Posted 3/27/06 1200EST

NZD/USD: Kiwi is completing a parabolic decline that began in February but clearly intensified in March. The acceleration lower has become essentially vertical, which typically results in a final spike low followed by a reversal. The most recent thrust below 0.6200 may represent this final spike or there may still be one more push to come, but prices are also approaching a significant psychological level (0.6000) which also coincides with actual technical support: daily and weekly trendline support from the lows seen back in late 2001/early 2002. The daily charts place this support level at 0.6000 and the weekly charts place the level slightly higher at 0.6050.

The background to Kiwi's decline is signficant in what it suggests for the potential for a rebound. The RBNZ has been unusually explicit in trying to talk down its currency and has even taken steps to limit the issuance of 'Uridashi' bonds, NZD-denominated bonds issued by Japanese institutions, which were seen to be fueling unwanted demand for Kiwi. As well, Japanese institutions were active in the NZD/JPY carry trade (NZD base rates 5.75% vs. JPY base rates of 0.2%), and the end of the Japanese fiscal year at the end of March led to liquidations of the long NZD positions. This Japanese institutional selling depressed an already weak NZD market and likely accounted for a significant amount of the weakness seen in March.

When the new Japanese fiscal year begins on April 1 (possibly as soon as Tokyo trading on 3/30 when the value date will be April 3) the same Japanese institutions that have been selling Kiwi are very likely to return to buying NZD based on the continued yield pick-up. Japanese financial institutions (insurance companies that sell annuities, pension fund managers, and government retirement programs) are desperate for yield enhancement in the face of still negligible Japanese rates. On the interest outlook, while the NZ economy certainly could stand a rate cut and markets are actively speculating over one later this year, the RBNZ has indicated that a rate cut is unlikely this year. This suggests that even if the RBNZ changes its stance, which it may very well do, multiple rate cuts do not seem very likely, and Kiwi rates should still be relatively high compared to JPY and EUR.

This week's strategy will focus on establishing Kiwi longs on further weakness, looking to buy 50% of a position at 0.6050 (just 15 points from current levels at 0.6065) with the remaining 50% at 0.5980, just below key 0.6000 psychological and daily trendline support (I expect stop loss orders to be located at 0.6000 and want to use the resultant downdraft to buy at a slightly better level.) Stop loss for the resulting position is at 0.5950 or a daily close below 0.6000, whcihever comes first. The upside outlook begins to improve on a daily close above 0.6120 and a base is confirmed with a daily close over 0.6200, with an upside acceleration favored once over 0.6250 parabolic SAR (stop-and-reverse) resistance. Assuming we bottom around current levels, the upside objectives are between 0.6320 and 0.6450 initially. |

2026.2.13 图文交易计划:美指持续震荡 等1559 人气#黄金外汇论坛

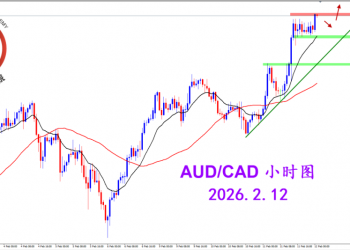

2026.2.13 图文交易计划:美指持续震荡 等1559 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1488 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1488 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1721 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1721 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1640 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1640 人气#黄金外汇论坛