WSJ 北京时间2006年04月01日07:33

纽约汇市周五尾盘,美元兑欧元上扬,良好的美国经济数据支撑了美元汇率。

美元今日开盘走强,因此前德国公布的疲软数据扭转了美元周四的大幅跌势。此后,一系列美国经济数据推动美元兑其他主要货币汇率进一步走高。但在伦敦市场定盘结束后,市场交投呈现清淡,美元在余下时间内均保持窄幅波动。

据电子交易系统显示,纽约汇市周五尾盘,欧元兑1.2124美元,低于周四尾盘的1.2156美元。

周五公布的数据包括个人收入和支出(此数据显示通货膨胀依然温和),以及好于预期的芝加哥采购经理人指数。

JP摩根驻纽约的固定收益和外汇全球主管Anton Pil表示,美国数据令外汇交易员对建立大规模头寸更加犹豫。美国经济仍在强劲增长,Fed继续加息的次数可能超过预期。

市场目前预期联邦基金利率在5月份升至5.00%的可能性为80%,在6月底升至5.25%的可能性为50%。一些经济学家预计Fed将在今年晚些时候继续加息,把利率提高至5.50%。

Pil称,上述数据(特别是芝加哥采购经理人指数)显示,市场还不能放弃对Fed加息的关注,这也最终限制了美元的下挫。

Pil表示,投资者希望在清楚了解Fed的动向后再对美元作出投资决定。美元并非会走强,而是将继续保持区间波动。

分析师称,投资者下周前可能都将保持观望,届时季度末的大幅振荡将结束,美国非农就业人数等新数据将开始影响投资者对Fed此后决定的预期。

Weekly Outlook 3-31-06

The dollar remained confined to recent ranges and is set to close only marginally lower from the prior week in US dollar index terms. Market action was mostly centered in the commodities, with sharp rallies in metals and energy standing out. While there are fundamental explanations for the surges in metals and energy, most are short-term and do not provide the underpinnings for sustained rallies in the commodities. For example, it is peak season for refinery outages due to maintenance ahead of peak output demand going into summer. As a result, gasoline and distillate inventories have fallen and it was the subsequent price gains in gasoline and heating oil that led crude oil prices higher, a case of the tail wagging the dog. Indeed, the recent rallies appear to be as much technically based as they are due to any fundamental shift, and this also suggests price gains may not be sustained. Gold broke over trendline resistance from prior highs at about $570/oz and has made a parabolic rally that looks to have peaked just below $590. Oil prices broke similar trendline resistance at about $63.60/bbl, sparking fresh buying that saw prices move to about $67.30 before stalling below more significant trendline resistance at $68.30, and reversing to close around 66.10 on the week. Keep an eye on the commodities next week and don’t be surprised if there are significant reversals.

The Fed delivered the expected ¼ point hike to bring the Fed funds rate to 4.75% and left the door open to additional increases. The paragraph of the FOMC statement devoted to monetary policy direction was identical to the language of the January statement, suggesting little has changed (or is known) as far as the Fed is concerned. The paragraph devoted to the Fed’s assessment of the economy was rewritten with more detail, most notably that the Fed is explicitly expecting growth to moderate in 2H 2006, but remained essentially the same: growth is solid and core inflation expectations remain contained, but with upside risks. Laggard market elements finally accepted that 5.0% is inevitable by May, but the Fed’s indications beyond then remain as unclear as they were going into this last meeting. Undoubtedly the Fed’s future course will be data driven and this leaves markets in the current position of interpreting most every data release as to it’s implications for monetary policy going forward. This further suggests that current ranges will be maintained as various data points suggest one direction, only to be reversed by the next data point. In terms of currencies, though, there is likely more downside risk for the US dollar should growth show signs of tapering off earlier or more sharply than currently expected.

