计算方法也不一样:

KDJ计算公式:

1.产生KD以前,先产生未成熟随机值RSV。其计算公式为:

N日RSV=[(Ct-Ln)/(Hn-Ln)] ×100

2.对RSV进行指数平滑,就得到如下K值:

今日K值=2/3×昨日K值+1/3×今日RSV

式中,1/3是平滑因子,是可以人为选择的,不过目前已经约定俗成,固定为1/3了。

3.对K值进行指数平滑,就得到如下D值:

今日D值=2/3×昨日D值+1/3×今日K值

式中,1/3为平滑因子,可以改成别的数字,同样已成约定,1/3也已经固定。

4.在介绍KD时,往往还附带一个J指标,计算公式为:

J=3D-2K=D+2(D-K)

可见J是D加上一个修正值。J的实质是反映D和D 与K的差值。此外,有的书中J指标的计算公式为:J=3K-2D

Stochastic Oscillator :

%K periods. This is the number of time periods used in the stochastic calculation;

%K Slowing Periods. This value controls the internal smoothing of %K. A value of 1 is considered a fast stochastic; a value of 3 is considered a slow stochastic;

%D periods. his is the number of time periods used when calculating a moving average of %K;

%D method. The method (i.e., Exponential, Simple, Smoothed, or Weighted) that is used to calculate %D.

The formula for %K is:

%K = (CLOSE-LOW(%K))/(HIGH(%K)-LOW(%K))*100

Where:

CLOSE — is today’s closing price;

LOW(%K) — is the lowest low in %K periods;

HIGH(%K) — is the highest high in %K periods.

The %D moving average is calculated according to the formula:

%D = SMA(%K, N)

Where:

N — is the smoothing period;

SMA — is the Simple Moving Average. |

2026.3.4 图文交易计划:黄金大幅下行 短期192 人气#黄金外汇论坛

2026.3.4 图文交易计划:黄金大幅下行 短期192 人气#黄金外汇论坛 2026.2.13 图文交易计划:美指持续震荡 等1580 人气#黄金外汇论坛

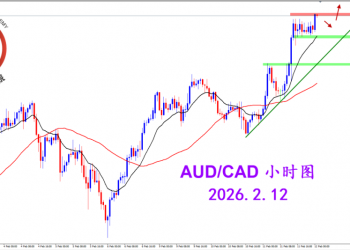

2026.2.13 图文交易计划:美指持续震荡 等1580 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1542 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1542 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1742 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1742 人气#黄金外汇论坛