场也很懂,也赚了不少,但是我的资金就是无法保持增长。当我参加一个匿名酗酒者聚会以后,一个深刻的认识让我不再过山车了。

One late afternoon I accompanied a friend to an AA meeting at a local YMCA. Suddenly, the meeting gripped me. I felt as if the people in the room were talking about my trading! All I had to do was substitute the word loss for the word alcohol.

有天傍晚,我陪一个朋友去参加当地基督教青年会的匿名酗酒者聚会。突然,这个聚会引起我的关注。我觉得整个房间的人是在谈交易!我所要做的就是把单词酒换成亏损。

People at the AA meeting talked about how alcohol controlled their lives, and my trading in those days was driven by losses - fearing them and trying to trade my way out. My emotions followed a jagged equity curve - elation at the highs and cold clammy fear at the lows, with fingers trembling above the speed dial button.

参加聚会的人在谈酒是如何控制了他们的生活,当时我的交易为亏损所累——害怕,想自己乱搞。我的情绪被上下起伏的资金曲线控制了——在高点兴高采烈,在低点又怕又冷,病态一样,手指在电话键盘上发抖。

Back in those days I had a busy psychiatric practice and saw my share of alcoholics. I began to notice similarities between them and losing traders. Losers approached markets the way alcoholics walked into bars. They entered with pleasant expectations, but left with mean headaches, hangovers, and loss of control. Drinking and trading lure people across the line from pleasure to self-destructiveness.

过去,我要做心理医生,所以我自己也会接待酗酒的病人。我开始发现他们和亏损的交易者之间的相似点。输家进入市场的模式和酗酒者进入酒吧一样。他们进去时满怀希望,但离开时头痛不已,头昏,无法自控。酗酒和交易诱惑人们把欢乐变成自毁。

Alcoholics and losers live with their eyes closed - both are in the grip of an addiction. Every alcoholic I saw in my office wanted to argue about his diagnosis. To avoid wasting time, I used to suggest a simple test. I’d tell alcoholics to keep on drinking as usual for the next week, but write down every drink, and bring that record to our next appointment. Not a single alcoholic could keep that diary for more than a few days because looking in a mirror reduced the pleasure of impulsive behavior. Today when I tell losing traders to keep a diary of their trades, many become annoyed.

酗酒者和输家都是闭着眼睛过日子——2者都是对一样东西上瘾。每个进入我办公室的酗酒者都要和我争论诊断结果。为了避免浪费时间,我建议做一个简单的测试。我告诉酗酒者像过去一样再喝一周,但是要记下每次喝酒的情况,下次见面时,把记录给我。没有一个酗酒者能多记几天,因为对着镜子降低了冲动的乐趣。现在,当我告诉亏损的交易者写日记时,很多人觉得生气。

Good records are a sign of self-awareness and discipline. Poor or absent records are a sign of impulsive trading. Show me a trader with good records, and I’ll show you a good trader.

优秀的交易记录说明自我意识好,纪律好。差的或者是没有内容的交易记录说明了冲动交易。如果一个交易者的交易记录优秀,这个交易者就是优秀的交易者。

Alcoholics and losers do not think about the past or the future, and focus only on the present - the sensation of alcohol pouring down the gullet or the market pulsing on the screen. An active alcoholic is in denial; he doesn’t want to know about the depth of his abyss, the severity of his problem, or the harm he is causing himself and others.

酗酒者和输家不思考过去和未来,只是关注现在——酒精在咽喉的感觉或者是屏幕上的市场波动。酗酒者拒绝现实,他不知道深渊的深度,问题的严重性,或者是他对自己及别人造成的伤害。

The only thing that can pierce an alcoholic’s denial is the pain of hitting what AA calls “rock bottom.” It is each individual’s private version of hell - a life-threatening illness, a rejection by family, a job loss, or another catastrophic event. The unbearable pain of hitting rock bottom punctures the alcoholic’s denial and forces him to face a stark choice: he can self-destruct or turn his life around.

只有在碰及到所谓的“底线”时,酗酒者才能明白现实。这是每个人的私人地狱——危及到生命的病情,家人的决裂,失业,或其它灾难。无法忍受的底线刺痛了酗酒者,逼他们做重大的抉择,他要么自毁,要么改变生活。

AA is a nonprofit voluntary organization whose only purpose is to help alcoholics stay sober. It doesn’t ask for donations, advertise, lobby, or take part in any public actions. It has no paid therapists; members help each other at meetings led by long-term members. AA has a system of sponsorships whereby older members sponsor and support newer ones.

匿名酗酒者聚会是自愿的组织,唯一的目的是帮助酗酒者保持清醒。它不需要捐款,广告,游说,也不参加公共活动。也没有收费的医生,会员互相帮助,由长期会员领导。匿名酗酒者聚会有自动的发起体制,老会员发掘并支持新会员。

An alcoholic who joins AA goes through what is called a 12-Step program. Each step is a stage of personal growth and recovery. The method is so effective that people recovering from other addictive behaviors have begun to use it.

任何加入匿名酗酒者聚会的酗酒者都要经历一个叫12步程序的过程。每一步都是个人的成长和恢复过程。这个方法很有效,对其它东西上瘾的人也开始用这个方法了。

The first step is the most important for traders. It looks easy, but is extremely hard to take. Many alcoholics can’t take it, drop out of AA, and go on to destroy their lives. The first step consists of standing up at a meeting, facing a room full of recovering alcoholics, and admitting that alcohol is stronger than you. This is hard because if alcohol is stronger than you, you cannot touch it again. Once you take the first step, you are committed to a struggle for sobriety.

