本帖最后由 ForexGG 于 2010-9-10 10:35 编辑

来点基本面的:

EUR/USD: Accepting Risk Grudgingly

So far this week, we have had upside surprises in AUD, US and Canadian employment reports, while peripheral sovereign debt spreads in the Euro Zone have narrowed since midweek peaks (Portugal the one exception there). With the notable exception of Greece, which has already gotten its regional default backstopping in place, the interest rates the peripherals are paying are not what would normally be associated with huge risk. Even Ireland is only paying 3.7% for 2-yr money, while Spain is at 2.17% and Portugal is at 3.67%. Things get a little expensive at 10-yrs, with Ireland at 5.9% and Portugal at 5.8%, but these are still historically low yields going back over the decades and not the kind of interest rates that preclude proper fiscal and monetary policies from producing reasonable medium to long-term economic prospects.

There has been some gnashing of teeth heard regarding the suspected DB share offering, but it makes sense to tap the markets to broaden the bank's deposit base and to start increasing its capital cushion before Basel III goes into effect. In fact, doing so now might save the bank money if we see the mountains of scared money in bunds, JGBs and Treasurys slowly migrate back into higher yielding and potential more productive investments in the quarters to come. Money is awfully cheap now, so unless you are expecting a second leg down in the Great Recession, it makes sense to tap the markets (particularly the debt markets) now.

Though there is no guarantee that the big 1.3% build in US July Wholesale Inventories was fully intentional, but the 0.6% rise in Sales suggests the bulk of the build was planned which means the report should go into the win column along with Jobless Claims and the Trade deficit drop reported Thursday. That being the case, a more risk-accepting tone ought to prevail in the markets, with the USD being sold against the higher yielding currencies. Even EUR/USD is sporting a fresh bid at 1.2745 last versus the 1.2685 NorAm morning pullback low (a 61.8% retrace of the overnight rally). The real question is whether light-volume apathy will deter or defer a strong move beyond the prior two days' highs at 1.2764-67. |

2025.12.16 图文交易计划:布油开放下行 关1290 人气#黄金外汇论坛

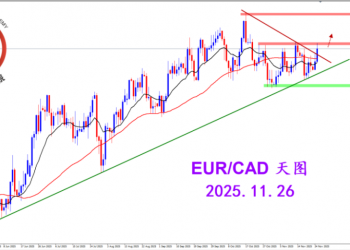

2025.12.16 图文交易计划:布油开放下行 关1290 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2881 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2881 人气#黄金外汇论坛 MQL5全球十大量化排行榜2957 人气#黄金外汇论坛

MQL5全球十大量化排行榜2957 人气#黄金外汇论坛 【认知】5745 人气#黄金外汇论坛

【认知】5745 人气#黄金外汇论坛