The week outlook

The dollar recovered sharply this week, a bit sooner than I expected, as higher core PPI readings rekindled fears of further Fed tightening to combat inflation. The dollar received an added boost mid-week as US sales of existing homes in February posted a 5.2% gain vs. an expected 1% decline, marking the first rise in existing home sales since Aug. 2005. However, the existing home sales report was an aberration from a steady decline in the housing market and largely attributed to warmer weather in January facilitating purchases that closed in February. The underlying trend was reaffirmed by Friday’s 10% drop in February new home sales, a more concurrent report, that also saw the inventory of unsold homes rise to a record level. The inventory of unsold existing homes held steady at 5.3 months worth, the highest since August 1998, suggesting that despite February’s surge, overall demand continues to slow. The good news on the housing front is that the real estate market slowdown does not appear to be heading for a collapse, and this will have important implications for the outlook for the second half of 2006 & 2007.

The price action during the past week was suggestive of greatly reduced interest from major market participants, most notably Japanese institutions, which typically reduce market activities significantly into the close of the Japanese fiscal year (end of March). Market information also indicates the dollar’s sharp rally on Thursday was attributed to stop-loss buying of dollars from speculative shorts that went with the prior week’s dollar decline, as opposed to fresh dollar-buying from asset managers. In US dollar index terms, the dollar retraced 76.4% of the prior week’s sell-off by Thursday, and then retraced 38.2% of that move lower on Friday, suggesting Elliot wave traders had a good week. The week leading up to FOMC meetings frequently tends to be range-bound and, despite the volatility seen this week, that’s exactly what we got. The dollar index is closing at 90.00, exactly mid-way between the highs of 91.15 seen two weeks ago and lows at 88.85 seen last week. This sets the stage for a significant reaction following the FOMC’s rate decision and statement, one that is likely to see ‘real money’ flows return to the market and provoke a sustained move.

But before I begin suggesting that an end to the 2006 range is at hand, let’s first consider what the FOMC is likely to do, considering the growth and inflation sides of the equation. The growth side is on balance still a positive in terms of further tightening, judging by the Fed’s March Beige Book report. While some signs of consumer retrenchment are evident (lower retail sales, core durable goods, lower NAHB index), the labor market remains solid, suggesting private consumption is unlikely to go into a tailspin and suggests 2Q growth in the range of 3-4% annualized. The outlook for the second half of 2006 remains heavily dependent on the housing market, both in terms of employment and consumption, and while realty activity is definitely slowing (it has been for the last 5 months at least), fears of a collapse appear unfounded at the moment. Taken together, it suggests private consumption is only adjusting to lower levels from previously unsustainable high rates, implying the Fed’s tightening is having the desired effect. On balance, the growth side of the equation suggests two more rate hikes from the Fed by May 10, followed by a data-dependent pause going into the 2H 2006.

Turning to the inflation side of the equation, recent price gauges continue to depict steady and contained price pressures, at least in core terms. Oil prices have risen in recent weeks, though, and it’s unclear yet how the Fed will view this, but it seems likely it will be interpreted only as a short-term market-driven effect, likely to subside by the summer. Then there are the second round effects of higher energy prices, which have been noticeably absent since oil prices spiked late last summer. Last week’s PPI readings (and January’s too) suggest second round effects may finally be making themselves known, at least upstream. While it is only two months of data, it does give cause to the Fed to lean toward greater vigilance and further tightening, certainly two more ¼ point hikes at least.

Putting the two sides of the equation together, I maintain the view that two more ¼% rate hikes are in store. The inflation side of the equation potentially argues for more than two hikes, but the Fed then risks hitting the brakes too hard and upsetting the growth of the economy. To preserve a ‘soft-landing’ scenario, I think this argues for two additional hikes, followed by a potentially extended period of steady monetary policy.

The key for market participants will be how the Fed phrases its intentions, keeping the door open to additional hikes while not alarming markets with phraseology that suggests the Fed is just now changing its view that inflation pressures are no longer contained. I’m inclined to think the FOMC statement will highlight the underlying soundness of the US economy, but will suggest that additional ‘fine-tuning’ of monetary policy may be needed to prevent price pressures from disrupting future economic growth. The FOMC will likely re-use the ‘data-dependent’ theme to govern the ‘fine-tuning’ down the road. This allows the Fed to keep the door open to another rate hike on May 10, while effectively signaling to the market that that’s the end of the steady rate increases.

How the market interprets the Fed’s statement is obviously critical to the fate of the dollar next week. On balance, the prospect of an additional hike beyond next week should keep the dollar supported, but seems unlikely to propel it out of recent ranges. The ‘data-dependent’ theme is also troublesome for a break-out, since the markets have been over-reacting to nearly every data announcement, leading to sharp reversals when the next data point suggests the opposite. Given the Fed’s stance, it seems unlikely now that US monetary policy is going to take us out of recent ranges before May.