第一步对交易者最重要。看起来简单,但很难做。很多酗酒者无法接受,退出了匿名酗酒者聚会,然后继续摧毁自己的生活。第一步包括在聚会时站起来,面对满屋都是正在恢复的酗酒者,开始承认酒精比你强。这很难做到,因为如果酒精比你强,你就不能再碰它了。一旦你进行了第一步,你就承诺要戒酒了。

Alcohol is such a powerful drug that AA recommends planning to live without it one day at a time. A recovering alcoholic does not plan to be sober a year or five years from now. He has a simpler goal - go to bed sober tonight. Eventually those days of sobriety add up to years. The entire system of AA meetings and sponsorships is geared toward the goal of sobriety one day at a time.

酒精是很强的药,匿名酗酒者聚会建议找一天时间不要喝酒。一个正在恢复的酗酒者可不希望戒酒1年或5年。他有一个简单的目标——今晚睡前不喝酒。最终,这些天加起来就是几年了。匿名酗酒者聚会的聚会和发展模式就是实现一天不喝酒。

AA aims to change not only the behavior but the personality in order to reinforce sobriety. AA members call some people “sober drunks.” It sounds like a contradiction in terms. If a person is sober, how can he be a drunk? Sobriety alone is not enough. A person who has not changed his thinking is just one step away from sliding back into drinking under stress or out of boredom. An alcoholic has to change his way of being and feeling to recover from alcoholism.

匿名酗酒者聚会的目的不仅仅是改变行为,还要改变性格,这样才能加强戒酒。匿名酗酒者聚会的会员喊别人是“戒酒的醉酒人。”听起来很矛盾。如果一个人戒酒了,他们会喝醉?仅仅戒酒还不够。一个人如果不改变他的思想,下次再遇到压力时,无聊时,他还会去喝酒。要从酗酒状态恢复,酗酒者需要改变自己的方式和感觉。

I never had a problem with alcohol, but my psychiatric experience had taught me to respect AA for its success with alcoholics. It was not a popular view. Each patient who went to AA reduced the profession’s income, but that never bothered me. After my first AA meeting I realized that if millions of alcoholics could recover by following the program, then traders could stop losing, regain balance, and become winners by applying the principles of AA.

我向来没有饮酒方面的问题,但是我作为心理医生的经验却告诉我要尊敬匿名酗酒者聚会的成功模式。那不是流行的方式。每个去匿名酗酒者聚会的人,会让我减少收入,但我不在意。当我第一次参加匿名酗酒者聚会后,我认识到,如果按照这个程序,几百万的酗酒者能恢复,那么交易也可以停止亏损,恢复资金,并利用匿名酗酒者聚会的原则成为赢家。

How can we translate the lessons of AA into the language of trading?

如何把匿名酗酒者聚会的课程翻译成交易的语言呢?

A losing trader is in denial. His equity is shrinking, but he continues to jump into trades without analyzing what is going wrong. He keeps switching between markets the way an alcoholic switches between whiskey and cheap wine. An amateur whose mind isn’t strong enough to accept a small loss will eventually take the mother of all losses. A gaping hole in a trading account hurts self-esteem. A single huge loss or a series of bad losses smash a trader against his rock bottom. Most beginners collapse and wash out. The lifetime of an average speculator is measured in months, not years.

一个亏损的交易者不接受现实。他的资金在缩水,但他继续进行交易,并不分析哪里错了。他不停地换市场,就像酗酒者在威士忌和便宜的葡萄酒之间换来换去一样。业余选手的思想意识还不知道小亏损最终会变成大亏损。交易账户的大洞会伤害自尊心。一次巨大的亏损或一系列的亏损会严重伤害一个交易者,打破他的底线。大部分新手崩溃,退出了。一个投机者的生命是用月来度量的,不是年。

Those who survive fall into two groups. Some return to their old ways, just like alcoholics crawl into a bar after surviving a bout of delirium. They toss more money into their accounts and become customers of vendors who sell magical trading systems. They continue to gamble, only now their hands shake from anxiety and fear when they try to pull the trigger.

生存下来的人分为2组。一些人回到过去的老方式,就像酗酒者在疯狂后又回到酒吧。他们花更多的钱,成为销售魔力交易系统生意人的客户了。他们继续赌博,在扣扳机的时候他们的手由于焦急和恐惧而抖的厉害。

A minority of traders that hit rock bottom decide to change. Recovery is a slow and solitary process. Charles Mackay, the author of one of the best books on crowd psychology, wrote almost two centuries ago that men go mad in crowds, but come to their senses slowly, and one by one. I wish we had an organization for recovering traders, the way recovering alcoholics have AA. We don’t because trading is so competitive. Members of AA strive for sobriety together, but a meeting of recovering traders could easily be poisoned by envy and showing off. Markets are such cutthroat places that we don’t form mutual support groups or find sponsors. Some opportunists hold themselves out as traders’ coaches, but most make me shudder at their sharkiness. If we had a traders’ organization, I’d call it Losers Anonymous (LA). The name is blunt, but that’s fine. After all, Alcoholics Anonymous does not call itself Drinkers Anonymous. A harsh name helps traders face their impulsivity and self-sabotage. Since we do not have LA, you’ll have to walk on the road to recovery alone. I wrote this book to help you along the way.

