加拿大制造业数据削弱了加元

Not much to like about the Canadian Mfg data for July, with Shipments down 0.9%, Inventories up 0.3% and New Orders tanking by 3.9%. The Loonie has been knocked back by the bad news, with USD/CAD bouncing from 1.0264 to 1.0306 last. The NY Fed's Sept Mfg index reading at 4.14 vs 7.1 in Aug and the sharp rise in petroleum import prices in August are likely to be glossed over.

Risk is mixed to lower at this stage, with stocks a shade lower, Tsy yields higher out the curve higher and oil and gold both lower. The latter is in part due to the BOJ intervention to support the USD/JPY and other yen crosses and also a profit-taking response after new all-time highs posted Tuesday.

Technically, USD/CAD's lows on Tuesday came quite close to the corralling lower 10 and 21-day Bolli bands. If we were to see a close above yesterday's 1.0306 high it would give bears something to ponder at this point, particularly with daily Slow Stochs trying to bottom out in the teens. We think talk of Fed QE2 this week has been a bit hyped and will be priced out to the buck's benefit. |

2025.12.16 图文交易计划:布油开放下行 关1290 人气#黄金外汇论坛

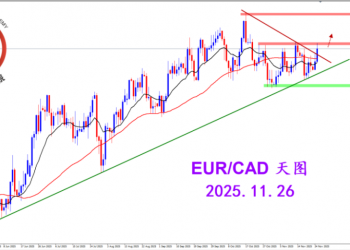

2025.12.16 图文交易计划:布油开放下行 关1290 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2881 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2881 人气#黄金外汇论坛 MQL5全球十大量化排行榜2957 人气#黄金外汇论坛

MQL5全球十大量化排行榜2957 人气#黄金外汇论坛 【认知】5745 人气#黄金外汇论坛

【认知】5745 人气#黄金外汇论坛