ECB officials may also provide increasingly neutral comments based on a leveling-off of economic sentiment and growth in the Eurozone over the last several weeks, suggesting the next ECB tightening will be postponed until late spring/early summer.

Given my outlook for the FOMC statement and the return of Japanese institutions, I favor a generally higher dollar next week. The key technical level will be a break over 91.00 on a daily close basis; this level represents daily trendline resistance dating back to the November 2005 highs. This level may prove difficult to break through if JPY selling on the crosses materializes as I expect, since this will mean that EUR, GBP, CAD, AUD, & NZD will all be bought against the dollar, while the JPY will be sold against the dollar. Since the dollar index is 80% weighted to European currencies, it may not break higher, even though USD/JPY returns to test 119.00 and above. The risk to this JPY negative scenario comes from China currency adjustments and the impending visit of Chinese president Hu.

04:14pmNEXT WEEK : From the US, March Chicago PMI, Michigan sentiment, Feb PCE deflator and personal spending on Friday.

02:57pmNEXT WEEK : The FOMC begins its two-day meeting on Monday and will make its rate announcement the next day. The focus will be the statement that follows, with the market looking for an indication as to what to expect in the coming months. Despite that clearly being the highlight of the week, there is still key data from Europe to look out for

01:03pmBernanke told a Congressman in a follow-up letter to his testimony last month that the USD was likely to remain the invoice currency for oil. Consistent with past comments on the USD as a reserve currency

3/27 2000 US FOMC two day meeting begins

3/28 0800 Germany IFO business climate Mar 103.3 102.9

3/28 0800 Germany IFO current assessment Mar 101.9 102.0

3/28 0800 Germany IFO expectations survey Mar 104.8 104.0

3/28 1500 US Consumer confidence Mar 101.7 102.0

3/28 1500 US Richmond Fed index Mar 0.00 n/a

3/28 1915 US FOMC rate announcement 3/28 4.50% 4.75%

3/28 2200 US ABC consumer confidence w/e 3/27 -8 n/a

3/29 1200 US MBA mortgage applications 3/24 -1.6% n/a

3/29 1345 US Fed officials speak at payments conf.

3/30 0755 Germany Unemployment change Mar -5K -5K

3/30 1330 US GDP annualized 4Q-final 1.6% 1.7%

3/30 1330 US GDP price index 4Q-final 3.3% 3.3%

3/30 1330 US Personal consumption 4Q-final 1.2% n/a

3/30 1330 US Initial jobless claims w/e 3/25 302K 300K

3/30 1330 US Continuing claims w/e 3/18 2.472 mio n/a

3/30 1730 US Fed's Poole speaks at student invest. forum

3/30 1730 EC ECB's Trichet speaks

3/31 0600 Germany Retail sales YoY Feb 1.7% 1.5%

3/31 0600 Germany Retail sales MoM Feb 1.8% -0.4%

3/31 0830 EC ECB's Trichet speaks

3/31 0900 EC Eurozone industrial confidence Mar -2 -2

3/31 0900 EC Business climate indicator Mar 0.61 0.62

3/31 0900 EC Eurozone consumer confidence Mar -10 -10

3/31 0900 EC Eurozone CPI estimate YoY Mar 2.3% 2.2%

3/31 0900 EC Eurozone CPI estimate YoY Mar 2.3% 2.2%

3/31 1330 US Fed's Hoenig speaks on 2006 outlook

3/31 1330 US Personal income Feb 0.7% 0.4%

3/31 1330 US Personal spending Feb 0.9% 0.0%

3/31 1330 US PCE deflator YoY Feb 3.1% 2.9%

3/31 1330 US PCE core MoM Feb 0.2% 0.1%

3/31 1330 US PCE core YoY Feb 1.8% 1.7%

3/31 1445 US Univ. of Michigan consumer confidence Mar-final 86.7 87.0

3/31 1500 US Chicago purchasing managers index Mar 54.9 57.0

3/31 1500 US Factory orders Feb 1.6% 1.0%

[ 本帖最后由 phangson 于 2006-3-26 20:57 编辑 ] |

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛

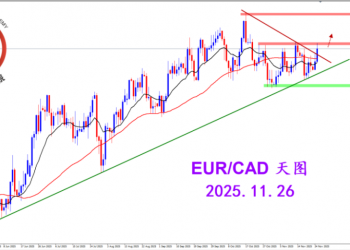

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛 MQL5全球十大量化排行榜3300 人气#黄金外汇论坛

MQL5全球十大量化排行榜3300 人气#黄金外汇论坛 【认知】6106 人气#黄金外汇论坛

【认知】6106 人气#黄金外汇论坛