有少数的交易者碰到底线以后决定改变自己。恢复过程是漫长和孤独的。查尔斯•麦凯写了一本关于大众心理的书,这是最好的书, 这本书大概是200年前写的,关于人在大众中的疯狂,但是一个一个的慢慢恢复到理性。我希望像匿名酗酒者聚会一样,我们也有一个组织帮助交易者恢复。我们没有这样的组织是因为交易就是竞争。匿名酗酒者聚会是为了一起戒酒,但是交易者聚会可能会变成嫉妒和炫耀。市场是割喉的场所,我们无法做到互相帮助或互相鼓励。有些教练提供的机会会帮助交易者,但大多数的鲨鱼还是让我不寒而栗。如果我们有交易者的组织,我可以称为匿名输家聚会。名字很犀利,但很好。犀利的名字让交易者面对冲动和自毁。由于我们并没有匿名输家聚会,你就得自己上路恢复了。我写这本书就是在路上帮助你的。

Businessman’s Risk vs. Loss

生意人的风险对亏损

Years ago, when I began my recovery from losing, each morning I held what I called a Losers Anonymous meeting for one. I’d come into the office, turn on my quote screen, and while it was warming up I’d say, “Good morning, my name is Alex, and I am a loser. I have it in me to do serious damage to my account. I’ve done it before. My only goal for today is to go home without a loss.” When the screen was up, I’d begin trading, following the plan written down the night before while the markets were closed.

多年前,当我从亏损中恢复时,每天早晨,我都会举行匿名输家聚会,只有1个人。我走进办公室,打开波动屏幕,启动时,我会说:“早上好,我的名字叫亚历山大,我是一个输家。我把自己的账户严重摧毁了。过去也干过。我今天唯一的目标是回家时没有亏损。”当屏幕好了时,我开始交易,按照头天晚上写好的计划交易。

I can immediately hear an objection - what do you mean, go home without a loss? It is impossible to make money every day. What happens if you buy something, and it goes straight down - in other words, you’ve bought the top tick of the day? What if you sell something short and it immediately rallies?

我立刻听见有人反对——你什么意思,回家时没有亏损?不可能每天赚钱的。如果你买了什么,它突然下跌怎么办——换句话说,你买在最高点怎么办?如果你卖掉什么,它立刻上涨怎么办?

We must draw a clear line between a loss and a businessman’s risk. A businessman’s risk is a small dip in equity. A loss goes through that limit. As a trader, I am in the business of trading and must take normal business risks, but I cannot afford losses.

我们必须在亏损和生意人的风险之间划一条清晰的线。生意人的风险就是资金的少量减少。亏损就是指亏的更多。作为交易者,我做交易的时候必须接受商业风险,但不能接受亏损。

Imagine you’re not trading but running a fruit and vegetable stand. You take a risk each time you buy a crate of tomatoes. If your customers do not buy them, that crate will rot on you. That’s a normal business risk - you expect to sell most of your inventory, but some fruit and vegetables will spoil. As long as you buy carefully, keeping the unsold spoiled fruit to a small percentage of your daily volume, your business stays profitable.

假如说你不是交易,而是摆摊做水果和蔬菜生意。你每买一篮子西红柿都要承担风险。如果你的客户不买,亏损就是你的。这是正常的商业风险——你希望卖掉你的库存,但是一些水果和蔬菜会坏掉。只要你认真做事,把要坏的水果控制在比较小的比例,你的生意就会赚钱。

Imagine that a wholesaler brings a tractor-trailer full of exotic fruit to your stand and tries to sell you the entire load. He says that you can earn more in the next two days than you made in the previous six months. It sounds great - but what if your customers don’t buy that exotic fruit? A rotting tractor-trailer load can hurt your business and endanger its survival. It’s no longer a businessman’s risk - it’s a loss.

假如说批发商开来一卡车外国水果到你的摊位,准备全部卖给你。他说你未来2天赚的钱要比过去半年都多。听起来不错——但是如果你的客户不买外国水果怎么办?一卡车的水果都烂掉,那真的是伤害生意,危及生存。这不是生意人的风险——这是亏损。

Money management rules draw a straight line between a business-man’s risk and a loss, as you will see later in this book.

资金管理的原则会在生意人的风险和亏损之间画一条线,你会在本书后面看到。

Some traders have argued that my AA approach is too negative. A young woman in Singapore told me she believed in positive thinking and thought of herself as a winner. She could afford to be positive because discipline was imposed on her from the outside, by the manager of the bank for which she traded. Another winner who argued with me was a lady from Texas in her seventies, a wildly successful trader of stock index futures. She was very religious and viewed herself as a steward of money. Each morning she got up early and prayed long and hard. Then she drove to the office and traded the living daylights out of the S&P. The minute a trade went against her, she’d cut and run - because the money belonged to the Lord and wasn’t hers to lose. She kept her losses small and accumulated profits.

