What you have described and what is in FX wizard are one and the same, however there is a subtle difference in how Rob, I and many others actually use the Camarilla lines.

As with all cams and pivots it is best to treat them simply as areas of support and/or resistance, points at which the market can and does take a breather before moving one way or the other.

I would suggest an understanding of the Camarilla principles is no bad thing, however for the purpose of trading with FX Wizard then treat them simply as another line of support or resistance and apply the trading rules accordingly. Same goes for the M lines. Don't over complicate your trading any more than you have to.

MidnightRun Posted: Thu Feb 24, 2005 9:47 pm Post subject: Clarification on camarilla needed

--------------------------------------------------------------------------------

Can anyone confirm whether or not camarilla pivot liens in Rob's FXWizard system are the same as described below (the description was borrowed from a website I found using Google).

Also, what is the significance of M lines in the FX Wizard?

Thanks

P.S. I pasted the text and I see that the charts are not there. Hopefully, the discription will be sufficient.

"Trading with the SureFireThing 'Camarilla' Equation

The original version of SureFireThing's Camarilla Equation is for experienced traders. This SureFireThing Camarilla Equation involves you in trading both with and against the trend, using simple rules based around price penetration of the L3 and L4 levels at the bottom of the days range, or the H3 and H4 levels at the top of the day's range. It relies on the fact that success in intraday trading requires you to enter and exit trades with the backing of major support or resistance; the positioning of this resistance being determined by the equation.

To use the SureFireThing Camarilla Equation, you enter yesterday's open, high, low and close. The calculator then gives you (to 2 decimal places) 8 levels of intraday support and resistance. There are 4 of these levels above yesterday's close, and 4 below as shown below:

Long or Short with the SureFireThing Camarilla Equation

As you can see, trading with the SureFireThing Camarilla Equation is quite simple. The important levels to note are the 'L3' and 'H3' levels, where you may expect a reversal to occur, and the 'L4' and 'H4' levels that show you where a major breakout has been confirmed. How you specifically enter a trade depends to a great extent on the way the market opens.

Market Open INSIDE 'L3’

The following applies both to going 'Long' and going 'short'. If the market opens INSIDE the L3 and H3 levels (i.e. BETWEEN the higher H3 and the Lower L3), you must wait for price to approach either of these two levels. Whichever it hits first (L3 or H3) determines your trade:

If the HIGHER H3 level is hit, you go SHORT (against the trend) in the expectation that the market is about to reverse. Some traders recommended using the higher 'H4' level as your stoploss point, although SureFireThing recommend you 'know your market' and set the stop at a distance that you are comfortable with, as a penetration up thru the H4 level actually shows that a major breakout may be under way.

SureFireThing would also recommend that you wait for price to bounce back down inside the H3 level again before entering the trade, as you will therefore be technically trading WITH the short term trend. A fair amount of experience is needed for this style of trading.

The opposite, of course applies if the LOWER L3 level is hit first - wait for it to come back up inside the lower L3 level, then go LONG.

Market Opens OUTSIDE 'L3’

In this case, you wait for the market to move back up thru the L3 level - you will then be trading WITH the trend, and once again, some traders recommended using the L4 level as your stop loss (although perhaps the best day trading tip SureFireThing can give you on this topic is to recommend using a sensible stop based on your knowledge of your market, or failing that, the value offered by the {b} version of the Equation)..

Taking profits is a matter of personal judgement - just be aware that you WILL want to take profits at some time during the day, because the market is unlikely to 'behave' and stay right-sided for your trade.

Research suggests that these reversals from L3 and H3 happen as often as 4 times out of 5 during intraday trading.

Using the original Equation to trade 'breakouts' is also eminently possible, and essentially involves you going LONG if price penetrates UP thru the higher H4 level, or going SHORT if price penetrates DOWN thru the lower L4 level.

The H4 and L4 levels, by the way, can sometimes correspond well with the {b} version 'Go' levels, and up to 40% or more of the day's range can be captured in such a 'breakout' fashion."

[ 本帖最后由 grunge 于 2006-1-28 21:08 编辑 ] |

2026.2.13 图文交易计划:美指持续震荡 等1417 人气#黄金外汇论坛

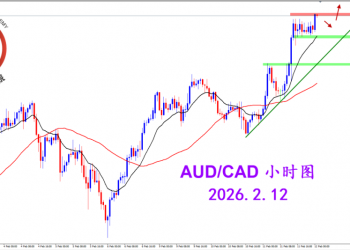

2026.2.13 图文交易计划:美指持续震荡 等1417 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1372 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1372 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1576 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1576 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1495 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1495 人气#黄金外汇论坛