4/17 EC EU institutions closed for holiday

4/17 1230 US Fed's Guynn & Ferguson speak at risk conf.

4/17 1230 US Empire manufacturing index Apr 31.2 24.0

4/17 1300 US Net foreign security purchases Feb $66.0 bio $60.0 bio

4/17 1605 US Fed's Moskow on workforce quality

4/17 1700 US NAHB housing market index Apr 55 55

4/17 1800 US Fed's Kroszner speaks at risk conf.

4/18 1230 US PPI MoM Mar -1.4% 0.4%

4/18 1230 US PPI ex-F&E MoM Mar 0.3% 0.2%

4/18 1230 US PPI YoY Mar 3.7% 3.4%

4/18 1230 US PPI ex-F&E YoY Mar 1.7% 1.7%

4/18 1230 US Housing starts Mar 2.120 mio 2.050 mio

4/18 1230 US Building permits Mar 2.179 mio 2.100 mio

4/18 1545 US Fed's Yellen speaks on economy

4/18 1605 US Fed's Moskow speaks at auto industry conf.

4/18 1800 US Fed's Warsh speaks at financial panel

4/18 1800 US FOMC minutes released 3/28

4/18 2100 US ABC consumer confidence w/e 4/17 -9 n/a

4/19 1100 US MBA mortgage applications w/e 4/14 -5.5% n/a

4/19 1230 US CPI MoM Mar 0.1% 0.4%

4/19 1230 US CPI ex-F&E MoM Mar 0.1% 0.2%

4/19 1230 US CPI YoY Mar 3.6% 3.5%

4/19 1230 US CPI ex-F&E YoY Mar 2.1% 2.0%

4/20 0900 EC Eurozone CPI MoM Mar 0.3% 0.6%

4/20 0900 EC Eurozone CPI YoY Mar 2.3% 2.2%

4/20 0900 EC Eurozone CPI core YoY Mar 1.2% 1.3%

4/20 1230 US Initial jobless claims w/e 4/15 313K 309K

4/20 1230 US Continuing claims w/e 4/8 2.424 mio n/a

4/20 1400 US Leading indicators Mar -0.2% 0.0%

4/20 1600 US Philadelphia Fed index Apr 12.3 15.0

4/20 1900 US Fed's Bernanke speaks to minority summit

4/21 0645 France Consumer spending Mom Mar 1.8% -1.1%

4/21 0645 France Consumer spending YoY Mar 4.5% 3.7%

WSJ 北京时间 2006年04月15日06:49

纽约汇市周五尾盘,美元基本持平至小幅走高,市场交投极为清淡,因全球许多金融市场今日都因假日而休市。

主要货币在纽约交易时段基本持稳。美国股市和债市今日休市。不过,由于周五并非美国法定假日,加之外汇市场理论上从不休市,市场仍可能出现少量交易。下周一欧洲部分市场仍将继续休市。

纽约汇市尾盘,电子交易系统显示,欧元兑1.2114美元,周四尾盘为1.2113美元

美国联邦储备委员会(Federal Reserve, 简称Fed)发布的3月份美国工业产值数据并没有对汇市产生很大影响。

由于制造业和采矿业产值较前月有所回升,美国3月份工业产值增速加快。3月份工业产值增长0.6%,2月份增幅为0.5%。2月份工业产值初步数据为增长0.7%。

3月份开工率从2月份的81.0%升至81.3%,2月份的初步数据为81.2%。3月份开工率为2000年9月份以来的最高水平,同时也略高于1972-2005年期间的平均值81.0%。

此外,Brown Brother Harriman表示,今日汇市面临的最重要的变动因素是,中国宣布将放宽对合格境内公司和居民个人保留外汇及在海外投资的限制。

中国央行(People's Bank of China)周五早间表示,允许符合条件的银行集合境内机构和个人的人民币资金投资于海外固定收益类产品。同时允许符合条件的基金管理公司和经纪商集合境内机构和个人自有外汇,用于在境外进行的包含股票在内的组合证券投资。

中国央行表示,将拓展保险机构境外证券投资业务,允许符合条件的保险公司购汇投资于固定收益类产品及货币市场工具。

分析师表示,虽然上述改革举措可减轻人民币面临的部分升值压力,但短期内投资于海外的资金规模可能过小,不足以产生重大影响。Brown Brothers Harriman在报告中写道,表面上看,这次改革将促使资本外流。这些举措意味著对经常项目的管制有了变化,今后进口商可以更方便地购入外汇,并可能有助于刺激市场长期来被压抑的对进口产品的需求。