有些交易者和我争论,说我的匿名酗酒者模式太消极了。新加坡的一位年轻女士告诉我,他相信积极思考,并把自己想象成赢家。她可以选择积极是因为有外部力量告诉她纪律性,她负责交易的银行经理会帮助她。另外一个赢家和我争论,她是得克萨斯州的70多岁的女士,她交易股指期货非常成功。她很信宗教,觉得自己就是金钱管家。每天早晨她都要大声祈祷。然后她开车到办公室,开始交易标准普尔股指期货。如果有不利的交易,她止损逃跑——因为她觉得这笔钱属于上帝的,不算她亏的。她的亏损总是很少,利润则累计了很多。

I thought that our approaches had a lot in common. Both of us had principles outside the market preventing us from losing money. Markets are the most permissive places in the world. You may do anything you like, as long as you have enough equity to put on a trade. It’s easy to get caught in the excitement, which is why you need rules. I rely on the principles of AA, another trader relies on her religious feelings, and you may choose something else. Just make sure you have a set of principles that clearly tells you what you may or may not do in the markets.

我觉得她的模式和我的有很多共同之处。我俩都有原则,防止我们亏钱。市场是这个世界上最放纵的地方。只要你的资金足够多,你想干什么就可以干什么。你在疯狂的时候很容易被抓住,所以需要原则。我依赖匿名酗酒者的原则,其它交易者依赖他们的宗教信仰,你可以选择其它东西。记住,要保证你的一套原则明确地告诉你什么该做,什么不该做。

Sober in Battle

战斗时保持清醒

Most traders open accounts with money earned in business or the professions. Many bring a personal track record of success and expect to do well in the markets. If we can run a hotel, perform eye surgery, or try cases in court, we can surely find our way between the high, the low, and the close! But the markets, which seem so simple at first, keep humbling us.

很多交易者把生意中或打工的钱拿来开户。很多人还带来了成功的交易记录,希望在市场中大干一场。如果我们可以经营宾馆,做眼科手术,法庭辩论,我们一定能找到最高点,最低点和收盘的地方!但是关于市场,一开始看起来很简单,但它会羞辱我们。

Little blood gets spilled in trading, but the money, the lifeblood of the markets, has a major impact on the quality and the length of our lives. Recently, a friend who writes a stock market advisory showed me a stack of letters from his subscribers. The one that caught my eye came from a man who made enough money trading to pay for a kidney transplant. It saved his life, but I thought of what happened to legions of others who also had big needs but traded poorly and lost money.

市场鲜血溅出,但是金钱,市场生命之血,会对我们的生命质量和长度造成冲击。最近,我的一个写投资报告的朋友给我看他的读者来信。这个读者引起了我的注意,他为了做肾移植,赚了很多钱。市场救了他,但是我想大部分人也同样有重大的需求,但是他们亏的很惨。

Trading is a battle. When you pick up your weapon and put your life on the line, would you rather be drunk or sober? You have to prepare yourself, choose your fight, go in when you are ready, and quit after you’ve done what you’ve planned. A man who is cool and sober calmly picks his fights. He enters and leaves when he chooses and not when some bully throws him a challenge. A disciplined player chooses his own game out of hundreds available. He doesn’t have to chase every rabbit like a dog with its tongue hanging out - he lays an ambush for his game and lets it come to him.

交易就是战争。当你拿起武器,用生命去战斗时,你愿意是喝醉了,还是清醒的?你要做好准备,选择你的战斗,准备好了再行动,计划完成就退出。一个冷静清醒的人会选择他的战斗。他自己选择进出,如果有人威胁他,他就不理会。一个有纪律的玩家在几百个机会里面选择自己最擅长的游戏。他不会像狗一样伸着舌头去追所有的兔子——他会爬下来做埋伏,等待最适合他的机会到来。

Most amateurs won’t admit they are trading for entertainment. A common cover story is that they’re in the markets to make money. In reality, most traders get tremendous thrills tossing money at half-baked ideas. Trading financial markets is more respectable than betting on ponies, but the kicks are just as good.

大部分业余选手都不会承认交易只是为了好玩。通常的说法是到市场赚钱。事实上,大部分交易者用不成熟的思想花钱找刺激。在金融市场交易要比赛马更尊重市场,被踢是正常的。

I tell my horse-playing friends to imagine going to a race where you can place bets after the horses are out of the gate and take your money off the table before the race ends. Trading is a fantastic game, but its temptations are very intense.

我告诉赛马的朋友,想象一下,赛马时,你在马跑出去的时候下注,在结束前收钱。交易是一个了不起的游戏,但它的诱惑力很强。

THE MATURE TRADER

成熟的交易者

Successful traders are sharp, curious, and unassuming people. Most have been through losing periods. They graduated from the school of hard knocks, and that experience helped smooth their rough edges.

成功的交易者是犀利的,认真的,无法想象的人。大部分都经历过输家阶段。他们在艰苦的学校毕业了,经验磨去了他们的棱角。

Successful traders are self-assured but never arrogant. People who survive in the markets remain alert. They trust their skills and trading methods, but keep their eyes and ears open for new developments. Confident and attentive, calm and flexible, successful traders are fun to be with.

成功的交易者自我安慰,但不傲慢。从市场中生存下来的人都很警惕。他们相信自己的技巧和交易方法,但是会继续睁大眼,竖起耳朵,关注新的发展。自信且留心,冷静且灵活,这是成功交易者喜欢的方式。

Successful traders are often unconventional people, and some are very eccentric. When they mix with others, they often break social rules. The markets are set up for the majority to lose money, and a small group of winners marches to a different drummer, in and out of the markets.

