GBP/JPY

This week"s upward escape from the month-long consolidation range has a claimed another trophy o/n by clearing the 38.2% retracement of the 213.05-200.60 down trend at 205.35. Prices have been as high as 205.77 this session and are at 205.59 last. The next hurdle is at 206.00, where December 20 and 21 highs reside.

The daily uptrend continues to strengthen and is only moderately overbought on the slow stochs reading, having plenty of room for added price advances on RSI and the ADX. The rising 1% MA envelope top at 205.70 today has been breached, suggesting there may be scope for an eventual run at the 2% top, today at 207.75, although that is unlikely this session. Former daily tops in the 204.55-75 range make for decent support at this point.

EUR/JPY

EUR/JPY continues to test session highs at 141.71 with heavy GBP/JPY demand said to be supporting the cross. Stops at 206.00 were triggered on the cross with large buying interest seen from Japanese accounts. The GBP/JPY has breached the base of the Ichimoku cloud for the first time since early January, rising above the base at 206.12. Traders also report broad-based JPY cross buying from a UK fund. EUR/JPY resistance remains at 142.00/10.

There is also talk of Japanese accounts buying EUR bunds that is helping to support the cross.

[ 本帖最后由 ForexGG 于 2006-1-25 10:02 编辑 ] |

2026.2.13 图文交易计划:美指持续震荡 等1415 人气#黄金外汇论坛

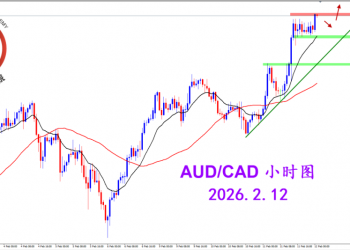

2026.2.13 图文交易计划:美指持续震荡 等1415 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1370 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1370 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1572 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1572 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1494 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1494 人气#黄金外汇论坛