A Second Read On The Number Still Looking Good For USD

Hourly earnings rose 0.06, payrolls came in better-than-expected, and revisions were positive . Sadly, the unemployment was the same at 9.6%. Overall, a modest positive and the USD should remain bid on the back of it. Spot is approaching 85.20/50 stops but offers are set between 85.20 and 85.75, as well. New bids will likely be placed 84.80 on any retracement. Risk appetite was already on the mend heading into the number helped by a slight uptick in HK PMI overnight. One local item to be aware of is the recent sell-off in JGBs. Indeed, a reoffering of 20-year and 30-year JGBs garnered little demand. The weakness is partly blamed on a too-close-to-call DPJ leadership race with both sides leaning toward more stimulus. The weakness also reflects the rise in risk appetite over the course of the week. As such, JGB yields sit at 7-week highs. This spread divergence and exporter/real money offers should cap any large rise in the USD but there is a risk of late London USD buying on position squaring. |

2026.3.4 图文交易计划:黄金大幅下行 短期135 人气#黄金外汇论坛

2026.3.4 图文交易计划:黄金大幅下行 短期135 人气#黄金外汇论坛 2026.2.13 图文交易计划:美指持续震荡 等1577 人气#黄金外汇论坛

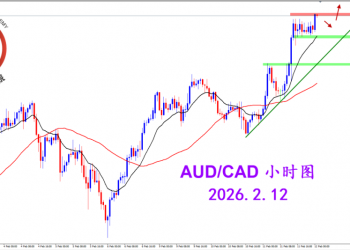

2026.2.13 图文交易计划:美指持续震荡 等1577 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1522 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1522 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1723 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1723 人气#黄金外汇论坛