成功的交易者通常不是传统的人,有些还很古怪。当他们和别人在一起,他们经常会打破社会规则。设置市场的目的就是让大部分人亏钱,少数赢家根据不同的鼓声,进出市场。

Markets consist of huge crowds of people watching the same trading vehicles, mesmerized by upticks and downticks. Think of a crowd at a concert or in a movie theater. When the show begins, the crowd gets emotionally in gear and develops an amorphous but powerful mass mind, laughing or weeping together. A mass mind also emerges in the markets, only here it is more malignant. Instead of laughing or weeping, the crowd seeks each trader’s private psychological weakness and hits him in that spot.

市场大众看着相同的波动,被上涨和下跌迷惑。想象一下一场音乐会或者电影的观众。演出开始的时候,大众开始进入情绪状态,形成了无形的,但是有力量的大众情绪,一起哭,一起笑。大众情绪在市场也会出现,但是恶意的。不是一起哭,一起笑,大众寻找交易者的心理弱点并攻击之。

Markets seduce greedy traders into buying positions that are too large for their accounts and then destroy them with a reaction they cannot afford to sit out. They shake fearful traders out of winning trades with brief countertrend spikes before embarking on runaway moves. Lazy traders are the favorite victims of the market, which keeps throwing new tricks at the unprepared. Whatever your psychological flaws and fears, whatever your inner demons, whatever your hidden weaknesses and obsessions, the market will seek them out, find them, and use them against you, like a skilled wrestler uses his opponent’s own weight to toss him to the ground.

市场吸引贪婪的交易者重仓买入,然后利用回调摧毁他们,因为重仓是无法忍受亏损的。他们利用快速的回调动摇已经赢利的交易者,吓的他们发抖,出场,然后快速拉升。偷懒的交易者是最好的受害者,他们就喜欢欺负没准备的人。你的心理缺点,恐惧,内心的恶魔,脆弱,困扰,市场会找到这些心理,利用它们对付你,就像高水平的摔跤手利用对手的体重把对手摔倒在地。

Successful traders have outgrown or overcome their inner demons. Instead of being tossed by the markets, they maintain their own balance and scan for chinks in the crowd’s armor, so that they can toss the market for a change. They may appear eccentric, but when it comes to trading they are much healthier than the crowd.

成功的交易者已经成熟了,或者是克服了心魔。不但不会被市场欺负,他们会自己保持平衡,寻找市场的漏洞,所以他们会欺负市场。他们看起来很古怪,但是在交易的时候,他们比大众健康多了。

Being a trader is a journey of self-discovery. Trade long enough, and you will face all your psychological handicaps - anxiety, greed, fear, anger, and sloth. Remember, you’re not in the markets for psychotherapy; self-discovery is a byproduct, not the goal of trading. The primary goal of a successful trader is to accumulate equity. Healthy trading boils down to two questions you need to ask in every trade: “What is my profit target?” and “How will I protect my capital?”

作为交易者的过程就是自我发现的旅程。交易的时间越长,你就会发现自己的心理缺陷——焦急,贪婪,恐惧,愤怒,懒惰。记住,你不是在接受治疗,自我发现只是副产品,不是交易的目标。成功的交易者的目标就是赚钱。成功的交易会回答你每笔交易时的2个问题:“我的利润目标是多少?”和“我如何保护我的资金?”

A good trader accepts full responsibility for the outcome of every trade. You cannot blame others for taking your money. You have to improve your trading plans and methods of money management. It will take time, and it will take discipline.

优秀的交易者自己为自己的每笔交易负责。你不能怪别人抢了你的钱。你必须提高自己的交易计划,方法和资金管理。这是需要时间的,还需要纪律。

Discipline

纪律

A friend of mine used to have a dog-training business. Occasionally a prospective client would call her and say, “I want to train my dog to come when called, but I do not want to train it to sit or lie down.” And she’d answer, “Training a dog to come off-leash is one of the hardest things to teach; you must do a lot of obedience training first. What you’re saying sounds like, ‘I want my dog be a neurosurgeon, but I do not want it to go to high school.’ ”

我有个朋友,过去做训狗生意。偶尔,满怀希望的客户会打电话说:“我想训练我的狗,叫它来就来,但是我不想训练它坐或躺下来。”她回答说:“训练狗不戴狗带是最难的事,首先要从很多听话的动作开始。你说的话就等于:“我希望我的狗能做神经外科医生,但我不想它去上学。””

Many new traders expect to sit in front of their screens and make easy money day-trading. They skip high school and head straight for neurosurgery.

很多新交易者希望坐在屏幕前,做日内交易,赚轻松钱。他们等于是想不上学就能做神经外科医生。

Discipline is necessary for success in most endeavors, but especially in the markets because they have no external controls. You have to watch yourself because no one else will, except for the margin clerk. You may put on the stupidest and self-destructive trades, but as long as you have enough money in your account, no one will stop you. No one will say hold on, wait, think what you’re doing! Your broker will repeat your order to confirm he got it right. Once your order hits the market, other traders will scramble for the privilege of taking your money.

