IF NO IMPLYMENT,THEN WHAT?

REUTERS FOREX-Dollar slips before Fed rate meeting

Tue Jan 31, 2006 6:31 AM ET

By Katie Hunt

LONDON, Jan 31 (Reuters) - The dollar eased against the euro and the yen on Tuesday, with dealers adjusting positions before an expected rise in U.S. interest rates amid jitters over monetary policy after Fed Chairman Alan Greenspan retires.

But currencies were still confined to narrow ranges before the Federal Reserve policy meeting, with traders reluctant to take fresh positions before the central bank issues its statement after the gathering, Greenspan's last at the helm after 18 years.

The U.S. central bank, which is widely expected to raise its funds rate to 4.5 percent from 4.25 percent, is due to start its meeting at 1400 GMT and issue its statement at 1915 GMT.

"The dollar may see some positional adjustment on the uncertainty of the contents of the FOMC (Federal Open Market Committee) statement after the decision ... but 25 basis points is a done deal," said Kamal Sharma, currency strategist at Bank of America.

With data suggesting the U.S. economy has been humming along since the Fed's last meeting in December, the central bank will give itself room to raise rates again at the March meeting by keeping the statement's wording roughly the same, some traders say.

However, others said that the Fed could remove any forward-looking signals from the statement, providing Greenspan's successor Ben Bernanke with a clean slate.

"I don't think the market will push far before the FOMC statement. If they remove the sentence implying some further measured tightening then the dollar is at risk," said Gavin Friend, currency strategist at Commerzbank.

Euro zone data released on Tuesday painted a mixed picture for the currency bloc's economy. |

|

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛

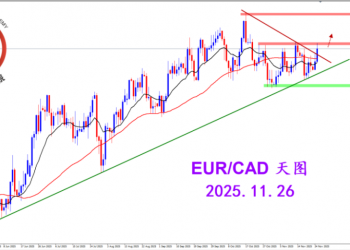

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛 MQL5全球十大量化排行榜3300 人气#黄金外汇论坛

MQL5全球十大量化排行榜3300 人气#黄金外汇论坛 【认知】6106 人气#黄金外汇论坛

【认知】6106 人气#黄金外汇论坛