4/24 1000 Germany Industrial production MoM Feb -0.1% 0.6%

4/24 1000 Germany Industrial production YoY Feb 3.3% 5.5%

4/24 1530 EC ECB's Trichet speaks in NYC

4/24 1630 EC ECB's Gonzalez-Paramo speaks in NYC

4/24 1700 EC ECB's Mersch speaks in Luxembourg

4/25 0800 Germany IFO-business climate Apr 105.4 104.7

4/25 0800 Germany IFO-current conditions Apr 105.1 104.8

4/25 0800 Germany IFO-expectations Apr 105.7 104.3

4/25 0800 EC Eurozone current account balance Feb -11.3 bio n/a

4/25 0900 EC Eurozone trade balance Feb -10.8 bio -3.0 bio

4/25 0900 EC Eurozone trade balance s.a. Feb -2.5 bio -2.0 bio

4/25 1300 Germany CPI YoY Apr-prelim 1.8% 1.9%

4/25 1300 Germany CPI MoM Apr-prelim 0.0% 0.2%

4/25 1300 Germany CPI-EU harmonized MoM Apr-prelim 0.1% 0.2%

4/25 1300 Germany CPI-EU harmonized YoY Apr-prelim 1.9% 2.1%

4/25 1400 US Consumer confidence Apr 107.2 106.0

4/25 1400 US Existing home sales Mar 6.91 mio 6.70 mio

4/25 1400 US Richmond Fed index Apr 21 10

4/25 2100 US ABC weekly consumer confidence 4/24 -7 n/a

4/26 0610 Germany GfK consumer confidence May n/a n/a

4/26 0900 EC Eurozone industrial production MoM Feb 0.0% 0.2%

4/26 0900 EC Eurozone industrial production Yoy Feb 2.5% 3.1%

4/26 1100 US MBA mortgage applications w/e 4/21 -1.7% 6.8%

4/26 1230 US Durable goods orders Mar 2.7% 1.6%

4/26 1230 US Durable goods ex-transportation Mar -1.2% 1.5%

4/26 1400 US New home sales Mar 1.080 mio 1.106 mio

4/26 1800 US Fed's Beige Book

4/27 0755 Germany Unemployment change Apr 30K -35K

4/27 0755 Germany Unemployment rate Apr 11.4% 11.3%

4/27 0900 EC ECB's Bini-Smaghi speaks

4/27 1230 US Initial jobless claims 4/22 303K 305K

4/27 1400 US Fed's Bernanke testifies on the economy

4/27 1400 US Help wanted index Mar 39 40

4/27 1715 US Fed's Kohn speaks on business capex

4/28 0650 France PPI MoM Mar 0.1% 0.4%

4/28 0650 France PPI YoY Mar 3.5% 3.2%

4/28 0900 EC Eurozone industrial confidence Apr -1 -1

4/28 0900 EC Eurozone consumer confidence Apr -11 -11

4/28 0900 EC Eurozone CPI estimate YoY Apr 2.2% 2.3%

4/28 1130 US Fed's Bies speaks on risk mgmt

4/28 1230 US GDP annualized 1Q-prelim 1.7% 4.9%

4/28 1230 US GDP price index 1Q-prelim 3.5% 2.8%

4/28 1230 US Personal consumption 1Q-prelim 0.9% 5.0%

4/28 1230 US Employment cost index 1Q 0.8% 0.9%

4/28 1345 US Univ. of Michigan confidence April-final 89.2 89.0

4/28 1400 US Chicago PMI Apr 60.4 58.3

WSJ 北京时间 2006年04月22日08:12

纽约汇市周五交投活跃,美元兑欧元温和下跌,纽约汇市周五尾盘,据电子交易系统(EBS)的报价,欧元兑1.2340美元左右,周四尾盘为1.2315美元。

因外国央行在外汇储备中减持美元资产的消息再度传出,再次引发市场的担忧。美元在纽约交易时段承受压力,原因是俄罗斯一位高官对美元储备资产地位发表质疑,同时前夜瑞典央行宣布在外汇储备中已减持了美元资产。俄罗斯财政部长Alexei Kudrin周五对美元作为全球未来最主要储备货币的地位发出质疑之声,他指出美元近来的走势出现大幅波动。在周末国际货币基金组织(International Monetary Fund)和世界银行(World Bank)会议召开前的新闻发布会上,Kudrin表示,鉴于许多央行在外汇储备中持有大量美元计价证券,因此美元兑主要货币近来的显著波动走势令人感到不满。