对于任何冒险来说,纪律是必须的,尤其是在市场中,因为你没有外部控制。由于没人照顾你,你就要自己照顾自己,管保证金的职员例外。你可以一直进行最蠢最自毁的交易,只要你的账户还有足够的钱,是没有人阻止你的。没有人说打住,等等,想想你在做什么!你的经纪人会重复说一次你的订单,以便确认。一旦你的订单进入市场,其他交易者就要想尽一切办法赚你的钱。

Most fields of human endeavor have rules, yardsticks, and professional bodies to enforce discipline. No matter how independent you feel, there is always some agency looking over your shoulder. If a doctor in private practice starts writing too many prescriptions for painkillers, he’ll soon hear from the health department. Markets impose no restrictions, as long as you have enough equity. Adding to losing positions is similar to overprescribing narcotics, but nobody will stop you. As a matter of fact, other market participants want you to be undisciplined and impulsive. That makes it easier for them to get your money. Your defense against self-destructiveness is discipline. You have to set up your own rules and follow them in order to prevent self-sabotage.

大部分的人类冒险都有原则,标准,以及专业人士保证纪律。无论你感觉多么独立,总是有专家在保护你。如果一个私人医生给病人开了很多止痛药,健康部门一定会找他了解情况。市场里没有限制,只要你有足够的资金。摊平成本等于使用过量的麻醉药,但没有人阻止你。事实上,其它市场参与者希望你没有纪律,希望你冲动。这样他们就很容易赚你的钱。防止自毁的就是纪律。你必须建立自己的原则并使用这些原则,以防止自毁。

Discipline means designing, testing, and following your trading system. It means learning to enter and exit in response to predefined signals rather than jumping in and out on a whim. It means doing the right thing, not the easy thing. And the first challenge on the road to disciplined trading involves setting up a record-keeping system.

纪律意味着设计,测试,并使用你的交易系统。就是根据提前设置好的信号进场,出场,而不是冲动地进进出出。要做正确的事,不要做简单的事。进行有纪律的交易遇到的第一个挑战就是建立一个交易记录系统。

Record-Keeping

做交易记录

Good traders keep good records. They keep them not just for their accountants but as tools of learning and discipline. If you do not have good records, how can you measure your performance, rate your progress, and learn from your mistakes? Those who do not learn from the past are doomed to repeat it.

优秀的交易者做优秀的交易记录。他们保持交易记录不仅仅是为了他们的账户,而是为了学习和纪律性。如果你没有好的交易记录,你如何计算你的成绩,给你的进步打分,从错误中学习?如果不从错误中学习,必然会重复错误。

When you decide to become a trader, you sign up for an expensive course. By the time you figure out the game, its cost may equal that of a college education, only most students never graduate - they drop out and get nothing for their money except for memories of a few wild rides.

当你决定要做个交易者,你等于报名上了昂贵的课程。当你搞清楚这个游戏的时候,花费差不多可以读个大学了,而且大部分学生无法毕业——他们退学了,交了不少学费,除了一点狂野的记忆,什么都没得到。

Whenever you decide to improve your performance in any area of life, record keeping helps. If you want to become a better runner, keeping records of your speeds is essential for designing better workouts. If money is a problem, keeping and reviewing records of all expenditures is certain to uncover wasteful tendencies. Keeping scrupulous records turns a spotlight on a problem and allows you to improve.

无论何时,当你决定提高自己的水平时,做记录都会帮助你。如果你想成为优秀的赛跑手,做好记录才能想到更好的办法。如果钱是问题,保持做记录,并不断回顾,一定会找到亏钱的原因。认真地做记录,就会聚焦到问题上,你就会改进问题。

Becoming a good trader means taking several courses - psychology, technical analysis, and money management. Each course requires its own set of records. You’ll have to score high on all three in order to graduate.

做一个优秀的交易者意味着学习多个课程——心理,技术分析,资金管理。每个课程都需要自己做交易记录。你必须在3门课上都取得高分才能毕业。

Your first essential record is a spreadsheet of all your trades. You have to keep track of entries and exits, slippage and commissions, as well as profits and losses. Chapter 5, “Method - Technical Analysis” on trading channels will teach you to rate the quality of every trade, allowing you to compare performance across different markets and conditions.

你的第一个关键交易记录是记录所有交易的电子表格。你必须记录进场,出场,滑点和佣金,包括利润和亏损。在第05章,方法——技术分析,会谈到通道,会告诉你如何记录每笔交易,教你在不同市场情况下做成绩对比。

Another essential record shows the balance in your account at the end of each month. Plot it on a chart, creating an equity curve whose angle will tell you whether you are in gear with the market. The goal is a steady uptrend, punctuated by shallow declines. If your curve slopes down, it shows you’re not in tune with the markets and must reduce the size of your trades. A jagged equity curve tends to be a sign of impulsive trading.

另外一个关键的交易记录可以显示你每月底的账户情况。它是图形,资金曲线的角度可以告诉你你是否和市场同步。目标是要实现稳定上涨,中间有小的下跌。如果你的曲线是下跌的,说明你和市场不同步,你必须减少你的仓位。上下起伏的资金曲线就说明你是冲动交易。

Your trading diary is the third essential record. Whenever you enter a trade, print out the charts that prompted you to buy or sell. Paste them on the left page of a large notebook and write a few words explaining why you bought or sold, stating your profit objective and a stop. When you close out that trade, print out the charts again, paste them on the right page and write what you’ve learned from the completed trade.

你的交易日记是第三个关键交易记录。不管你何时进行交易,把提示买卖喜好的图打印出来。把它们贴在笔记本的左边,并写几个词解释你为什么买卖,写上你的利润目标和止损点。当你出场时,再把图打印出来,贴在笔记本的右边,写上你从这次交易中学到了什么。

These records are essential for all traders, and we will return to them later in Chapter 8, “The Organized Trader.” A shoebox crammed with confirmation slips does not qualify as a record-keeping system. Too many records? Not enough time? Want to skip high school and dive into neurosurgery? Traders fail because of impatience and lack of discipline. Good records set you apart from the market crowd and put you on the road to success.

