Preview of Fed Chairman Bernankeâ™s Congressional testimony: Wednesday February 15, 1000 EST (1500GMT) Financial markets are awaiting the testimony of the new Fed Chairman, Ben Bernanke. His testimony before the House Financial Services committee will involve two components: 1) Bernankeâ™s prepared comments and 2) Q&A from House Committee members. His prepared testimony will be repeated on Thursday before the Senate Banking Committee. In his prepared remarks, the highlights of which will be released as he begins speaking at about 1000EST, Bernanke will be relating the âœcentral tendencyâ¿ economic forecasts that were developed at the Jan. 31 FOMC. Despite his not taking part in those deliberations, it seems unlikely he will deviate significantly from this most recent FOMC analysis. Those comments essentially boil down to: the US economy remains on solid, but recently uneven, footing; long-term inflation expectations remain contained; but resource utilization pressures (tightening labor markets & higher energy costs) threaten the short-term inflation outlook.

The critical element of his prepared testimony will be Bernankeâ™s own views of the short-term inflation risks. There is plenty here to get hawkish about, and markets will be keying off his language for signs of the degree of further monetary tightening he thinks is necessary. To the extent that Bernanke appears comfortable that short-term inflation pressures are manageable with further minimal tightening, the markets will interpret this as more dovish. On the other hand, to the extent that Bernanke suggests that the short-term inflation picture is too fluid to predict with certainty, or is evolving differently than earlier indicated, the market will interpret this as hawkish and begin pricing in 3 more ¼% rate hikes instead of the current 1-2. There is no way to know what questions heâ™ll be asked in the Q&A segment, but it seems likely he will be asked about his work on inflation-targeting. Also, look for Bernanke to hit a lot of chords on the note of fighting inflation, remaining vigilant, price stability is essential to long-term economic growth, etc., all in effort to establish his central bankerâ™s inflation-fighting credibility. Current market sentiment appears decidedly expectant of hawkish remarks and a higher interest rate environment going forward. The US dollar is at its highest levels of the year and US 10 year yields are at their highest levels since mid-November. This suggests that the market is positioned for relatively hawkish comments, and the risk, then, is for less- than-hawkish comments resulting in a wholesale liquidation of dollar-longs and 10-year short-covering. The key levels to watch for continuations of the dollarâ™s rally are: EUR/USD 1.1780/1800;with each of these levels representing trendline support/resistance from last yearâ™s US dollar highs. Ultimately, given the marketâ™s expectations and positioning, it will fall to Bernanke to provide enough hawkish rhetoric to keep the moves going, and this may be a tough order to fill in his first outing.

US: 1000EST (1500GMT) Fed Chairman Bernanke delivers his semi-annual testimony to House financial services committee. 1300EST (1800GMT) NAHB housing market index for February is expected to remain steady at 57.

US: 0700EST (1200GMT) MBA weekly mortgage applications. 0830EST (1330GMT) NY Fedâ™s Empire Manufacturing Index for February is expected to dip to 18.0 from 20.1. 0900EST (1400GMT) TICS net foreign security purchases for December are estimated to register $76.2 mio (prior $89.1 bio). That consensus estimate is based on only 4 analystsâ™ estimates, so the market will still be gauging off the TICS inflow relative to the trade deficit, which is running around $65 bio. A reading above $75 bio should not hurt the dollar, but a level closer to the $65 bio level could. Another reading north of $80 bio should allow the dollar to probe higher, but Bernanke-testimony later will keep the impact muted. 0915EST (1415GMT) January industrial production is forecast to rise 0.2% (prior 0.6%) and capacity utilization is expected ton tick up to 80.8% from 80.7%.

LONDON UPDATE Yesterdays's reaction to the hyperstrong retail sales release raises the possibility that the market is either sitting long dollars and in a take-profit mood or waiting on Bernanke's words today in front of Congress. The dollar's advance against a majority of the G7 carries on but it is noted that momentum oscillators are in overbought territory which can warn of a breather in price action. Looking specifically at EUR/USD we note a fair amount of 2-way price action as European corporates were cited on the bid and with the lack of follow-through we saw some decent profit taking from macro accounts who have been short EUR/USD from better levels. The short-term pivot point on the topside looks to be the 100-day moving average at 1.1950 - a break of this level may see weaker shorts stop out while downside objective remains to be 1.1780/1.1810. The market expects Bernanke to stick close to recent FOMC comments, so there will be an appropriate emphasis on data dependence and to reflect the hawkish shift in the central FOMC tendency since the time that Bernanke was on the Board. Overall, the Q&A in his testimony would be the possibility for his own views to slip in. Given what fixed income has priced in already, the data releases do not seem likely to be enough to take the USD much further. The Bernanke Q&A thus may hold the higher risk for market driving developments. |

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛

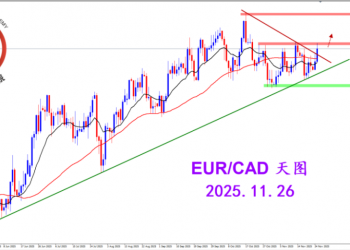

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛 MQL5全球十大量化排行榜3300 人气#黄金外汇论坛

MQL5全球十大量化排行榜3300 人气#黄金外汇论坛 【认知】6106 人气#黄金外汇论坛

【认知】6106 人气#黄金外汇论坛