外汇技术分析师George Davis表示,俄罗斯财政部长的此番言论似乎引发了美元普遍走软。

Davis表示,受该消息的影响,美元延续了前夜交易中因瑞典央行(Swedish Riksbank)声明而出现的跌势。瑞典央行表示,已在外汇储备中减持了美元资产。在近年来,外国央行外汇储备多元化一直是投资者的心头之忧。

分析师表示,在市场担忧外汇储备资产多元化之际,另一种担忧也开始浮现,即经常提及的美国赤字问题之虑。随著美国加息周期似乎正越来越接近尾声,市场开始再次关注美国的结构性失衡问题。

与此同时,油价上涨也对美元走势构成压力。周五,纽约市场油价达到创纪录的每桶逾75美元水平。

Weekly Outlook 4-21-06

The dollar suffered a potentially significant decline this week, breaking lower after weeks of pent-up range trading. The original catalyst appears to have been comments from a Chinese official suggesting that China would gradually increase its imports and gradually reduce its accumulation of US debt. Thin markets on Easter Monday exacerbated the dollar’s slide, but the crack in the dollar’s hull had begun to spread. Market sentiment on the dollar quickly turned negative, with continuing tensions with Iran, dovish Fed comments, and relatively benign inflation readings subsequently allowing markets to push the dollar lower. The dollar appeared to be making a stand by mid-week, but could not overcome persistent selling by so-called ‘real money’ asset managers. On Friday, Sweden’s Rijksbank announced that it had re-allocated its reserves over the prior four weeks, reducing USD holdings, eliminating JPY holdings and increasing EUR reserves among other changes. While the announcement was post-facto, the Rijksbank action highlighted the ongoing theme of reserve diversification away from the USD, and this put the buck on the defensive going into the week’s close.

While the movements in this past week bear many of the hallmarks of an emerging trend toward dollar weakness, we have been here before several times in the last few months and the dollar has rallied back. In US dollar index terms, the dollar’s decline this week has brought us back to 87.70/80, which marked the lows seen on 9/23/05 and 1/24/06 as well as the low for this week’s decline. A daily close below the 87.70 level is needed to confirm that the dollar is set to shift lower.

The overall backdrop to a US dollar decline has been developing for several months since the Fed first signaled back in Dec. that it was nearing the end of its cycle of interest rate increases. While the Fed has still not sounded the ‘all-clear’ on further rate hikes, comments from SF Fed Pres. Yellen, a known dove, outlined the concerns over future rate increases and essentially indicated that it would take a data surprise in the growth or inflation pictures to cause the Fed to continue tightening. Going forward, the major risk for the USD is that given the time lag effect of rate hikes and sharply higher oil prices in the last few weeks, the widely anticipated growth slowdown in 2H 2006 will coincide with sharply higher inflation readings. This will leave the Fed stuck between the proverbial ‘rock and a hard place’, either raising rates amid a stalling economy to fight inflation, potentially sending it into a tailspin, or allowing inflation to increase and erode the value of USD-denominated assets. The latter is clearly the worst case scenario for the US dollar and one worth watching closely.

The data next week could be overwhelmed by any follow-through USD selling, with market participants discounting any dollar-positive reports, and jumping on any data disappointments as an excuse to sell the buck. From the US, April consumer confidence and existing home sales, both of which are expected to show declines, start the week on Tuesday. On Wednesday, March durable goods and new home sales are both forecast to register gains, but the key will be the Fed’s Beige Book, issued in advance of the May 10 FOMC meeting. If the dollar is to avoid an even sharper decline, hawkish interest rate expectations will be needed and the Beige Book will be the best source from which to gauge. Friday also see’s a slate of US data, beginning with 1Q GDP, which is forecast to verge on 5% annualized, but this report is likely to be heavily discounted, or at least it should be, and provide little support to a falling dollar. Also out on Friday are 1Q US personal consumption, ECI (employment cost index), Univ. of Michigan final April consumer sentiment and the Chicago PMI.

Elsewhere, Key Eurozone data will be the German April IFO on Tuesday, followed by preliminary April CPI readings later that morning. Also of note, ECB president Trichet will speak in NY at the Council on Foreign Relations. I wonder if he will have any comments on the strength of the Euro or weakness of the dollar? |

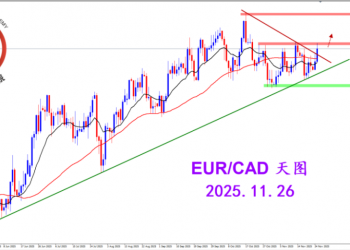

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛 MQL5全球十大量化排行榜3301 人气#黄金外汇论坛

MQL5全球十大量化排行榜3301 人气#黄金外汇论坛 【认知】6107 人气#黄金外汇论坛

【认知】6107 人气#黄金外汇论坛