这些交易记录对交易者很关键,我们会在“第08章,有条理的交易者”一章继续谈。塞满鞋盒的交易确认单不能算做交易记录系统。要做的记录太多了?没有时间?你想跳过中学直接读神经外科医生?交易者失败就是因为没有耐心,没有纪律。优秀的交易记录把你和大众分开,让你走上成功之路。

Training for Battle

为战斗做训练

How much training you need depends on the job you want. If you want to be a janitor, an hour of training might do. Just learn to attach a mop to the right end of the broomstick and find a pail without holes. If, on the other hand, you want to fly an airplane or do surgery, you’ll have to learn a great deal more. Trading is closer to flying a plane than to mopping a floor, meaning you’ll need to invest a lot of time and energy in mastering this craft.

根据工作性质不同,你需要的训练也不同。如果你想成为大楼清洁工,一个小时的训练就够了。只要学会使用拖把和扫帚的正确一端,并确认水桶没有洞就行了。如果你想学开飞机,做手术,你需要学很多东西。交易和开飞机非常一样难,而不是用拖把拖地那么简单,这意味着你需要花费很多时间和精力去掌握它。

Society mandates extensive training for pilots and doctors because their errors are so deadly. As a trader, you are free to be financially deadly to yourself - society does not care, because your loss is someone else’s gain. Flying and medicine have standards and yardsticks, as well as professional bodies to enforce them. In trading, you have to set up your own rules and be your own enforcer.

社会要求对飞行员和医生做严格的训练,那是因为他们的错误是致命的。作为交易者,你可以选择给自己造成致命的结果——社会不关心,因为你的亏损是别人的收益。飞行和医疗行业都有标准的,还有专业人士帮助他们。在交易中,你必须建立自己的原则,自己帮助自己。

Pilots and doctors learn from instructors who impose discipline on them through tests and evaluations. Private traders have no external system for learning, testing, or discipline. Our job is hard because we must learn on our own, develop discipline, and test ourselves again and again in the markets.

飞行员和医生通过指导者学习,而且指导者会通过测试和评估告诉他们纪律性。交易者没有这样的外部系统可以学习,测试,或学到纪律性。我们的工作很难,因为我们要自学,形成纪律,一次又一次地在市场中测试自己。

When we look at training for pilots and doctors, three features stand out. They are the gradual assumption of responsibility, constant evaluations, and training until actions become automatic. Let us see whether we can apply them to trading.

当我们观看飞行员和医生的训练时,有3个突出的特征。它们是慢慢地负责任,不断地评估,训练。我们来看看这3个特征是否可以应用到交易上。

1. The Gradual Assumption of Responsibility_A flying school doesn’t put a beginner into a pilot’s seat on his first day. A medical student is lucky if he is allowed to take a patient’s temperature on his first day in the hospital. His superiors double-check him before he can advance to the next, slightly higher level of responsibility.

慢慢地负责任 飞行学校不会在第一天让新手坐在驾驶的位置上。在医院,如果一个医学生第一天可以量病人的体温,他是幸运的。他的上司会监视他,直到它可以到下一步,下一步需要更多的责任。

How does this compare to the education of a new trader?

如何和教育新交易者比较呢?

There is nothing gradual about it. Most people start out on an impulse, after hearing a hot tip or a rumor of someone making money. A beginner has some cash burning a hole in his pocket. He gets a broker’s name out of a newspaper, FedExes him a check, and enters his first trade. Now he is starting to learn! When do they close this market? What is a gap opening? How come the market is up and my stock is down?

交易不是慢慢的。大部分人突然听说了一个消息或一个耳语说某人赚了大钱,就冲动地开始了。新手有钱挥霍。他在报纸上找到了一个经纪人,把支票快递给他,然后开始第一次交易。现在,他要开始学习了!他们何时出场?什么是跳空缺口?为什么市场在涨,我的股票在跌?

A “sink or swim” approach does not work in complex enterprises, such as flying or trading. It is exciting to jump in, but excitement is not what good traders are after. If you do not have a specific trading plan, you’re better off taking your money to Vegas. The outcome will be the same, but at least there they’ll throw in some free drinks.

对于复杂的事业来说,“沉下去或者游起来”的方法不行,比如飞行和交易。跳下去很刺激,但刺激不是优秀的交易者追求的东西。如果你没有明确的交易计划,还不如带钱去拉斯维加斯。因为结果是一样的,至少那里的饮料是免费的。

If you are serious about learning to trade, start with a relatively small account and set a goal of learning to trade rather than making a lot of money in a hurry. Keep a trading diary and put a performance grade on every trade.

如果你想很认真地学习交易,用小账户开始,设定几个学习目标,先学习,而不是尽快赚钱。每笔交易都要做日记,并打分。

2. Constant Evaluations and Ratings_The progress of a flying cadet or a medical student is measured by hundreds of tests. Teachers constantly rate knowledge, skills, and decision-making ability. A student with good results is given more responsibility, but if his performance slips, he has to study more and take more tests.