不过该机构评论称,无论如何,在5月1日正式生效前,上述改革措施不太可能立即对汇市产生很大影响;这些举措应被视为中国为开放资本市场所推出的一系列改革措施的一部分。

Weekly Outlook 4-14-06

Major currencies were confined to relatively tight ranges this past week as the Easter holidays reduced trading interest significantly. As such, the major themes of the prior week (ECB delaying its next hike/Fed’s Poole suggesting 5.25% is reasonable) failed to play out to any measurable degree in the currencies. However, US 10 year Treasury yields continued to press higher, surpassing 5.00% and set to close just below 5.05%, suggesting fixed income markets are now pricing in a Fed Funds rate north of 5.00%, as suggested by the Fed’s Poole. Normally this would have translated into a firmer US dollar, but events in the geo-political realm have likely prevented this from happening. Iran’s announcement that it had successfully enriched uranium was the latest development in a simmering confrontation over Iran’s nuclear ambitions. The prospect of a future military confrontation between the US and Iran has resulted in a discount to the dollar, one that currently appears to outweigh the premium afforded by rising yields. Oil prices and gold also pressed higher based on the risk associated with a new conflict in the Middle East.

The stand-off with Iran does not appear likely to be resolved anytime soon, and is likely to go through several more ups-and-downs before culminating in US military action sometime later this year. The most important element to understand, and one that markets are slowly coming to grips with, is that the Iranian government cannot back down in the face of pressure from the US and the West, if only for internal political reasons. Short of a political coup in Iran, this stand-off is not going away. That leaves diplomacy, which can be expected to drag on for several months at the minimum, with various allies decrying Iran’s actions but stopping short of supporting economic or other sanctions. Even if sanctions are approved, there is little reason to expect them to produce the desired outcome, and it’s more likely that they will result in further global economic disruption as oil prices are pushed higher on supply concerns. All the while, the Iranian government will still be pursuing its nuclear ambitions, something that Pres. Bush has declared he will not allow. I believe this is truly a case of an immovable force meeting an unyielding object, with time as the only variable until a confrontation.

When the Iranian situation is factored into the outlook for the dollar, along with an eventual end to Fed rate hikes and a US slowdown in the second-half of 2006, the potential for a higher dollar seems limited indeed. But for the foreseeable next few months, rising US yields and continued solid US growth are likely to prevent a significant decline in the dollar. Only when US growth appears to be slowing and the Fed has signaled a neutral bias will the dollar begin trending lower. This suggests that the range-trading conditions of the last few months are likely to persist through June at least.

In the short-term, however, markets will continue to trade the data and next week’s calendar is chock-full of market moving reports, most of which, based on expectations, do not augur well for the US dollar . Monday sees the release of the NY Fed’s Empire manufacturing index, which is expected to fall to 24 from 31.2. Monday’s highlight, though, will be the February TICS report of net foreign security purchases, which is forecast to show a $60 bio net inflow into the US. The market is likely to pounce on any result below the US monthly trade deficit, especially as recent TIC inflows have been trending lower and registering right around monthly trade deficit levels. A weak result could start the dollar off on a downward spiral. The US releases March PPI data on Tuesday and CPI on Wednesday, with forecasts calling for relatively benign core MoM readings, but with headline MoM increases. Focus on the core readings which should work to soften the dollar. Thursday sees March leading indicators (expected flat) and the Philadelphia Fed index (expected rise to 15.0 from 12.3).

Chinese Pres. Hu Jintao is set to visit the US next week , Keep this in mind for April’s durable goods report.

In dollar index terms, I suggested last week that the US dollar needed to get past 89.75 to continue its recovery higher. The index reached 89.85 on several failed attempts to rally and is set to close at 89.62 for the week. This weekly close level keeps the larger ‘rounding top’ formation viable and the preferred scenario going forward. In fact, for the ‘rounding’ part to continue, an acceleration lower is needed shortly, and this likely coincides with a disappointing TICS report on Monday. Any move lower on Monday could be further exacerbated by thin liquidity conditions as most major trading centers will still be out for the Easter Monday holiday. Daily momentum readings also indicate the dollar’s recovery since 4/6 (Trichet’s comments) is stalling and the broader indication of a move lower is set to resume. Keep an eye on the 89.75/80 area in the US dollar index, and while that resistance remains intact, the dollar’s downside is favored. |

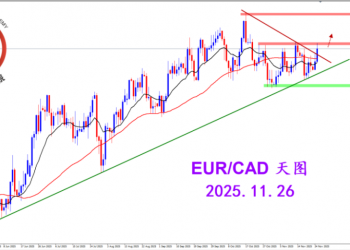

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛 MQL5全球十大量化排行榜3301 人气#黄金外汇论坛

MQL5全球十大量化排行榜3301 人气#黄金外汇论坛 【认知】6107 人气#黄金外汇论坛

【认知】6107 人气#黄金外汇论坛