焦点关注

为期两天的美联储会议自今日开始,日图EURUSD, USDJPY呈现盘整

EURGBP日图突破阻力0.6875,周图 0.6975为下一阻力

Tuesday, March 28, 2006 8:30 AM EST Here we are on this highly anticipated March FOMC meeting where Mr. Bernanke and company are widely expected to increase the overnight borrowing rate by another 25 bps. Expect price action to whippy and directionless heading into the 2:15 pm EST announcement. The Euro products were firmly bid in overnight sessions as positive Eurozone economic data hit the tape sending our bullish Gartley EURGBP pattern to within 5 points of our initial target. Long trades where taken from the 0.6870-65 level which wound up being the dead low and price has advanced some 35 points, at $18 dollars per point, since entry. The most compelling feature of this chart which I failed to mention yesterday is the symmetry on the 240 min chart of measured move AB=CD in not only price, but in time. Leg AB and CD both took 34 bars to complete while leg X-A took 55 bars to complete. Does anybody know the relevance of the number 34 and 55? They are the 9th and10th members of the Fibonacci number sequence (1,1,2,3,5,8,13,21,34,55,89.) For a quick review if you divide any number in Fib sequence by the previous you will find the divine ratio, Phi, or 1.618. And as our loyal readers know, 1.618 has been the staple of my report which began 12 months ago. Yes, that's right, we are on our 1 year anniversary here at Strategy of the Day which is exactly why I am torturing you like this. It is time to push our analysis ahead of traditional retracements and projections and to the next level advanced Fibonacci patterns. |

2026.2.13 图文交易计划:美指持续震荡 等1560 人气#黄金外汇论坛

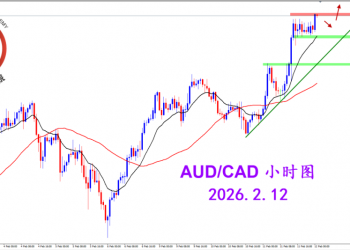

2026.2.13 图文交易计划:美指持续震荡 等1560 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1505 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1505 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1722 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1722 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1640 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1640 人气#黄金外汇论坛