不断地评估和打分 军校学生或医学生会通过几百种方式接受测试。教师会不断地给他们的知识,技巧和决策能力打分。分数越高的学生则承受更多的责任,如果他的分数下滑,他需要学更多的东西,接受更多的测试。

Do traders go through a similar process?

交易者会经历相似的过程吗?

As long as you have money in your account, you can make impulsive trades, trying to weasel your way out of a hole. You can throw confirmation slips into a shoebox, and give them to your accountant at tax time. No one can force you to look at your test results, unless you do it yourself.

只要你的账户还有钱,你可以做冲动交易,导致亏损。你可以把成交确认单扔进鞋盒,在交税的时候拿出来。没有人会逼你看测试的结果,除非你自己做测试。

The market tests us all the time, but only a few pay attention. It gives a performance grade to every trade and posts those ratings, but few people know where to look them up. Another highly objective test is our equity curve. If you trade several markets, you can take this test in every one of them, as well as in your account as a whole. Do most of us take this test? No. Pilots and doctors must answer to their licensing bodies, but traders sneak out of class because no one takes attendance and their internal discipline is weak. Meanwhile, tests are a key part of trading discipline, essential for your victory in the markets. Keeping and reviewing records, as outlined later in this book, puts you a mile ahead of undisciplined competitors.

市场会一直测试我们,但很少有人注意。它会给每个级别的人评分,但是很少有人知道去哪里看。另外一个非常可观的测试是我们的资金曲线。如果你在不同市场交易,你可以分别测试,这和一个账户的测试方法是一样的。我们大多数人会测试吗?不会。飞行员和医生必须回应监管机构,交易者则可以开溜,因为没有人让他们上课,他们自己的内部纪律很弱小。同时,测试是交易纪律的关键部分,对在市场中取胜非常重要。坚持做交易记录并不断复习,像本书后面说的一样,就会让你比没有纪律的竞争者强了。

3. Training until Actions Become Automatic During one of my finals in medical school I was sent to examine a patient in a half-empty room. Suddenly I heard a noise from behind the curtain. I looked, and there was another patient - dying. “No pulse,” I yelled to another student, and together we put the man on the floor. I began pumping his chest, while the other fellow gave him mouth to mouth, one forced breath for four chest pumps. Neither of us could run for help, but someone opened the door and saw us. A reanimation team raced in, zapped the man with a defibrillator and pulled him out.

一直训练,直到可以自动行动为止 我在医学校的最后一个学期,我被安排去一个半空的房间检查病人。突然,我听见窗帘后面有噪音。我去看,看见另外一个病人——快死了。“没有脉搏”我朝另外一个学生大喊,我们一起把这个人放到地上。我开始压他的胸部,另外一个学生对他做人工呼吸。我俩都没有去找人帮忙,但是有人打开门看见了我们。急救组跑来了,用除纤颤器救他。

I never had to revive anyone before, but it worked the first time because I had five years of training. When the time came to act, I didn’t have to think. The point of training is to make actions automatic, allowing us to concentrate on strategy.

我以前从没救过人,但第一次成功了,因为我接受了5年的训练。当需要行动时,我不必思考。训练的目的就是自动行动,让我们专注在策略上。

What will you do if your stock jumps five points in your favor? Five points against you? What if your future goes limit up? Limit down? If you have to stop and think while you’re in a trade, you’re dead. You need to spend time preparing trading plans and deciding in advance what you will do when the market does any imaginable thing. Play those scenarios in your head, use your computer, and get yourself to the point where you do not have to ruminate about what to do if the market jumps.

如果股票跌了5个点,怎么办?5个点?如果你的期货涨停了怎么办?跌停了呢?如果你在交易时还要思考,你死定了。你应该花时间提前做计划,并把可能出现的情况及对策都想好。用大脑思考这些情况,在电脑上看好,如果市场突然变化,你要知道不经过思考就能怎么办。

The mature trader arrives at a stage where most trading actions have become nearly automatic. This gives you the freedom to think about strategy. You think about what you want to achieve, and less about tactics of how to achieve it. To reach that point, you need to trade for a long time. The longer you trade and the more trades you put on, the more you’ll learn. Trade a small size while learning and put on many trades. Remember, the first item on the agenda for a beginner is to learn how to trade, not to make money. Once you’ve learned to trade, money will follow.

成熟的交易者能达到这个地步,大多数交易行为几乎是自动的。这就给了你思考策略的自由。你想你想要得到的,很少去想如何得到。要想达到这个境界,你需要交易很长的时间。你交易的时间越长,交易次数越多,你学到的越多。学习时交易小仓位,同时交易多个市场。记住,新手的第一任务是学习如何交易,不是赚钱。如果你学会了交易,钱就会来的。 |

2026.3.4 图文交易计划:黄金大幅下行 短期312 人气#黄金外汇论坛

2026.3.4 图文交易计划:黄金大幅下行 短期312 人气#黄金外汇论坛 2026.2.13 图文交易计划:美指持续震荡 等1634 人气#黄金外汇论坛

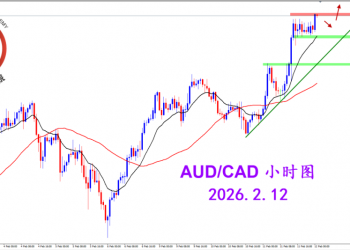

2026.2.13 图文交易计划:美指持续震荡 等1634 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1607 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1607 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1781 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1781 人气#黄金外汇论坛