EUR/USD

BUY if the U.S. securities markets are to continue in a bear market and the Euro is going to go up against the U.S. Dollar. SELL if you expect Wall Street to recover and the U.S. Dollar to climb against the Euro.

USD/JPY

BUY if you expect the Yen is about to be weakened in support of Japanese trade. SELL if Japanese equity is leaving the U.S. financial markets to make stronger investments at home.

GBP/USD

BUY if growth in the U.K. will continue to lead G7 nations. SELL if you believe the British are about to adopt the Euro, expecting the Pound to weaken against the U.S. Dollar as it is devalued in anticipation of the merger.

USD/CHF

BUY if you think that the impact of international instability is overvalued. SELL if you believe that conservative investors will be seeking out traditional havens such as Switzerland as a hedge against weakness in the U.S. economy.

EUR/CHF

BUY if you expect that the Swiss government to devalue the currency to accelerate exports to Europe. SELL if inflation takes hold in Germany and France, increasing the value of the Swiss Franc against the Euro.

AUD/USD

BUY if world commodity prices are going to boost the commodity-based export market in Australia. SELL if the Australian economy shows signs of recession or unfavorable trade imbalances are emerging.

USD/CAD

BUY if the US economy is going to rebound faster than Canada. SELL if the Canadian Dollar is fundamentally undervalued against the U.S. Dollar.

NZD/USD

BUY if you think the notoriety of the “Lord of the Rings” films will increase income from tourism. SELL if you expect international uncertainties to continue to depress the tourist industry.

EUR/GBP

BUY if you believe the U.K. is about to adopt the Euro, expecting the Pound to weaken as it is devalued prior to the merger. SELL if you believe that the U.K. economy will grow at a faster rate than the European Union as a whole.

EUR/JPY

BUY if the Japanese banking crisis is expected to worsen. SELL if you believe that Europe is going into recession, anticipating the Euro to fall against the Yen.

GBP/JPY

BUY if the Bank of England is going to raise interest rates. SELL if the Nikkei index is about to outperform the FTSE.

CHF/JPY

BUY if you believe that international instability will cause an oil price spike, impacting the import-dependent Japanese economy. SELL if you expect regional conflicts will result in lower oil prices, making Japanese markets more attractive than the conservative Swiss Franc.

GBP/CHF

BUY if you expect the Bank of England to raise rates. SELL if you believe the British are about adopt the Euro, anticipating a weaker Pound against the Swiss Franc as it is devalued in anticipation of the merger.

EUR/AUD

BUY if Australia is heading towards recession. SELL if you expect international commodity prices are going to increase dramatically. |

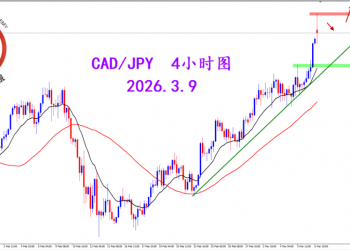

2026.3.9 图文交易计划:加日突破压制 多头305 人气#黄金外汇论坛

2026.3.9 图文交易计划:加日突破压制 多头305 人气#黄金外汇论坛 网纸「TL282.cc」腾龙公司游戏会员账号注册488 人气#美股论坛

网纸「TL282.cc」腾龙公司游戏会员账号注册488 人气#美股论坛 网纸「TL282.cc」腾龙公司注册游戏会员账号492 人气#美股论坛

网纸「TL282.cc」腾龙公司注册游戏会员账号492 人气#美股论坛 网纸「TL282.cc」腾龙怎么注册账号会员63 人气#游枷利叶 专栏

网纸「TL282.cc」腾龙怎么注册账号会员63 人气#游枷利叶 专栏