REUTERS FOREX-Dollar near 3-week high vs yen ahead of Fed

Mon Jan 30, 2006 1:02 AM ET

TOKYO, Jan 30 (Reuters) - The dollar hovered just below a three-week high against the yen on Monday as traders waited for a Federal Reserve policy meeting to see how much more the U.S. currency's interest rate advantage will widen.

With many in the market looking to the Fed meeting on Tuesday for guidance on the dollar's future path, the yen hardly reacted to weaker-than-expected industrial production data from Japan.

An increase in the fed funds rate to 4.50 percent from 4.25 percent is already seen as a done deal, but traders were eager to comb over the Fed's post-meeting statement for clues about when the bank will stop its tightening campaign.

Some say a bump up on Tuesday would likely mark the end of a tightening campaign the Fed started in June 2004 and had helped to push the dollar up 15 percent against the yen and the euro last year.

But expectations are building that the central bank could keep raising after this week's gathering, helping to attract more investor funds to the dollar from lower-yielding currencies, especially the yen.

"I still think the U.S. interest rate will be raised to 4.75 percent and above," said a trader at a Japanese bank. "U.S. consumption is firm. So are U.S. stock and housing prices."

"I think the dollar/yen is at a watershed, after having achieved half of a retracement from its recent low," said Kotaro Kunimochi, director of forex trading at Barclays Bank in Tokyo. "I won't do anything. I'll just follow whichever way the market goes from now on."

The euro was little changed at $1.2095 <EUR=>. |

2025.12.16 图文交易计划:布油开放下行 关2686 人气#黄金外汇论坛

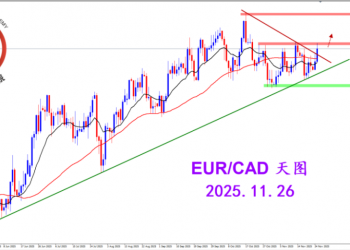

2025.12.16 图文交易计划:布油开放下行 关2686 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3216 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3216 人气#黄金外汇论坛 MQL5全球十大量化排行榜3293 人气#黄金外汇论坛

MQL5全球十大量化排行榜3293 人气#黄金外汇论坛 【认知】6099 人气#黄金外汇论坛

【认知】6099 人气#黄金外汇论坛