kingbear夜话:为什么你还没有赚到钱!——杂谈金融衍生品交易 |

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

| |

|

交易事典:勿期、勿贪、勿恐,顺市、轻仓、止损。

|

|

2026.2. 6 图文交易计划:纽美快速回落 短156 人气#黄金外汇论坛

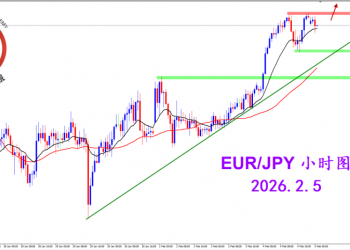

2026.2. 6 图文交易计划:纽美快速回落 短156 人气#黄金外汇论坛 2026.2.5 图文交易计划:欧日短线强势 谨慎401 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎401 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指399 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指399 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头534 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头534 人气#黄金外汇论坛