Treasury yields surged following the Fed’s statement and rallies in the commodities and energy complex, as bond markets appear to have been caught behind the curve somewhat. At the same time the yield curve un-inverted, suggesting a return to a more normal yield curve pattern lies ahead and that fixed income markets are gradually re-aligning their thinking that interest rates will remain at or above current levels for some time, as opposed to the preceding view that anticipated a rate cut sometime in late2006/early 2007 based on slower US growth. The dollar failed to get much traction from higher US yields, at least for now.

Next week’s data calendar Key , US data out next week begins with the ISM manufacturing index on Monday, ISM non-manufacturing on Wednesday and the March NFP report on Friday. The ECB will all hold rate setting meetings, but none are expected to change rates. Currency markets will be paying close attention to ECB president Trichet’s press conference following the ECB rate decision, looking for indications as to the timing of the next hike.

In terms of next week’s price action, the US dollar index is set to close in the middle of its recent range between 90.90-88.80 and all indicators are for further range trading conditions to persist.

4/3 0800 EC PMI manufacturing survey Mar 54.5 55.0

4/3 1400 US Construction spending MoM Feb 0.2% 0.5%

4/3 1400 US Pending home sales MoM Feb -1.1% -0.5%

4/3 1400 US ISM manufacturing Mar 56.7 57.5

4/3 1400 US ISM prices paid Mar 62.5 61.8

4/4 0900 EC Eurozone unemployment rate Feb 8.3% 8.3%

4/4 0900 EC Eurozone PPI MoM Feb 1.2% 0.5%

4/4 0900 EC Eurozone PPI YoY Feb 5.3% 5.4%

4/5 0045 US Fed's Hoenig speaks on mon. policy

4/5 0900 EC Eurozone retail sales MoM Feb 0.8% 0.0%

4/5 0900 EC Eurozone retail sales YoY Feb 0.9% 1.0%

4/5 1100 US MBA mortgage applications w/e 3/31 1.2% n/a

4/5 1400 US ISM non-manufacturing Mar 60.1 59.0

4/6 0045 US Fed's Hoenig speaks on monetary policy

4/6 1000 Germany Factory orders MoM Feb 1.4% 0.5%

4/6 1000 Germany Factory orders YoY Feb 14.3% 13.0%

4/6 1145 EC ECB rate announcement Apr 2.50% 2.50%

4/6 1230 EC ECB's Trichet press conference

4/6 1230 US Initial jobless claims w/e 4/1 302K 305K

4/7 0600 Germany Trade balance Feb 12.5 bio 13.0 bio

4/7 1000 Germany Industrial production MoM Feb -0.1% 0.6%

4/7 1000 Germany Industrial production YoY Feb 3.3% 5.5%

4/7 1000 EC Eurozone OECD leading indicators Feb n/a n/a

4/7 1230 US Change in non-farm payrolls Mar 243K 190K

4/7 1230 US Unemployment rate Mar 4.8% 4.8%

4/7 1230 US Avg hourly earnings Mom Mar 0.3% 0.3%

4/7 1230 US Avg hourly earning YoY Mar 3.5% n/a

4/7 1230 US Avg weekly hours Mar 33.7 33.8

4/7 1300 EC Eurozone fin. mins meet

4/7 1400 US Wholesale inventories Feb 0.1% 0.5% |

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛

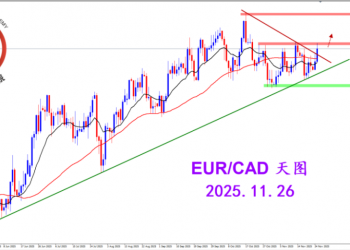

2025.12.16 图文交易计划:布油开放下行 关2693 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3220 人气#黄金外汇论坛 MQL5全球十大量化排行榜3300 人气#黄金外汇论坛

MQL5全球十大量化排行榜3300 人气#黄金外汇论坛 【认知】6106 人气#黄金外汇论坛

【认知】6106 人气#黄金外汇论坛